- United States

- /

- Semiconductors

- /

- NasdaqGS:INTC

Is Intel’s Recent Drop an Opportunity After Government Chip Incentives News?

Reviewed by Bailey Pemberton

- Ever wondered if Intel’s stock is actually a bargain, or if all the growth stories have already been priced in? Let’s dig into what could make this a smart pick for value-oriented investors.

- After a powerhouse year with shares up 66.3% year to date, Intel has recently cooled off, dropping by 6.4% in the past week and 11.8% over the past month. This shows the market is still figuring out where it should stand.

- Much of Intel’s recent volatility has been driven by excitement around its expansion into advanced chip manufacturing and news of fresh government incentives for domestic semiconductor production. Meanwhile, leadership changes and continued buzz about AI have kept the company firmly in the headlines as investors weigh new opportunities against legacy challenges.

- Right now, Intel scores a 3 out of 6 on our valuation framework, reflecting strengths and weaknesses across key checks. We’ll walk through how this score stacks up across standard valuation approaches and hint at an even better way to read the numbers so you can make your own call by the end of this article.

Approach 1: Intel Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company's intrinsic value by projecting its future cash flows and discounting them back to today’s dollar value. This helps investors understand what a business is truly worth based on its ability to generate cash over time.

Looking at Intel's DCF analysis, the company reported a last twelve months Free Cash Flow (FCF) of negative $13.65 billion, meaning it has been burning cash rather than generating it. Analyst forecasts project a turnaround, with FCF expected to climb to $4.32 billion by the end of 2029. From 2026 onwards, cash flows are estimated to move from a loss of $1.94 billion to positive territory, reaching over $10.95 billion by 2035 according to extended projections.

Based on this DCF approach, Intel’s estimated intrinsic value comes out to $14.53 per share. Compared to the current market price, this suggests Intel is trading at a 131.4% premium to its DCF-based fair value. In other words, the stock appears substantially overvalued according to cash flow fundamentals.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Intel may be overvalued by 131.4%. Discover 919 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Intel Price vs Sales (P/S)

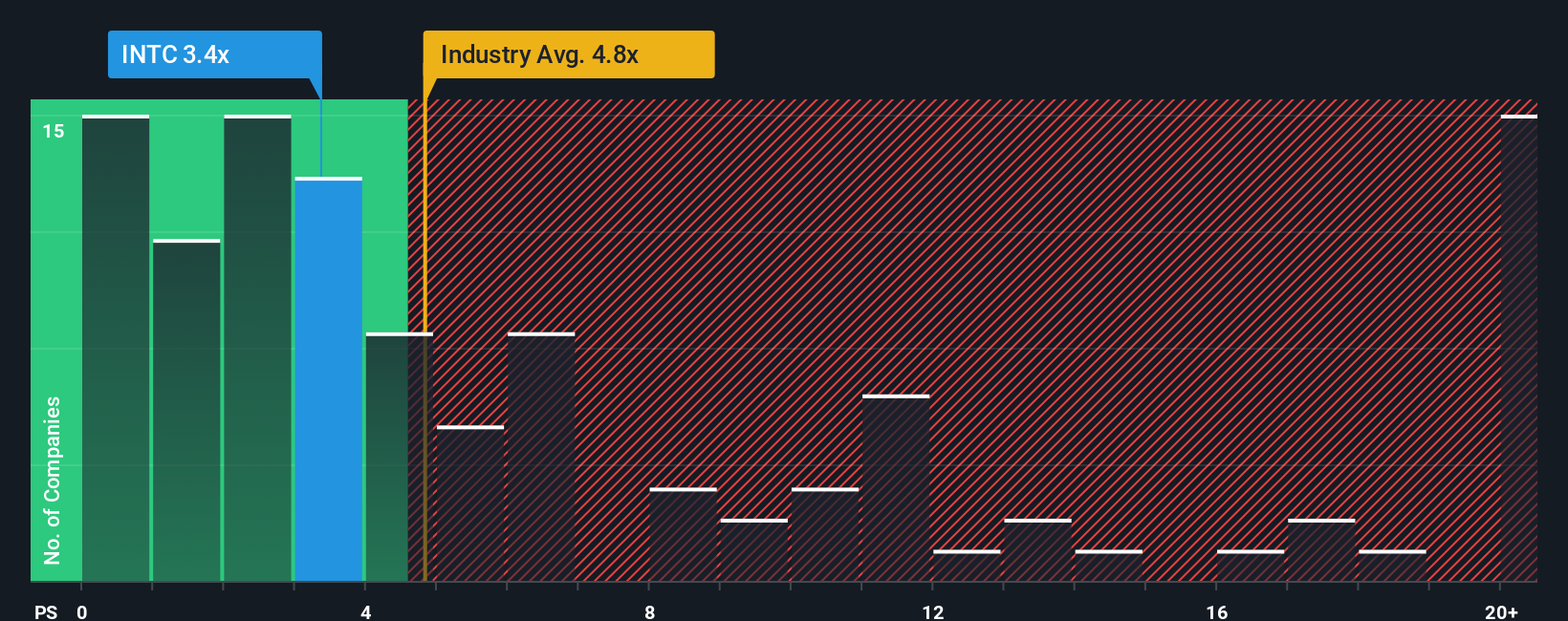

For companies where current profits are low or volatile, the Price-to-Sales (P/S) ratio is often a preferred valuation metric, particularly in the semiconductor industry. This is because sales figures tend to be more stable than earnings, making them a useful benchmark for assessing value, especially as Intel invests heavily to return to sustained profitability.

Growth expectations and company risk levels play a big role in what is considered a "normal" or "fair" multiple. Investors typically pay a higher P/S ratio for businesses expected to grow faster or carry less risk and a lower ratio for slower growers or riskier companies.

Currently, Intel trades at a P/S ratio of 3.00x. This is below the semiconductor industry average of 4.16x and well under the average of its direct peers at 13.61x.

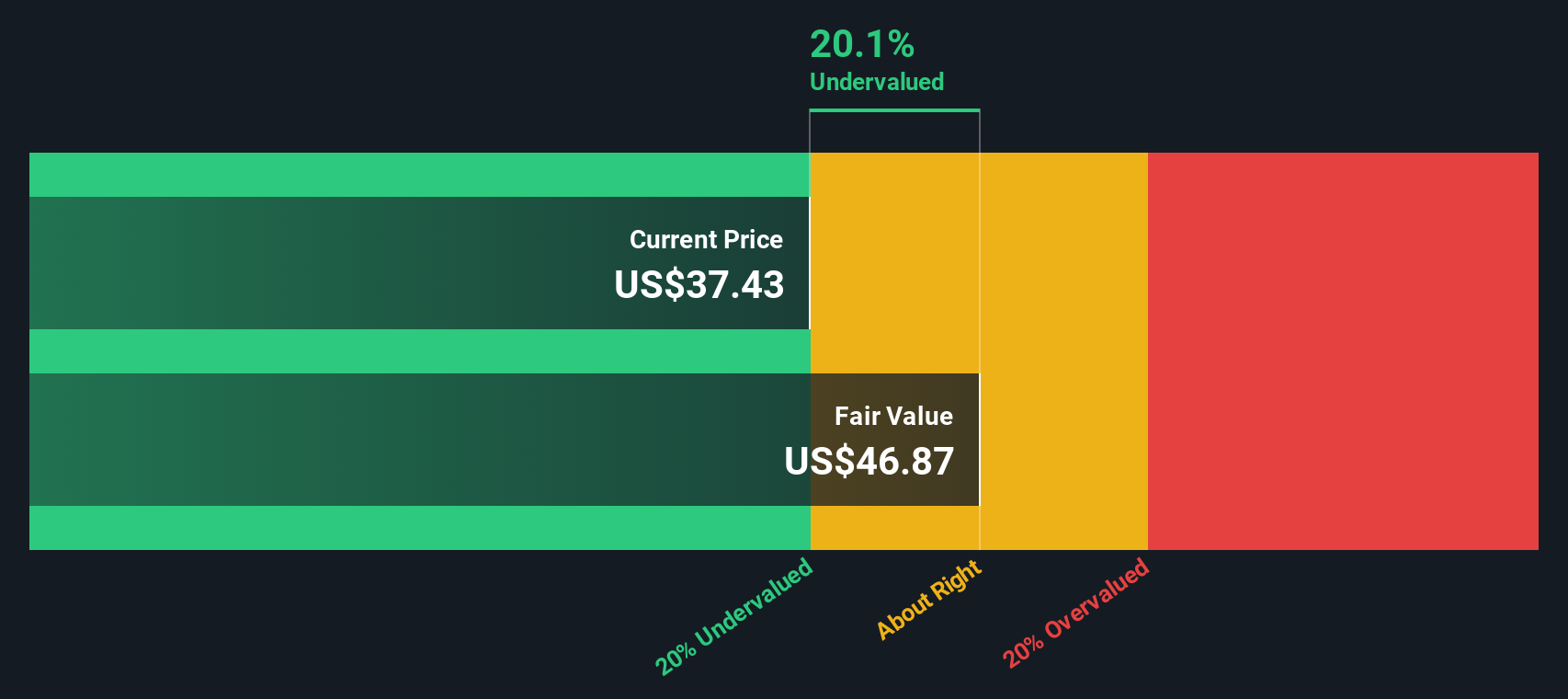

Simply Wall St’s Fair Ratio provides deeper context for what investors should be willing to pay. Unlike a basic peer or industry comparison, the Fair Ratio considers the company’s growth outlook, profit margins, risks, size, and sector, giving a more tailored sense of fair value. For Intel, the Fair Ratio is calculated at 5.52x, suggesting that investors would normally expect to pay that multiple, given its specific outlook and profile.

With Intel’s current P/S multiple coming in well under the Fair Ratio, the shares appear to be undervalued based on this method, even more so when compared to peers and the broader industry.

Result: UNDERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1422 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Intel Narrative

Earlier we mentioned that there’s an even better way to understand valuation, so let's introduce you to Narratives. On Simply Wall St, Narratives let you frame Intel’s story in your own words by connecting the company’s business outlook, key drivers, and risks directly to financial forecasts. This ultimately helps you estimate what the stock is truly worth based on your perspective.

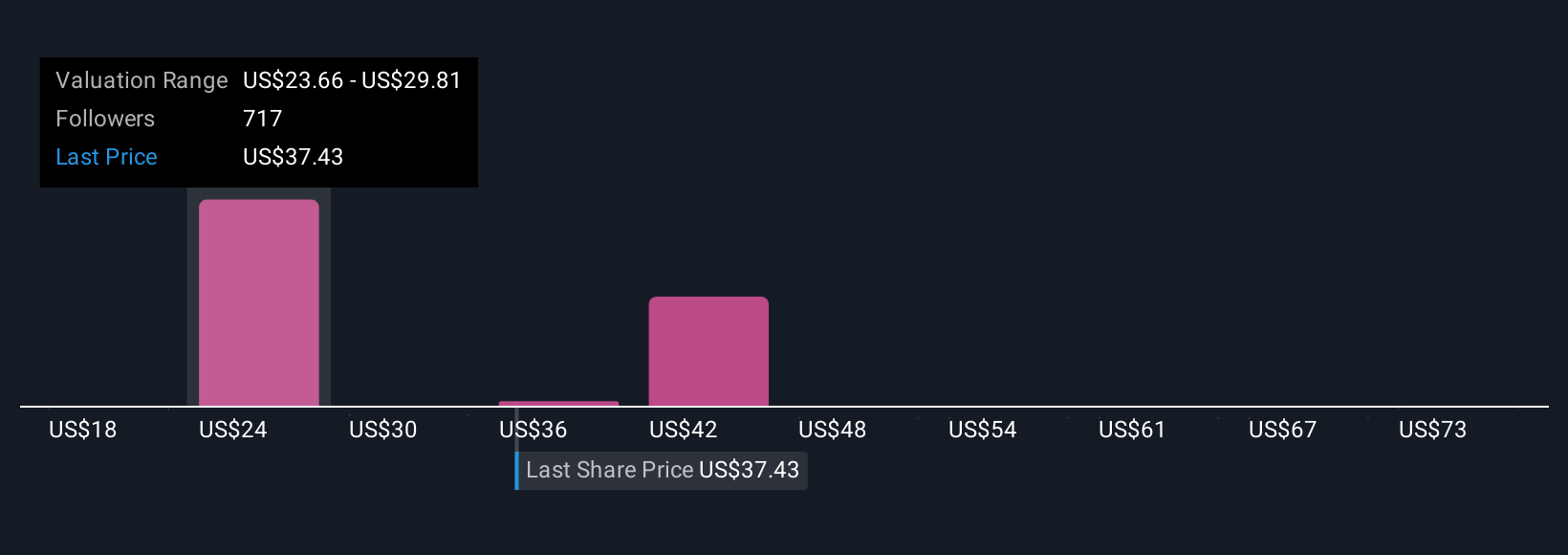

Unlike static models or one-size-fits-all ratios, Narratives are a dynamic tool used by millions of investors in the Community page. This makes the process of defining and refining your investment thesis both easy and interactive. When you build or follow a Narrative, it links together your assumptions for Intel’s growth, profitability, and risks to a fair value estimate. This enables you to make decisions by comparing that Fair Value to the current market Price.

Narratives are updated automatically as news breaks or earnings reports are released, keeping your view fresh and actionable without extra effort. For example, on Intel, the most optimistic active Narrative today sees a fair value over $37 per share, while the most cautious assigns just $16 per share. This reflects how two smart investors can interpret the same company very differently. The power of Narratives is that they help you decide where you stand and give you the tools to act when the numbers or facts change.

For Intel, however, we'll make it really easy for you with previews of two leading Intel Narratives:

Fair Value: $37.27

Currently trading at 9.8% below this fair value

Forecast Revenue Growth: 5.56%

- Restructuring and a focus on AI and foundry services are expected to boost agility, innovation, and revenue growth.

- Improved fundamentals are reflected in analysts raising price targets and increased confidence in the company’s strategy, despite notable challenges.

- Ongoing risks include organizational complexity, macroeconomic uncertainties, and execution challenges that could impact growth and margins.

Fair Value: $28.47

Currently trading at 18.1% above this fair value

Forecast Revenue Growth: 5.9%

- Intel remains a top player in PC and server processors, making strategic moves to restructure and focus investments.

- Significant manufacturing delays and aggressive timelines create uncertainty around Intel’s ability to regain parity with competitors.

- Market dominance in new areas like AI chips is uncertain, with strong competition from Nvidia and AMD challenging Intel’s turnaround prospects.

Do you think there's more to the story for Intel? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:INTC

Intel

Designs, develops, manufactures, markets, and sells computing and related products and services worldwide.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives