- United States

- /

- Semiconductors

- /

- NasdaqGS:KLAC

Is KLA’s 75% Stock Surge Justified After Recent Global Expansion Moves?

Reviewed by Bailey Pemberton

Trying to decide if KLA deserves a spot in your portfolio? You are definitely not alone; even seasoned investors are weighing their options with this headline-making stock. Over the past year, KLA has delivered impressive gains, surging nearly 70%, and its momentum is tough to ignore. Year-to-date, the stock is up a staggering 75%, and the five-year chart is enough to make any long-term investor envious, with a return of 518.5%. These moves, especially the recent 2.5% pop this week and a steady 4% climb over the last month, have caught plenty of attention across the market.

This strong performance has not come out of nowhere. Industry tailwinds around semiconductor manufacturing, strategic investments in new technology, and the ongoing wave of re-shoring advanced chip production have continued to shape sentiment. KLA has also been actively announcing collaborations on next-gen lithography tools and expanding its global footprint, all of which add context to investor optimism around growth potential and competitive positioning.

Of course, share price appreciation is only part of the story. Is KLA still undervalued at its current price of $1,114.32? When assessed across six key valuation checks, KLA earns a value score of 2, signaling there are some undervaluation signals, but also some caution flags to consider. Next, we will dive into the numbers that drive these checks, unpacking how KLA stacks up on each traditional valuation approach. At the end, I will share one of the smartest ways to cut through the noise on valuation.

KLA scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: KLA Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model is a popular valuation tool that estimates what a company is worth today based on projections of its future cash flows, which are then discounted back to present value. This approach helps investors determine if a stock is trading at a price above or below its intrinsic value.

For KLA, the most recent twelve months of Free Cash Flow came in at $3.72 billion. Analysts forecast KLA’s Free Cash Flow to grow, expecting it to reach as high as $6.30 billion by 2030. It is worth noting that analysts typically project out for the next five years, and numbers beyond that are modeled estimates. These long-term projections reflect expectations for ongoing growth in the semiconductor industry and KLA's ability to capitalize on that trend.

