- United States

- /

- Semiconductors

- /

- NasdaqGS:FSLR

Is First Solar Still a Standout After 30% Stock Jump in 2025?

Reviewed by Bailey Pemberton

So, you’re staring at First Solar’s stock chart and wondering whether it’s still got room to shine, or if it’s time to take profits and look elsewhere. The stock’s recent momentum has certainly caught investors’ eyes. Over just the past week, First Solar shares rose 4.1%, bringing the 30-day gain to 10.1%. Year-to-date, the stock is up an impressive 29.5%, and if you glance further back, you’ll see a 21.6% increase over the last year, a striking 82.0% gain in three years, and a massive 177.3% return over five years. This kind of long-term outperformance doesn’t happen by accident; it’s fueled by real developments and, lately, a surge in demand for next-generation renewable energy solutions.

One big reason behind these strong moves relates to industry-wide shifts: governments around the globe are ramping up support for clean energy, and solar manufacturers like First Solar have been quick to position themselves at the forefront. News of expanded production capacity and supply deals in the U.S. and abroad has reinforced investor confidence that First Solar can capture a growing share of the market. With clean-energy policies accelerating the transition away from fossil fuels, sentiment is increasingly optimistic, reflected in the rising stock price over both the short and long term.

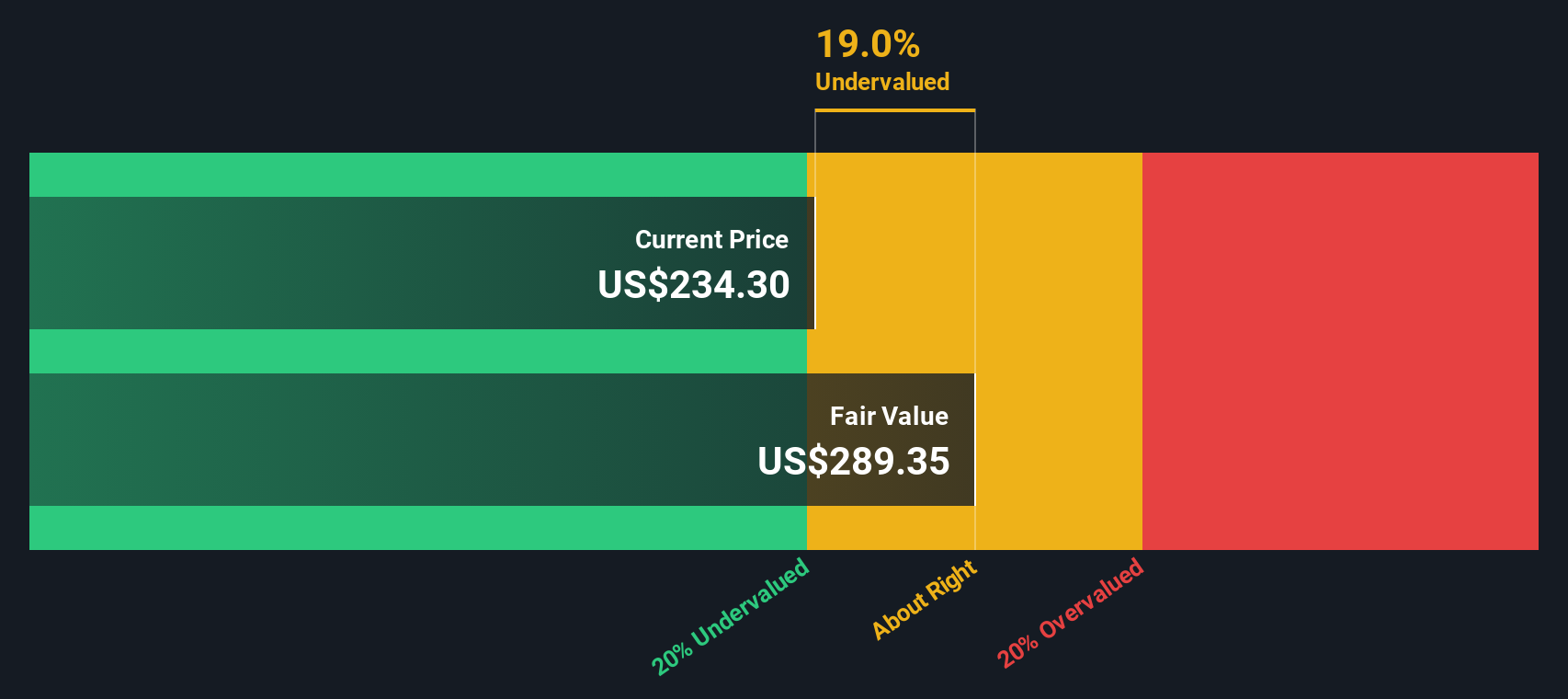

But the real question on everyone’s mind, especially after this kind of run, is whether First Solar still looks attractively valued or if upside is becoming limited. Based on six key valuation checks, the company’s value score comes in at 5 out of 6, pointing toward significant undervaluation by most traditional measures. Up next, we’ll dive into what those valuation approaches tell us about First Solar’s stock, and later, I’ll share a different perspective that might change how you think about what the company’s really worth.

