- United States

- /

- Semiconductors

- /

- NasdaqGS:GFS

How Investors May Respond To GlobalFoundries (GFS) Licensing TSMC GaN Technology for U.S. Power Chips

Reviewed by Sasha Jovanovic

- GlobalFoundries announced a technology licensing agreement with Taiwan Semiconductor Manufacturing Company Ltd. to access advanced 650V and 80V Gallium Nitride (GaN) technologies, enabling U.S.-based manufacturing of next-generation power chips for data centers, industrial, and automotive markets.

- This agreement is expected to help GlobalFoundries broaden its differentiated offerings and address increased demand for efficient power systems across high-growth sectors, while reinforcing U.S. semiconductor capacity.

- Now, we'll explore how access to TSMC's GaN technology could reshape GlobalFoundries' long-term positioning and investment outlook.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

GlobalFoundries Investment Narrative Recap

For investors considering GlobalFoundries, the central belief rests on the company’s opportunity to capture rising demand in automotive, data center, and industrial chips, especially as clients seek resilient, regional supply chains. The recent TSMC GaN technology licensing agreement expands GF’s differentiated power chip offerings in the US, but given its production launch is slated for late 2026, it is unlikely to materially affect near-term catalysts or address the most pressing risk: GF’s limited exposure to advanced process nodes, which remains a key challenge.

Among recent announcements, the expanded partnership with Silicon Labs stands out for its direct reinforcement of US-based manufacturing, aligning with customer needs for secure and efficient supply chains. This development supports GlobalFoundries’ long-term growth catalysts, particularly as demand rises for energy-efficient wireless solutions in industrial and IoT markets.

In contrast, investors should also be aware of the continued risk posed by GlobalFoundries’ lower participation in leading-edge process nodes, as...

Read the full narrative on GlobalFoundries (it's free!)

GlobalFoundries' narrative projects $8.6 billion revenue and $1.4 billion earnings by 2028. This requires 8.0% yearly revenue growth and a $1.5 billion earnings increase from -$115.0 million currently.

Uncover how GlobalFoundries' forecasts yield a $39.43 fair value, a 15% upside to its current price.

Exploring Other Perspectives

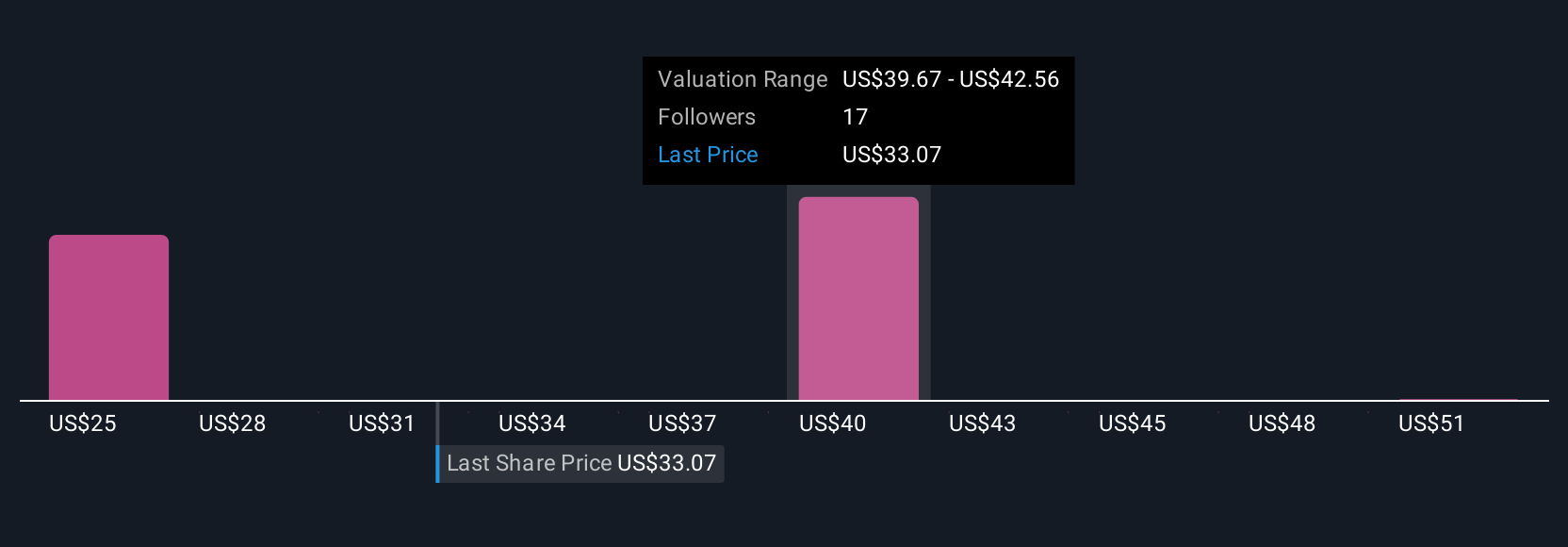

Five Community fair value estimates for GlobalFoundries range from US$27.47 to US$54.14 per share. While viewpoints vary widely, the ongoing challenge of limited exposure to advanced process technology has broader implications for future performance, explore these differing perspectives to inform your own outlook.

Explore 5 other fair value estimates on GlobalFoundries - why the stock might be worth 20% less than the current price!

Build Your Own GlobalFoundries Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your GlobalFoundries research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free GlobalFoundries research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate GlobalFoundries' overall financial health at a glance.

Ready For A Different Approach?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Outshine the giants: these 27 early-stage AI stocks could fund your retirement.

- Find companies with promising cash flow potential yet trading below their fair value.

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:GFS

GlobalFoundries

A semiconductor foundry, provides range of mainstream wafer fabrication services and technologies worldwide.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives