- United States

- /

- Semiconductors

- /

- NasdaqGS:KLAC

Assessing KLA (KLAC) Valuation After a 73% Year-to-Date Share Price Rally

Reviewed by Kshitija Bhandaru

See our latest analysis for KLA.

KLA has built impressive momentum this year, with the stock’s 73% rally making waves among tech investors and pointing to renewed optimism about the sector’s growth potential. While shorter-term share price returns have been modest, its 1-year total shareholder return still highlights robust gains over the longer run as investors continue to bet on semiconductor demand staying strong.

Curious to see what other semiconductor and AI-focused companies are catching attention? The latest See the full list for free. could open up your investing landscape.

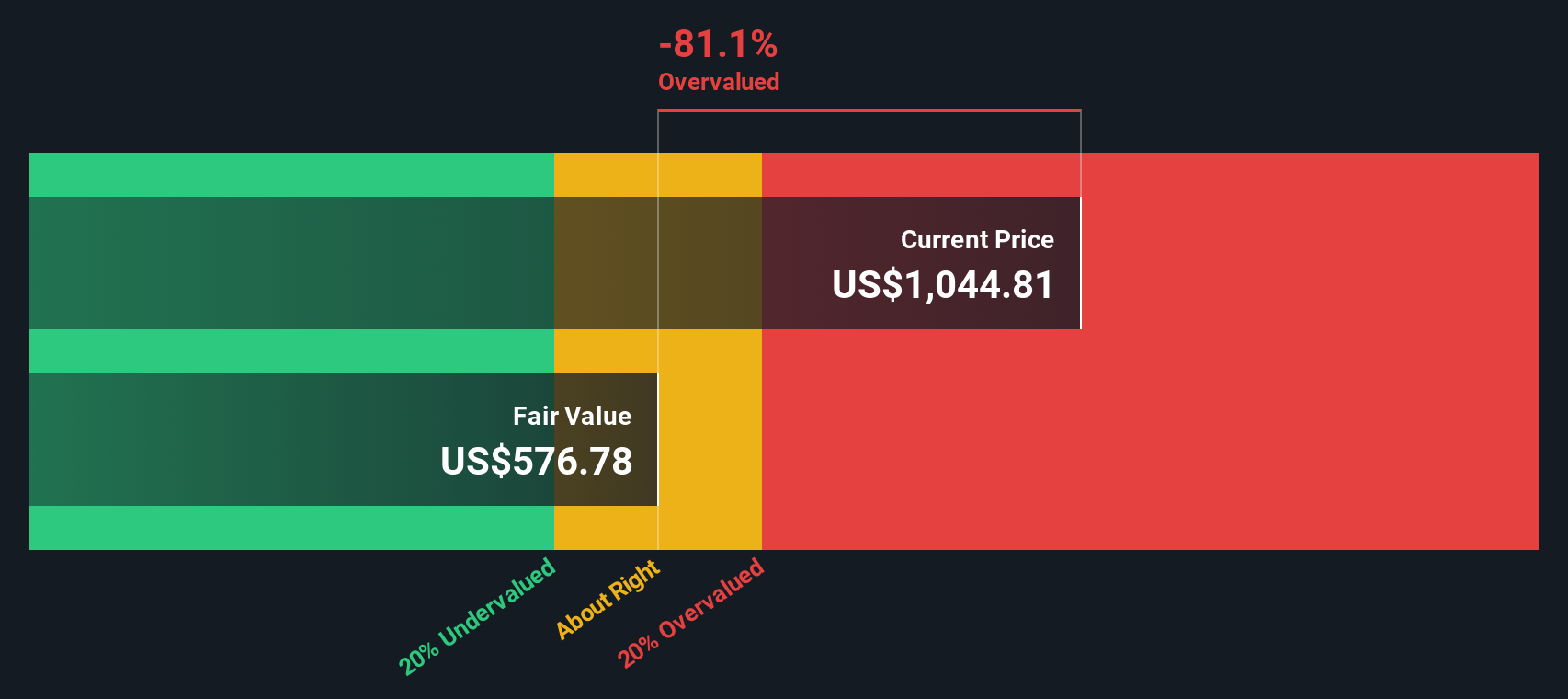

But with the stock trading near its recent highs, the big question is whether these impressive gains reflect KLA’s true value, or if the market is already factoring in all the company’s future growth prospects, leaving little room for upside.

Most Popular Narrative: 13% Overvalued

With KLA's last close at $1,101.55 and the most-followed narrative assigning fair value at $972.48, the market price sits well above what consensus expects. The numbers set the stage for a deeper look into what is driving this valuation divide.

The advanced packaging market is experiencing early-stage, secular growth fueled by adoption of 2.5D/3D architectures and HBM, driving KLA's advanced packaging revenue target for 2025 up nearly 80% year-over-year with expectations that this trend is "closer to the beginning than the end." This directly expands KLA's addressable market and should provide multi-year upside to revenue.

Want to know what powers that ambitious price target? The secret sauce is a mix of booming markets, bullish margin bets, and some head-turning revenue forecasts. Discover which growth levers analysts are boldly wagering on. Are the future numbers too good to be true or just the beginning? This is a valuation play you do not want to overlook.

Result: Fair Value of $972.48 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, challenges such as weaker revenues from China and escalating global tariffs could quickly undermine KLA's momentum and put pressure on the company's future growth outlook.

Find out about the key risks to this KLA narrative.

Another View: Sizing Up Value from a Different Angle

Now let us look at our DCF model, which estimates KLA's fair value at $613.88. This is significantly below the current share price. While market optimism may often drive a premium, this lower fair value suggests that recent gains could be stretching expectations. Will the market prove the model wrong, or is caution warranted?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own KLA Narrative

If you want a different perspective or believe in charting your own course, you can create a personal narrative from the data in just a few minutes. Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding KLA.

Looking for More Investment Ideas?

Don’t let the next big opportunity pass you by. The Simply Wall Street Screener gives you the power to track trends and target growth segments before the crowd.

- Access strong yields and consistent payouts by checking out these 19 dividend stocks with yields > 3%, providing reliable income and stability for long-term portfolios.

- Ride the wave of revolutionary tech by exploring these 26 quantum computing stocks, where industry leaders are unlocking the next level of computing potential.

- Spot fast-growing, future-focused companies in artificial intelligence when you scan these 24 AI penny stocks as they reshape the digital world.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if KLA might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:KLAC

KLA

Designs, manufactures, and markets process control, process-enabling, and yield management solutions for the semiconductor and related electronics industries worldwide.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives