- United States

- /

- Semiconductors

- /

- NasdaqGS:INTC

Does Intel’s 95% Jump in 2025 Reflect Its True Value After Chip Manufacturing Push?

Reviewed by Bailey Pemberton

- Ever wondered if Intel’s current share price really reflects the company’s value? You’re not alone. Savvy investors are always hunting for opportunities where the market may have missed something.

- Intel’s stock has seen its fair share of action lately, closing at $39.50 after surging 7.2% over the past month and delivering an impressive 95.4% gain so far this year.

- Behind these moves, Intel has been making headlines with its continued push into advanced chip manufacturing and strategic industry partnerships. Both of these factors have kept sentiment high. Most recently, chatter around tech sector momentum and potential government support for domestic semiconductor production has further fueled interest in the stock.

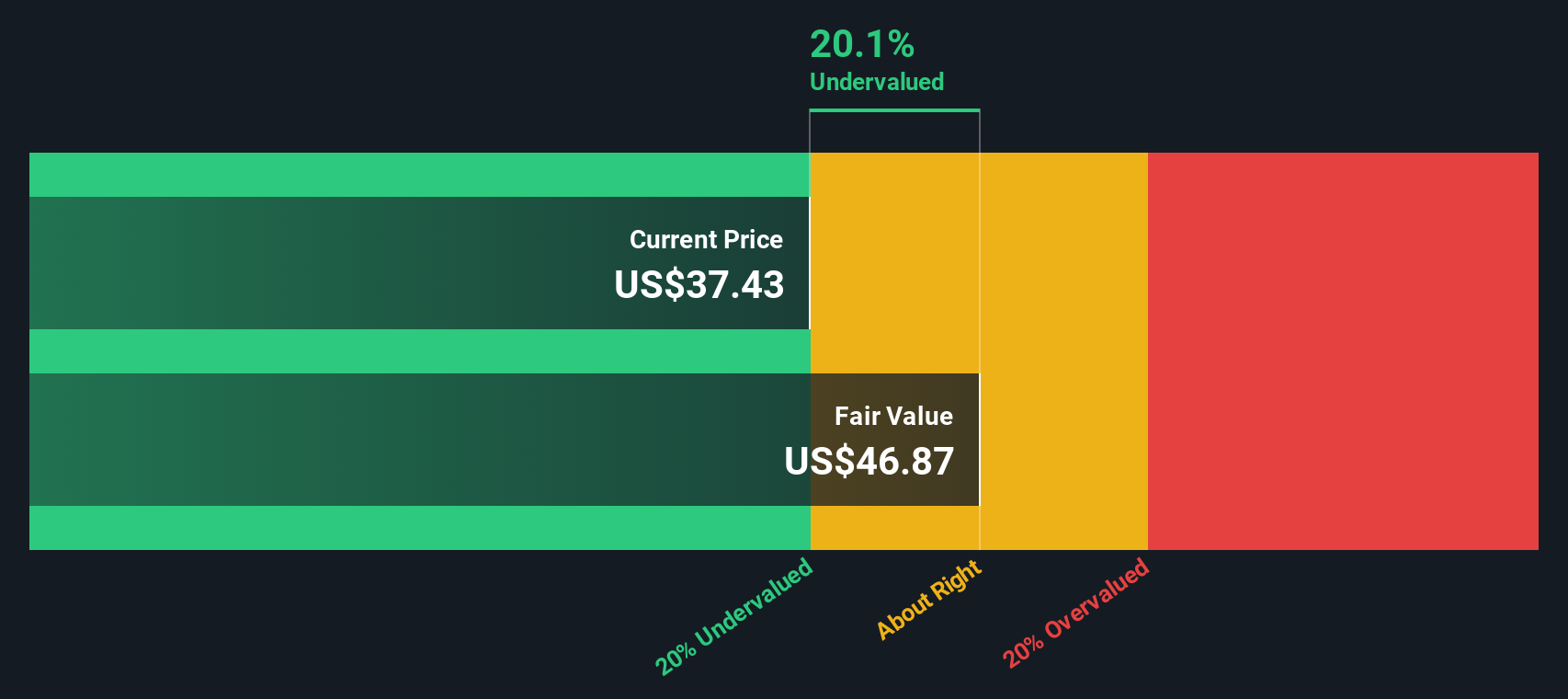

- According to our value assessment, Intel scores a 3 out of 6 on undervaluation checks. This suggests the market might be onto something, but there’s more to the story. We’ll dive into how these valuation numbers are calculated, and later, reveal an even sharper approach for understanding what Intel could really be worth.

Approach 1: Intel Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's intrinsic value by projecting its future cash flows and discounting them back to their value today. This approach aims to reflect what the business is truly worth, based on its ability to generate cash over time.

For Intel, the most recent cash flow figures show a last-twelve-month free cash flow of negative $13.7 Billion, reflecting the company's heavy investments and current spending cycle. Analyst estimates suggest cash flows will begin to recover in the coming years, with projected free cash flow reaching $4.3 Billion by 2029. Since most analysts only provide clear figures out to 2029, further projections to 2035 are extrapolated using industry growth rates.

Despite these recovery expectations, the DCF model arrives at an intrinsic value of $15.58 per share for Intel. With the current market price at $39.50, this valuation points to Intel being 153.6% overvalued by this measure. This wide gap suggests the market may be placing high hopes on growth or future developments that go well beyond conservative cash flow projections.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Intel may be overvalued by 153.6%. Discover 843 undervalued stocks or create your own screener to find better value opportunities.

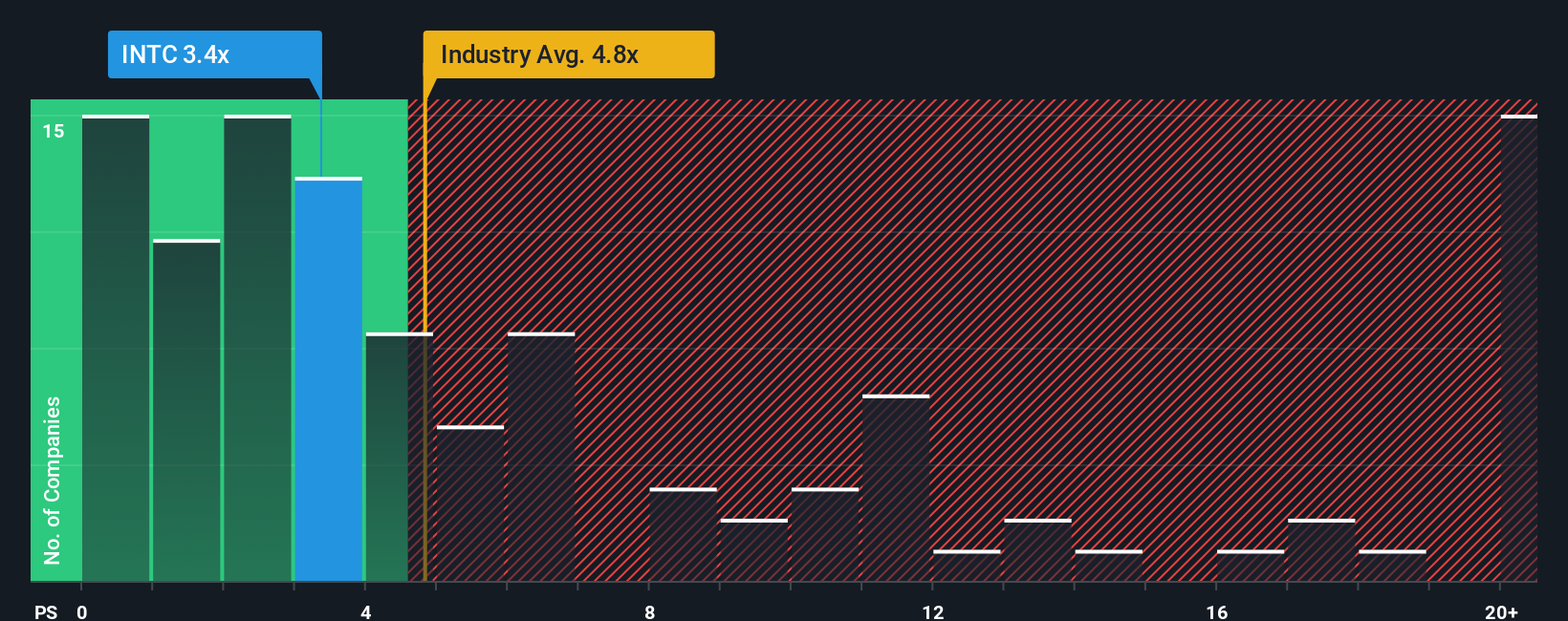

Approach 2: Intel Price vs Sales (P/S) Analysis

For companies like Intel, which may be in a heavy investment phase or just emerging from a period of lower profitability, the Price-to-Sales (P/S) multiple is a particularly useful way to gauge valuation. Unlike earnings-based metrics, the P/S ratio is less impacted by temporary swings in profitability and gives a clearer picture of how the market values each dollar of revenue. This is especially relevant in the semiconductor industry where sales growth is a strong indicator of scale and future potential.

Market optimism, growth prospects, and perceived business risk all influence what counts as a "reasonable" P/S multiple. Higher expected growth typically supports a higher P/S ratio, while greater risks or slowing sales could warrant a discount. At present, Intel trades at a P/S of 3.52x. Compared to the broader semiconductor industry average of 5.28x and peer average of 16.85x, Intel appears less expensive by this measure.

Simply Wall St’s proprietary Fair Ratio offers a more tailored benchmark. This metric incorporates Intel's growth outlook, industry landscape, profit margins, and company-specific risks to generate a fair value multiple. In this case, Intel’s Fair Ratio stands at 5.70x. Since this is meaningfully higher than Intel's actual P/S, it suggests the market is currently undervaluing the stock's revenue-generating potential, taking all these factors into account. Unlike simple peer comparisons, the Fair Ratio adapts to what actually matters for Intel right now and provides a more insightful assessment for investors.

Result: UNDERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1410 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Intel Narrative

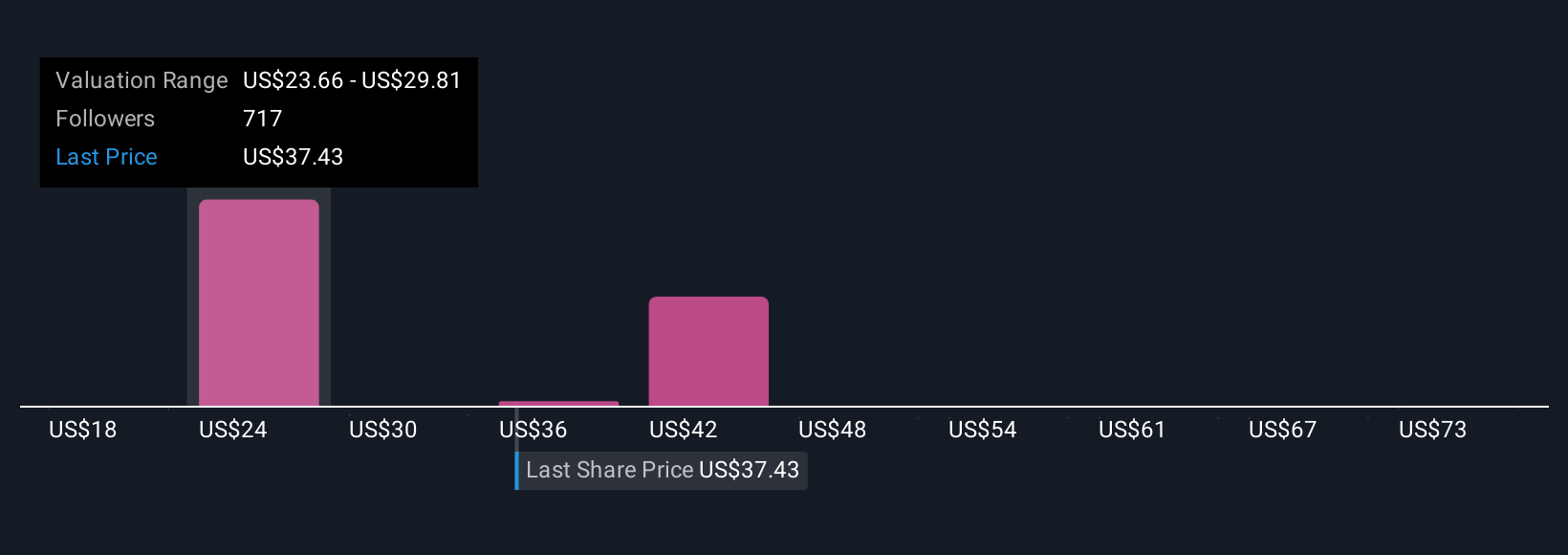

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is simply your story about Intel, your set of assumptions about how the company will perform, including your expectations for future revenue, margins, growth, and ultimately, fair value. Narratives bridge the gap between a company’s story, a concrete financial forecast, and the valuation that flows from all of these elements together.

With Narratives, available right on Simply Wall St’s Community page, you do not need to be an expert. You can quickly create and adjust your own forecast and see what Intel’s "fair value" would be using those assumptions. This helps you decide when to buy or sell by comparing your Narrative’s fair value directly to the current market price. Narratives update dynamically as fresh data, earnings, or news comes in, keeping your analysis relevant without any extra work from you.

For example, some Intel Narratives on Simply Wall St see a bullish fair value around $27 per share, while the most bearish put Intel closer to $14, illustrating how different perspectives and assumptions can lead to very different investment conclusions.

Do you think there's more to the story for Intel? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:INTC

Intel

Designs, develops, manufactures, markets, and sells computing and related products and services worldwide.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives