- United States

- /

- Semiconductors

- /

- NasdaqGS:INTC

Intel (INTC): A Fresh Look at Valuation After Recent Share Price Gains and Volatility

Reviewed by Simply Wall St

Intel (INTC) shares edged up today, offering investors a steady session amid a broader market pause. With recent gains still fresh in memory, some are watching Intel’s moves to gauge how semiconductor stocks might fare in the future.

See our latest analysis for Intel.

While Intel’s share price climbed 2.62% today, the 30-day share price return still sits at -9.87% after an especially strong 90-day run of 40.53%. Over the longer term, the one-year total shareholder return stands at 40.82%. These moves suggest momentum has cooled in the near term, but the bigger picture remains bright for those who held on through the recent rally.

If the ups and downs in semiconductor stocks have your attention, now is a great moment to explore other tech standouts with our See the full list for free.

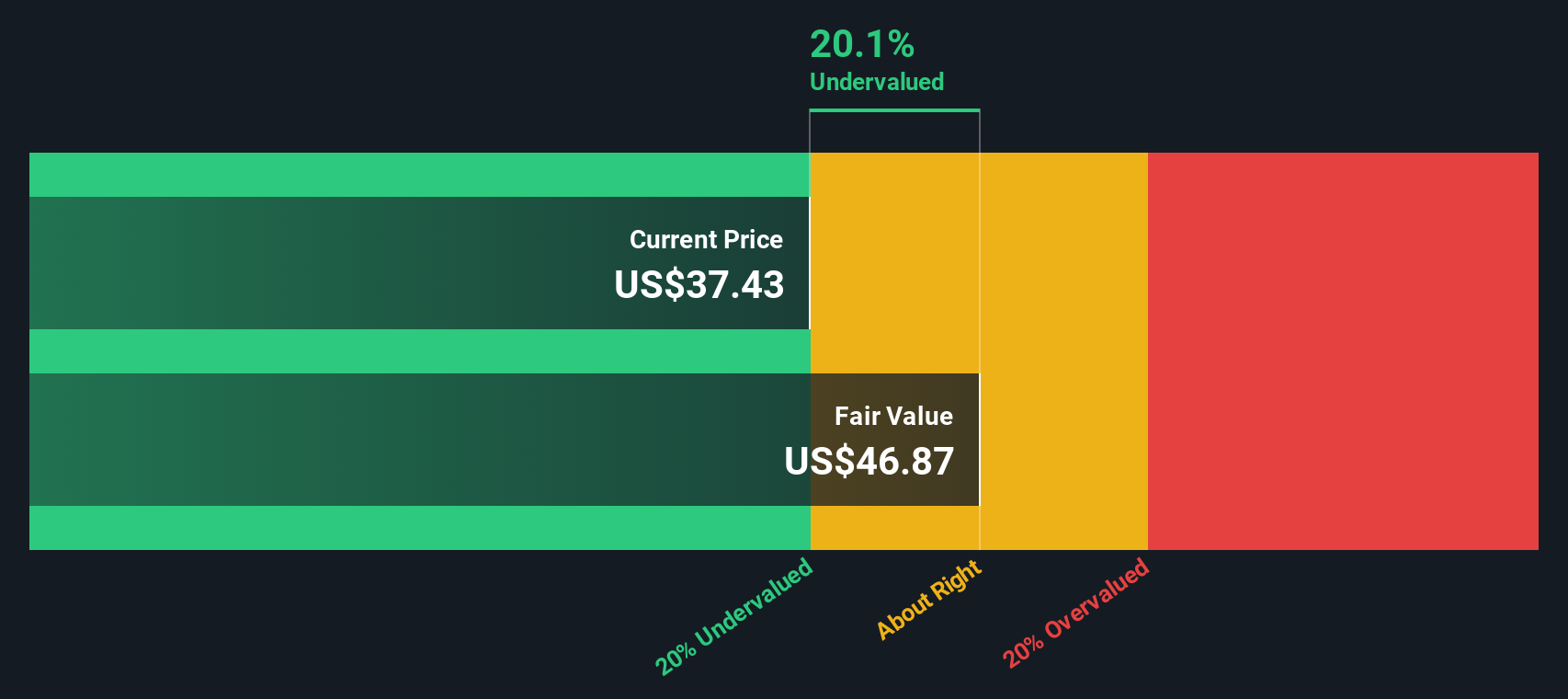

But after recent volatility, the key question remains: Is Intel’s current valuation reflecting untapped upside, or have investors already accounted for future growth, leaving little room for a bargain?

Most Popular Narrative: 7.4% Undervalued

Intel’s fair value estimate lands above the current market price, suggesting positive sentiment from the most widely followed narrative. This signals that investors eye more upside based on future performance expectations.

By refocusing its portfolio and eliminating non-core distractions, Intel aims to decrease operating expenses and streamline operations. This could potentially lead to improved profitability and net margins in upcoming years.

What’s fueling this valuation call? It’s the shift towards leaner operations, but also some bold financial projections, including dramatic swings in profit margins and ambitious long-term goals. Want to see the full set of numbers and tensions driving this narrative? Dive in for all the details.

Result: Fair Value of $37.27 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, organizational complexity and slower AI adaptation remain challenges that could stall Intel's recovery and could affect revenue growth in the years ahead.

Find out about the key risks to this Intel narrative.

Another View: Discounted Cash Flow Tells a Different Story

While the current valuation looks attractive compared to peers using classic price-to-sales ratios, the SWS DCF model estimates Intel’s fair value at only $14.51, far below today’s market price. This sharp difference raises the question: which approach reflects the real opportunity or risk for investors?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Intel for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 927 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Intel Narrative

If this viewpoint doesn’t match your take or you enjoy digging deeper on your own, you can quickly shape your own forecast based on the latest numbers. No expertise required. Do it your way

A great starting point for your Intel research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Unlock investment opportunities you might be overlooking. The right stock could be just a click away, and you don’t want to let the next big winner slip by.

- Target steady income streams by reviewing these 16 dividend stocks with yields > 3%, which have yields exceeding 3 percent and are notable for reliability.

- Capitalize on rapid innovation and explore the future with these 26 AI penny stocks, a group at the forefront of artificial intelligence breakthroughs.

- Seize value where others aren’t looking by checking out these 927 undervalued stocks based on cash flows, which may offer potential upside based on strong cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:INTC

Intel

Designs, develops, manufactures, markets, and sells computing and related products and services worldwide.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives