- United States

- /

- Semiconductors

- /

- NasdaqGS:GFS

Is GlobalFoundries (GFS) Building a Moat in Photonics With Its Latest Partnerships?

Reviewed by Sasha Jovanovic

- In late September 2025, GlobalFoundries announced a series of collaborations, including with Applied Materials to establish a waveguide fabrication facility in Singapore, Corning to develop detachable fiber connector solutions for its silicon photonics platform, and Egis Technology to integrate new direct time-of-flight sensors on its 55nm platform, all targeting new solutions for AI, smart sensing, and datacenter markets.

- These alliances highlight GlobalFoundries’ expanding role in enabling next-generation photonics and sensing innovations for high-demand sectors such as AI infrastructure, advanced computing, and automotive systems.

- We'll examine how GlobalFoundries' entry into advanced photonics manufacturing could further strengthen its positioning in high-growth technology markets.

Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

GlobalFoundries Investment Narrative Recap

To hold GlobalFoundries stock, an investor needs confidence in the potential for continued demand growth in automotive, IoT, and communications infrastructure chips, as well as the company's ability to expand capacity and leverage regional manufacturing in response to evolving trade policies. While the flurry of recent partnerships positions GlobalFoundries to win new business in photonics and smart sensing, the most important short-term catalyst remains government policy regarding domestic chip production. These news events raise GlobalFoundries' profile but do not materially change this key catalyst or the principal risk of lagging in advanced process node technology versus industry leaders.

Among the recent announcements, the collaboration with Applied Materials to build a waveguide fabrication facility in Singapore stands out as the most relevant. This move complements government incentives for high-tech manufacturing and aligns with market catalysts centered on increasing chip content in data center and AI applications. However, the ultimate impact depends on whether GlobalFoundries can maintain technological competitiveness, especially as large customers consider new sources or in-house solutions...

Read the full narrative on GlobalFoundries (it's free!)

GlobalFoundries is projected to reach $8.6 billion in revenue and $1.4 billion in earnings by 2028. This outlook assumes an 8.0% annual revenue growth rate and a $1.515 billion increase in earnings from the current level of -$115.0 million.

Uncover how GlobalFoundries' forecasts yield a $39.43 fair value, a 10% upside to its current price.

Exploring Other Perspectives

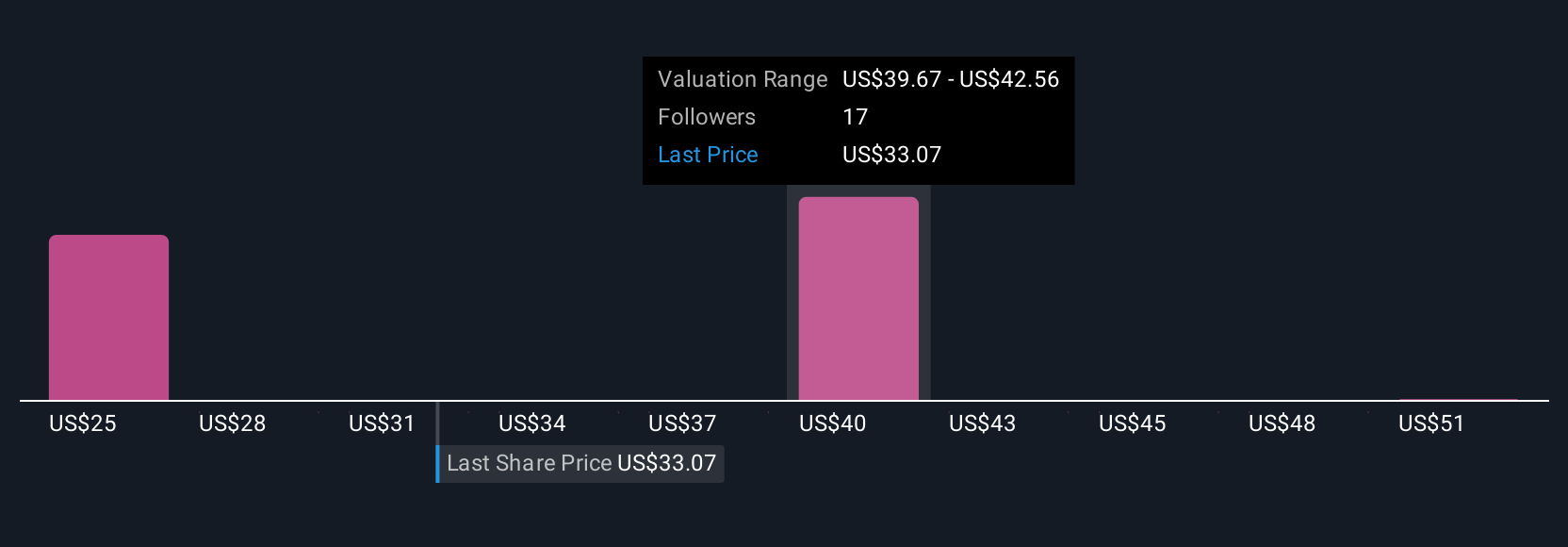

Five members of the Simply Wall St Community have posted fair value estimates for GlobalFoundries between US$25.20 and US$54.14. While opinions vary, ongoing industry shifts toward advanced semiconductor nodes could increasingly influence both revenue and market sentiment, see how your view aligns with theirs.

Explore 5 other fair value estimates on GlobalFoundries - why the stock might be worth as much as 51% more than the current price!

Build Your Own GlobalFoundries Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your GlobalFoundries research is our analysis highlighting 1 key reward that could impact your investment decision.

- Our free GlobalFoundries research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate GlobalFoundries' overall financial health at a glance.

Looking For Alternative Opportunities?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:GFS

GlobalFoundries

A semiconductor foundry, provides range of mainstream wafer fabrication services and technologies worldwide.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Constellation Energy Dividends and Growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026