Why First Solar is lagging behind its peers

Approach 1: First Solar Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s true value by projecting its expected future cash flows and then discounting them back to today’s dollars. This method aims to calculate what the business is really worth, regardless of short-term market noise, by putting a present value on its long-term potential.

For First Solar, the most recent trailing twelve months Free Cash Flow sits at a negative $1.25 billion, suggesting significant ongoing investments or cash outflows. Despite this, projections are optimistic. Analyst estimates and long-range forecasts anticipate Free Cash Flow will climb to $3.59 billion by 2029, with further increases extrapolated out a full decade. These projections are all in US Dollars and, after discounting, build the case for substantial long-term profitability and growth potential for the company.

Based on the DCF’s calculations, First Solar’s estimated intrinsic value comes in at $399.57 per share. This suggests that the current stock price is 39.6% below this fair value mark. In other words, the DCF model indicates First Solar is deeply undervalued at current levels.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests First Solar is undervalued by 39.6%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

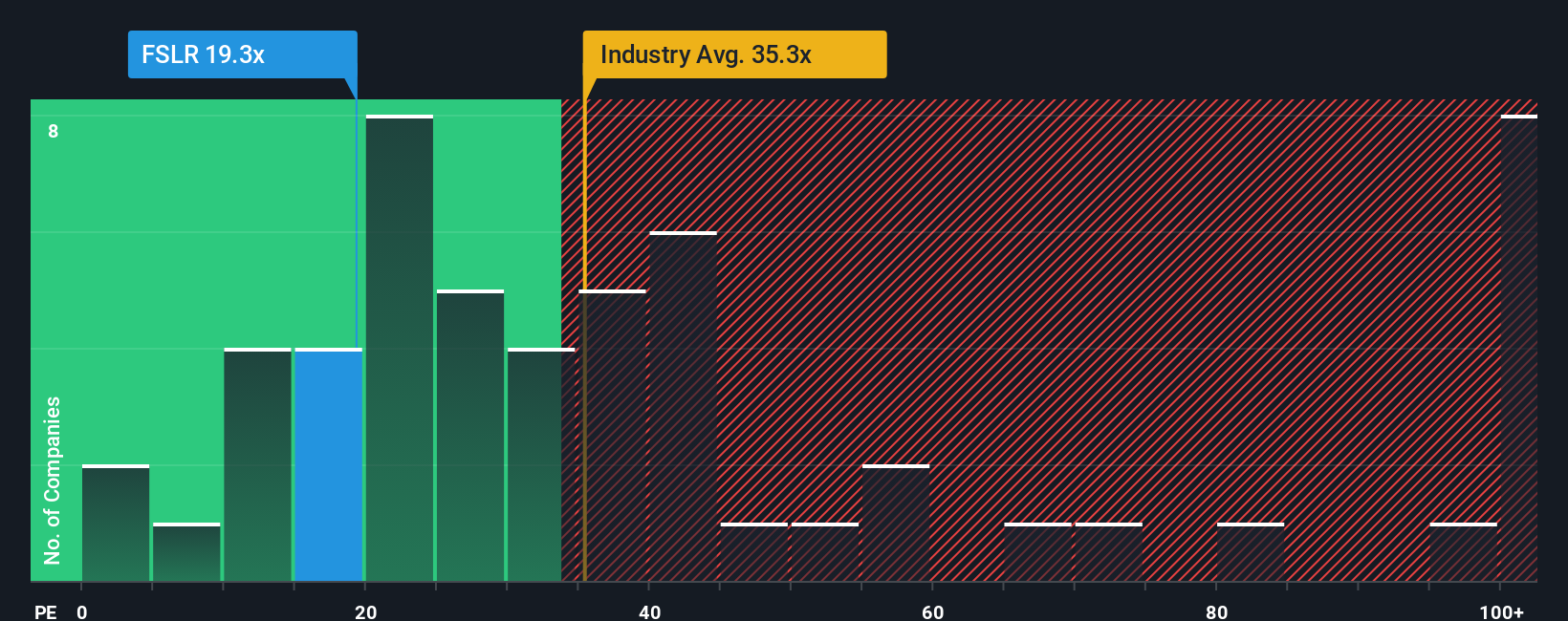

Approach 2: First Solar Price vs Earnings (P/E) Analysis

The Price-to-Earnings (P/E) ratio is a widely used valuation metric for profitable companies, as it measures how much investors are willing to pay today for a dollar of future earnings. It is particularly useful for companies like First Solar that already generate positive earnings, since it provides a sense of how the market is valuing the firm's profitability relative to its peers.

Growth expectations and perceived business risks both influence what a "normal" or "fair" P/E ratio should be. Faster-growing companies or those operating with lower risk profiles tend to warrant higher P/E multiples, while more mature or riskier firms typically trade at lower multiples. It is always helpful to benchmark against industry norms to see where a stock stands.

Currently, First Solar’s P/E ratio stands at 20.59x. The semiconductor industry’s average P/E is 39.53x, and peers trade even higher at an average of 84.19x. Although First Solar's P/E is noticeably below both benchmarks, Simply Wall St’s proprietary "Fair Ratio" model suggests the stock’s fair P/E should be 37.29x. This measure goes beyond simple peer comparisons by weighing in First Solar’s earnings growth, profit margins, market cap, industry, and company-specific risks, making it a more rounded benchmark for fair valuation.

The upshot: With a current P/E of 20.59x compared to a Fair Ratio of 37.29x, First Solar appears attractively valued through the lens of earnings multiples.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

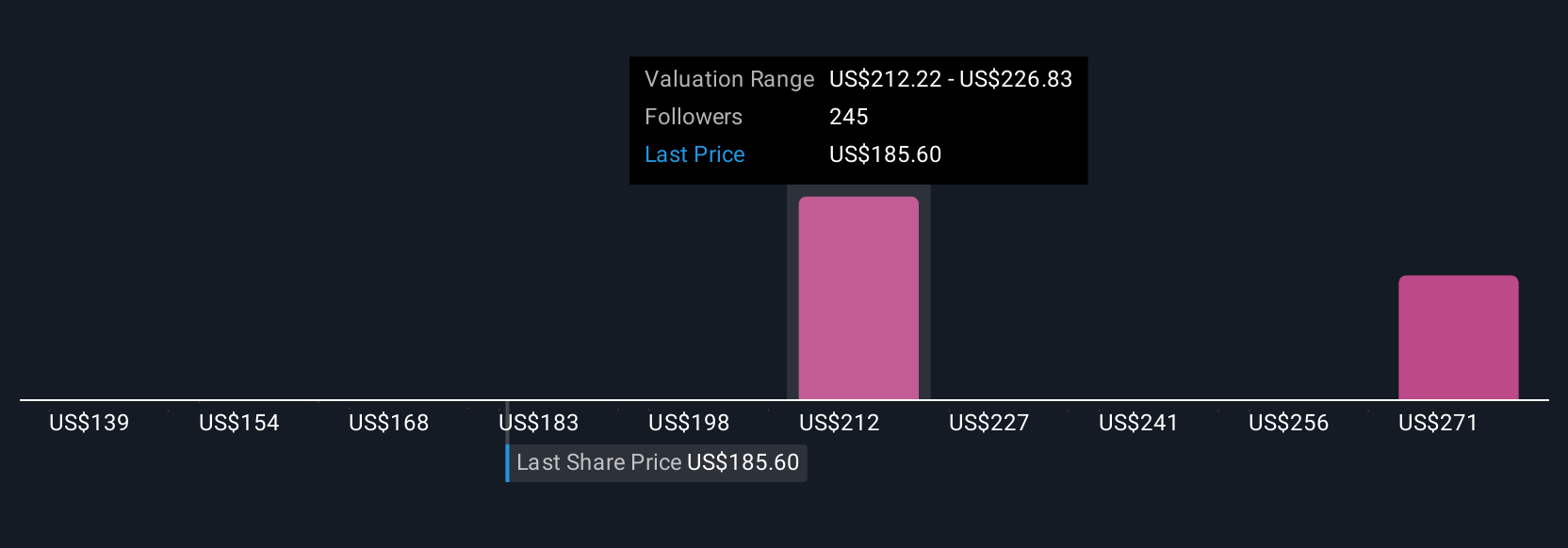

Upgrade Your Decision Making: Choose your First Solar Narrative

Earlier, we mentioned there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is your personal, story-driven view of a company that links its fundamental business outlook with your forecasts for future revenue, earnings, and profit margins, to an estimated fair value. With Narratives, you can move beyond generic ratios and connect the company's story and potential with your own assumptions. You can then instantly compare your view of fair value to the current market price to help decide when to act.

Narratives are easy to use and available to everyone through Simply Wall St's Community page, where millions of investors build and update their perspectives. What makes Narratives unique is that they are dynamic. Whenever fresh information emerges, like news headlines, analyst updates, or earnings results, your Narrative is seamlessly updated so your investing decisions stay as current as possible.

For example, some First Solar investors create bullish Narratives, expecting brisk U.S. manufacturing expansion and policy tailwinds to push earnings and fair value as high as $287 per share. Others build more cautious Narratives, wary of global policy or margin risks, and set their fair value at just $100. By comparing a range of Narratives, you empower yourself to invest with clarity, confidence, and a clear story that reflects your unique outlook.

Do you think there's more to the story for First Solar? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:FSLR

First Solar

A solar technology company, provides photovoltaic (PV) solar energy solutions in the United States, France, India, Chile, and internationally.

Undervalued with high growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Deep Value Multi Bagger Opportunity

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026