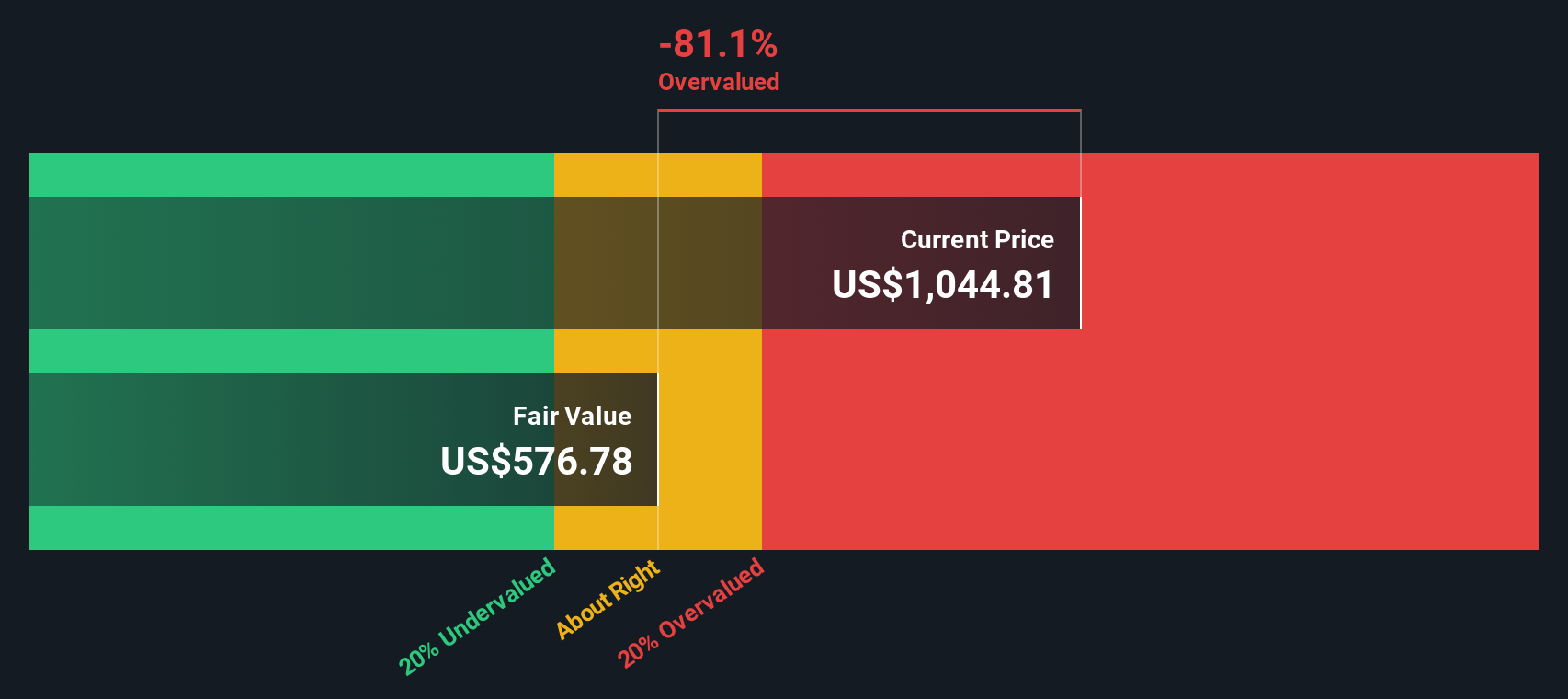

Based on the DCF model, KLA’s estimated fair value is $617.76 per share. When set against the current market price of $1,114.32, this implies the stock is trading at an 80.4% premium to its intrinsic value, flagging a significant level of overvaluation under this method.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests KLA may be overvalued by 80.4%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: KLA Price vs Earnings

The Price-to-Earnings (PE) ratio is a widely used valuation metric, especially for profitable companies like KLA. By comparing the company's current share price to its earnings per share, investors get a snapshot of market expectations for growth and profitability. A higher PE typically signals optimism about future expansion, while a lower number can indicate market caution or slower anticipated growth. However, what is considered a “normal” or “fair” PE ratio is shaped by a company’s growth prospects, risk profile, and the broader environment for its sector.

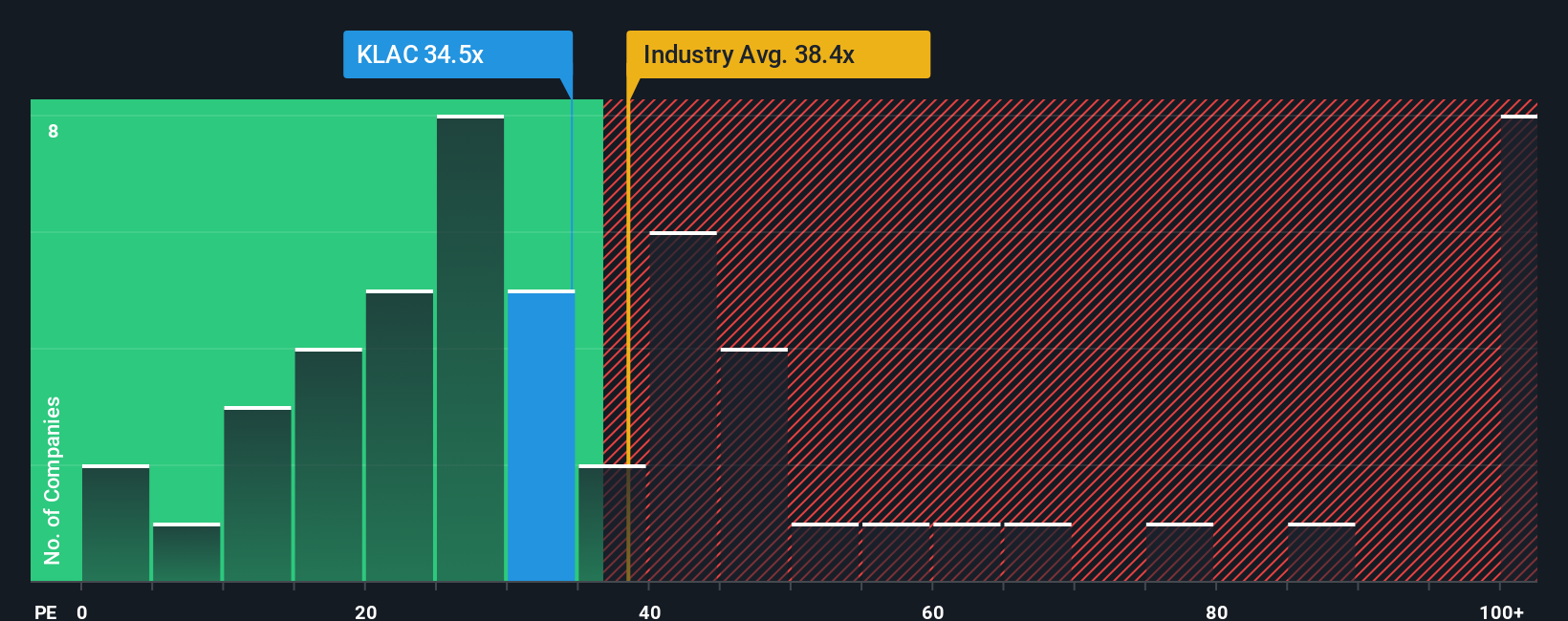

KLA’s current PE ratio stands at 36.1x, which is in the same ballpark as the semiconductor industry average of 37.2x and its peer group average of 37.9x. At first glance, this suggests the market is valuing KLA in line with its sector. However, this does not factor in the nuances of the company's unique position, growth rates, or risk factors relative to the competition.

This is where Simply Wall St's proprietary “Fair Ratio” comes into play. The Fair Ratio for KLA is 31.5x, which is generated by considering not just industry benchmarks, but also growth rates, profit margins, market cap, and risk factors that can meaningfully affect what a rational valuation should be. Rather than using a direct comparison to industry averages or peers, the Fair Ratio provides a more tailored, holistic perspective on what the company's PE ratio ought to be given its fundamentals.

Comparing KLA’s actual PE of 36.1x with its Fair Ratio of 31.5x suggests the stock is trading above what would be considered a balanced or justified level for its financial outlook and risk. This points toward a degree of overvaluation based on earnings multiples, even though headline numbers are close to the bigger industry picture.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your KLA Narrative

Earlier, we mentioned there is an even better way to understand valuation, so let’s introduce you to Narratives. Narratives are interpretive tools that let investors attach their own story, outlook, and expectations to a company like KLA. They go beyond the numbers to connect a unique perspective to a full financial forecast and an assumed fair value. By guiding you to articulate your assumptions about future revenue, earnings growth, and margins, Narratives translate your view of where KLA is heading directly into a dynamic and actionable valuation. This helps you cut through noise and see if your thesis supports a buy, sell, or hold decision versus the current share price.

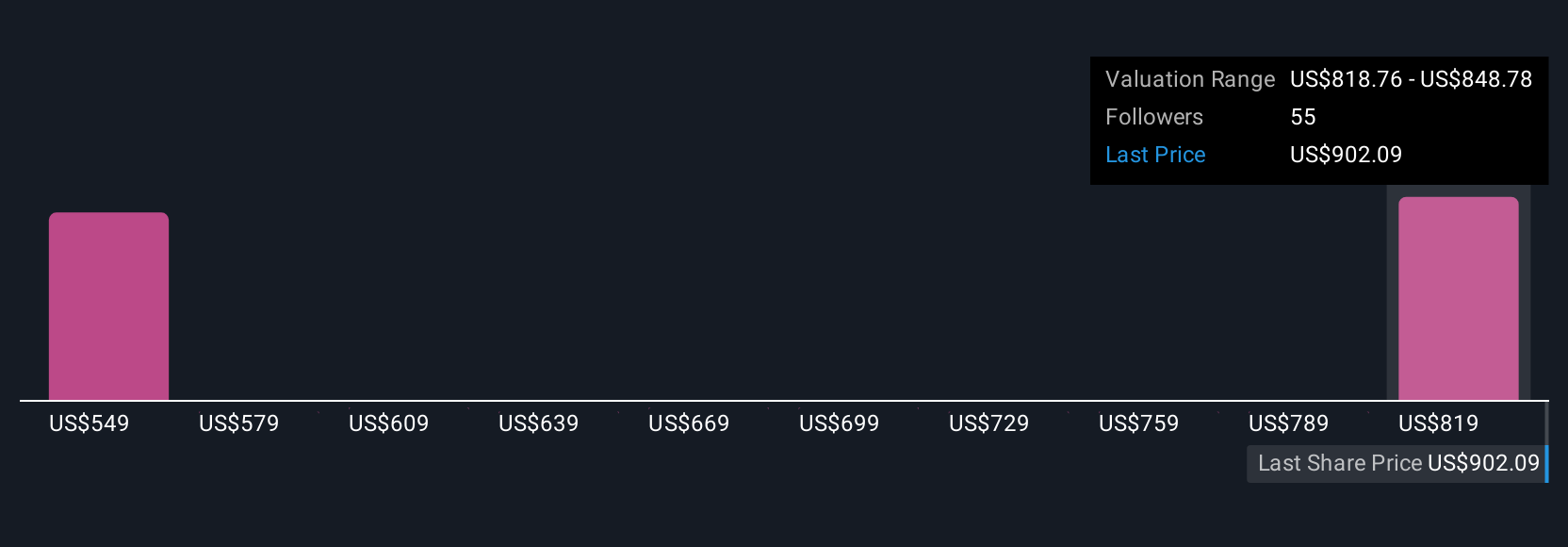

This feature is available to millions of users on Simply Wall St’s Community page, making it easy to update your KLA Narrative as soon as new earnings, news, or forecasts emerge. As a result, your fair value always reflects your latest outlook. Different investors may craft very different Narratives; for example, the most bullish outlook on the platform sees KLA as worth $1,075 per share, while the most cautious only values it at $745. Narratives let you compare where you stand and why, so you can invest smarter, with your story at the center of every decision.

Do you think there's more to the story for KLA? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if KLA might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:KLAC

KLA

Designs, manufactures, and markets process control, process-enabling, and yield management solutions for the semiconductor and related electronics industries worldwide.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives