- United States

- /

- Semiconductors

- /

- NasdaqGS:INTC

Will Leadership Changes at Intel (INTC) Accelerate Its Ambitions in AI and Digital Transformation?

Reviewed by Sasha Jovanovic

- In recent weeks, Intel announced the appointment of Cindy Stoddard as chief information officer and made several senior leadership changes, including expanding CEO Lip-Bu Tan’s oversight of the company’s artificial intelligence initiatives following key executive transitions.

- These appointments highlight Intel’s commitment to advancing its digital and AI transformation by bringing in experienced leadership known for driving innovative technology and operational excellence.

- To assess how these leadership changes may shape the company's growth, we'll explore their impact on Intel's ongoing AI and digital transformation strategy.

AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Intel Investment Narrative Recap

To be a shareholder in Intel today, you need to believe in the company’s ability to streamline its structure, accelerate AI strategy, and regain innovation leadership, all while managing significant operational complexity. The recent executive changes, particularly CEO Lip-Bu Tan’s expanded oversight of AI and the appointment of Cindy Stoddard as CIO, are intended to support Intel’s digital transformation. However, these moves have little immediate impact on Intel’s biggest short-term catalyst, faster AI execution, or on the key risk: slow adaptation to new workloads.

Of the latest announcements, Cindy Stoddard’s arrival as CIO stands out for its relevance to Intel’s digital and AI transformation focus. Her experience modernizing digital operations and leading cloud migration at Adobe may give Intel new momentum in strengthening internal IT, improving data integration, and accelerating secure decision-making, all priorities that align closely with Intel’s growth catalysts in AI and digital modernization.

But while these leadership changes signal progress, investors should also consider whether organizational complexity and execution risk...

Read the full narrative on Intel (it's free!)

Intel's outlook foresees $58.1 billion in revenue and $5.2 billion in earnings by 2028. This scenario is built on an annual revenue growth rate of 3.1% and a $25.7 billion increase in earnings from the current level of -$20.5 billion.

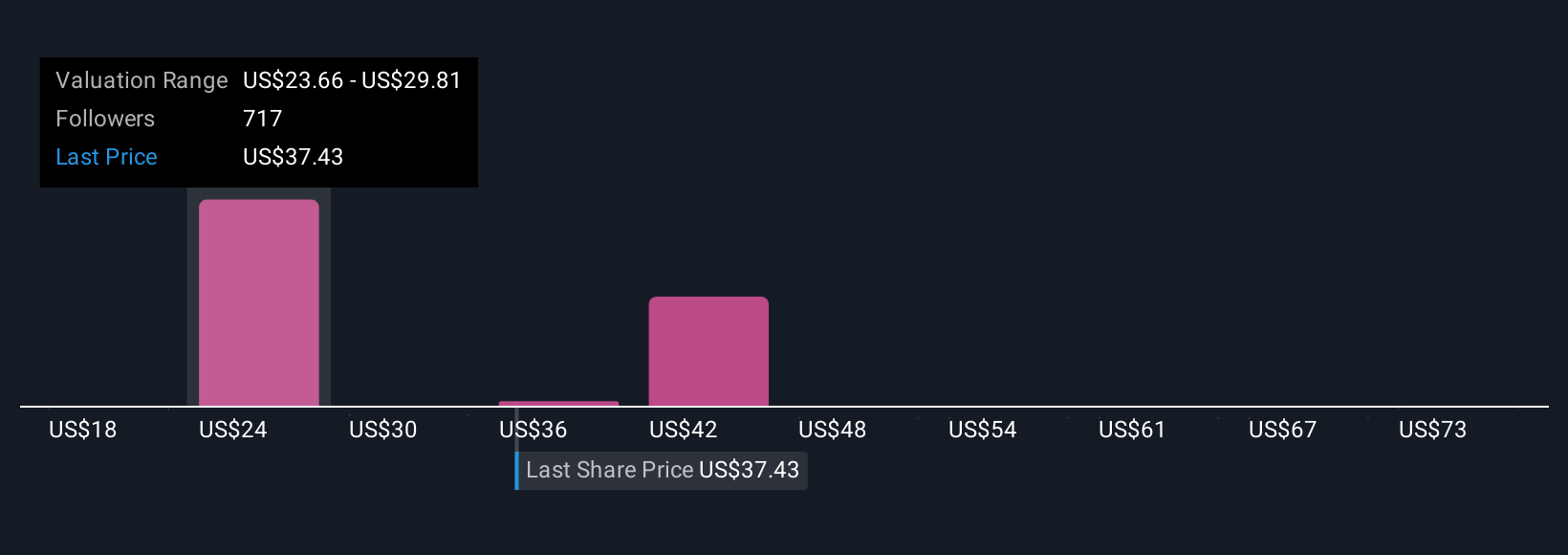

Uncover how Intel's forecasts yield a $37.27 fair value, a 6% upside to its current price.

Exploring Other Perspectives

The most optimistic analysts have argued that Intel’s aggressive push into AI solutions and ramp-up in advanced manufacturing nodes could drive revenue growth up to US$62.1 billion by 2028. Compared to the consensus, this outlook is much more optimistic and assumes that operational streamlining and tech investments deliver significant earnings expansion. As the latest news unfolds, you might find your assumptions shifting, so be sure to consider both perspectives when weighing your next steps.

Explore 28 other fair value estimates on Intel - why the stock might be worth as much as 6% more than the current price!

Build Your Own Intel Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Intel research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Intel research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Intel's overall financial health at a glance.

Contemplating Other Strategies?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 37 companies in the world exploring or producing it. Find the list for free.

- Outshine the giants: these 27 early-stage AI stocks could fund your retirement.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:INTC

Intel

Designs, develops, manufactures, markets, and sells computing and related products and services worldwide.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives