- United States

- /

- Semiconductors

- /

- NasdaqGS:FSLR

How First Solar's $775 Million Tax Credit Deal Could Reshape Liquidity for FSLR Investors

Reviewed by Sasha Jovanovic

- First Solar announced it has entered into two tax credit transfer agreements with a major digital payments company, enabling the sale of up to US$775 million in advanced manufacturing production tax credits generated in 2025 and 2026.

- This arrangement is designed to increase First Solar’s liquidity and underscores the growing value of monetizing renewable energy tax credits as a financing tool in the sector.

- We’ll explore how First Solar’s move to unlock liquidity from tax credits could strengthen its long-term earnings visibility and industry position.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

First Solar Investment Narrative Recap

To be a First Solar shareholder, you need to believe the company can maintain a leading position in U.S. solar manufacturing by capitalizing on domestic policy incentives and keeping a clear technological edge despite global competition and shifting policy risks. The recent tax credit transfer news improves liquidity and could support ongoing expansion plans, but does not fundamentally change the most important near-term catalyst: executing domestic manufacturing ramps and booking new contracts, nor does it remove the ongoing policy risk tied to U.S. subsidies and import tariffs.

One announcement especially relevant here is the company's plan to bring its new Alabama and Louisiana facilities online by 2025, aimed at boosting U.S. capacity to 14 GW next year. This capacity build-out aligns tightly with the tax credit monetization, as both initiatives help First Solar benefit from favorable U.S. policy and serve robust home-market demand, which remains the central growth driver as the sector faces global trade uncertainty.

In contrast, investors should be aware of First Solar’s exposure to abrupt changes in U.S. support or trade policy, especially as key incentives and tariffs approach renewal or reinterpretation in ...

Read the full narrative on First Solar (it's free!)

First Solar's outlook anticipates $7.0 billion in revenue and $3.2 billion in earnings by 2028. This is based on a forecasted annual revenue growth rate of 17.4% and an increase in earnings of $1.9 billion from the current level of $1.3 billion.

Uncover how First Solar's forecasts yield a $238.59 fair value, a 4% upside to its current price.

Exploring Other Perspectives

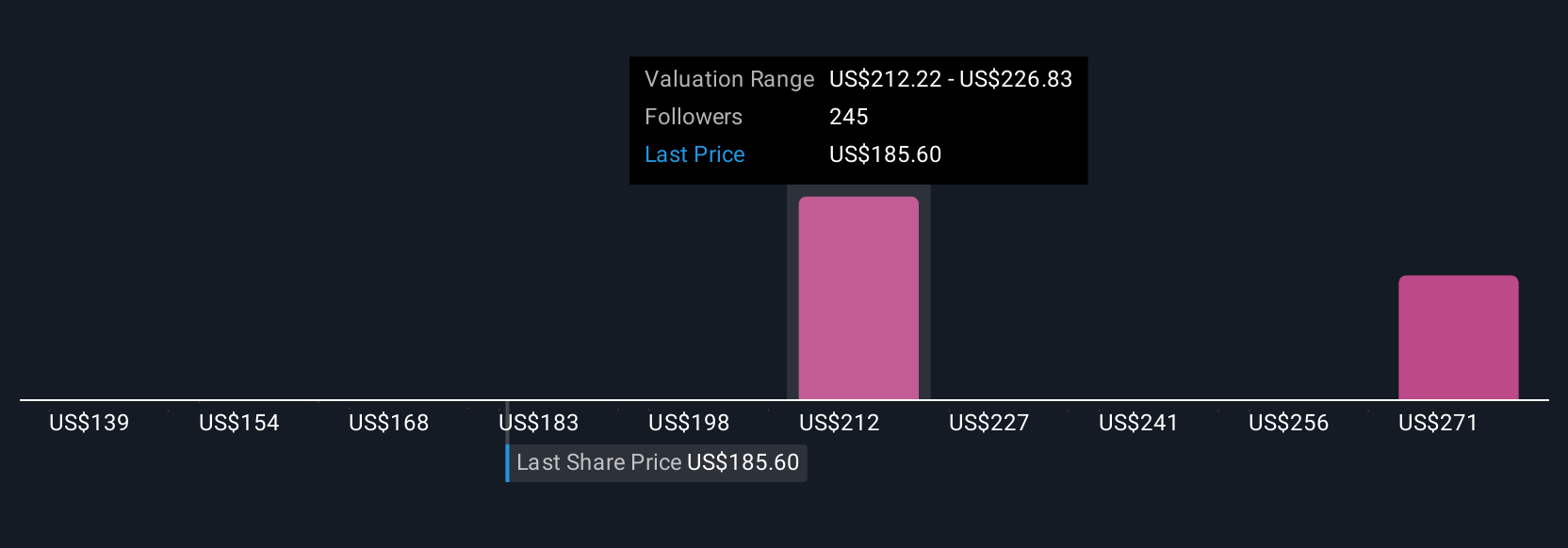

Twenty-eight fair value estimates from the Simply Wall St Community range from US$142 to US$399 per share, showing broad disagreement on future potential. With such varied viewpoints, keep in mind that policy-driven risks remain front of mind for many market participants.

Explore 28 other fair value estimates on First Solar - why the stock might be worth as much as 74% more than the current price!

Build Your Own First Solar Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your First Solar research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free First Solar research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate First Solar's overall financial health at a glance.

Curious About Other Options?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 27 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Find companies with promising cash flow potential yet trading below their fair value.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:FSLR

First Solar

A solar technology company, provides photovoltaic (PV) solar energy solutions in the United States, France, India, Chile, and internationally.

Undervalued with high growth potential.

Similar Companies

Market Insights

Community Narratives