- United States

- /

- Semiconductors

- /

- NasdaqGS:HIMX

Why Investors Shouldn't Be Surprised By Himax Technologies, Inc.'s (NASDAQ:HIMX) Low P/S

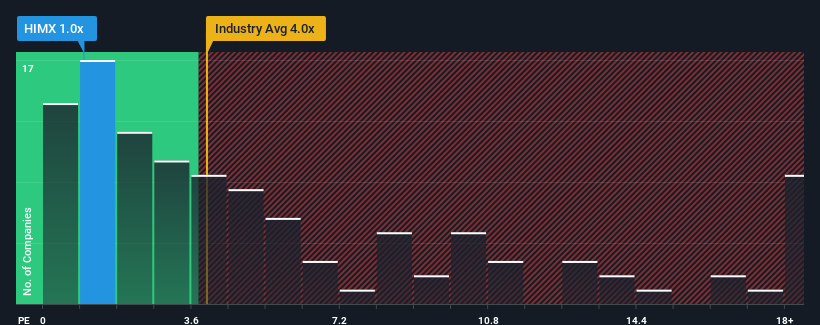

You may think that with a price-to-sales (or "P/S") ratio of 1x Himax Technologies, Inc. (NASDAQ:HIMX) is definitely a stock worth checking out, seeing as almost half of all the Semiconductor companies in the United States have P/S ratios greater than 4x and even P/S above 10x aren't out of the ordinary. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so limited.

View our latest analysis for Himax Technologies

How Has Himax Technologies Performed Recently?

While the industry has experienced revenue growth lately, Himax Technologies' revenue has gone into reverse gear, which is not great. It seems that many are expecting the poor revenue performance to persist, which has repressed the P/S ratio. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value.

Want the full picture on analyst estimates for the company? Then our free report on Himax Technologies will help you uncover what's on the horizon.Do Revenue Forecasts Match The Low P/S Ratio?

Himax Technologies' P/S ratio would be typical for a company that's expected to deliver very poor growth or even falling revenue, and importantly, perform much worse than the industry.

Retrospectively, the last year delivered a frustrating 21% decrease to the company's top line. This has soured the latest three-year period, which nevertheless managed to deliver a decent 6.6% overall rise in revenue. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been mostly respectable for the company.

Shifting to the future, estimates from the three analysts covering the company suggest revenue growth is heading into negative territory, declining 4.7% over the next year. With the industry predicted to deliver 45% growth, that's a disappointing outcome.

In light of this, it's understandable that Himax Technologies' P/S would sit below the majority of other companies. Nonetheless, there's no guarantee the P/S has reached a floor yet with revenue going in reverse. There's potential for the P/S to fall to even lower levels if the company doesn't improve its top-line growth.

The Bottom Line On Himax Technologies' P/S

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we suspected, our examination of Himax Technologies' analyst forecasts revealed that its outlook for shrinking revenue is contributing to its low P/S. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. It's hard to see the share price rising strongly in the near future under these circumstances.

It is also worth noting that we have found 2 warning signs for Himax Technologies that you need to take into consideration.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if Himax Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:HIMX

Himax Technologies

A fabless semiconductor company, provides display imaging processing technologies in China, Taiwan, Korea, Japan, the United States, and internationally.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success