- United States

- /

- Semiconductors

- /

- NasdaqGS:FSLR

First Solar (FSLR) Is Up 9.2% After Opening $1.1 Billion Louisiana Plant – Has the Bull Case Changed?

Reviewed by Sasha Jovanovic

- First Solar recently inaugurated its US$1.1 billion, fully vertically integrated manufacturing facility in Iberia Parish, Louisiana, expanding its annual solar module capacity by 3.5 gigawatts and creating more than 800 new American jobs.

- This major development strengthens First Solar's position as a leading U.S.-based solar manufacturer, highlighting significant investment in domestic supply chains and reduced reliance on overseas materials.

- We’ll examine how the new Louisiana facility’s scale and supply chain independence could shape First Solar’s investment outlook going forward.

The latest GPUs need a type of rare earth metal called Terbium and there are only 35 companies in the world exploring or producing it. Find the list for free.

First Solar Investment Narrative Recap

To be a shareholder in First Solar, you have to believe that U.S.-centered solar manufacturing, supported by favorable policies and large-scale capacity, is critical in capturing growth and higher margins in the solar sector. The newly opened US$1.1 billion Louisiana facility accelerates the company’s supply chain independence and reinforces its domestic focus, which directly addresses one of the most important short-term business catalysts, reduced reliance on imported modules. However, the biggest short-term risk remains continuous U.S. policy support; this facility alone does not materially lessen that risk right now.

One particularly relevant announcement is First Solar’s US$330 million investment in a new production line in Gaffney, South Carolina, to onshore Series 6Plus module manufacturing. This expansion aligns with the core catalyst of leveraging domestic policy incentives and supply chain stability, echoing the significance of the Louisiana plant’s contribution to future growth potential. These parallel investments highlight First Solar’s intensive commitment to U.S. manufacturing scale, but they depend on current policy conditions.

But, investors should also keep in mind the potential vulnerability if government incentives change or expire...

Read the full narrative on First Solar (it's free!)

First Solar's narrative projects $7.0 billion revenue and $3.2 billion earnings by 2028. This requires 17.4% yearly revenue growth and a $1.9 billion increase in earnings from $1.3 billion today.

Uncover how First Solar's forecasts yield a $271.61 fair value, in line with its current price.

Exploring Other Perspectives

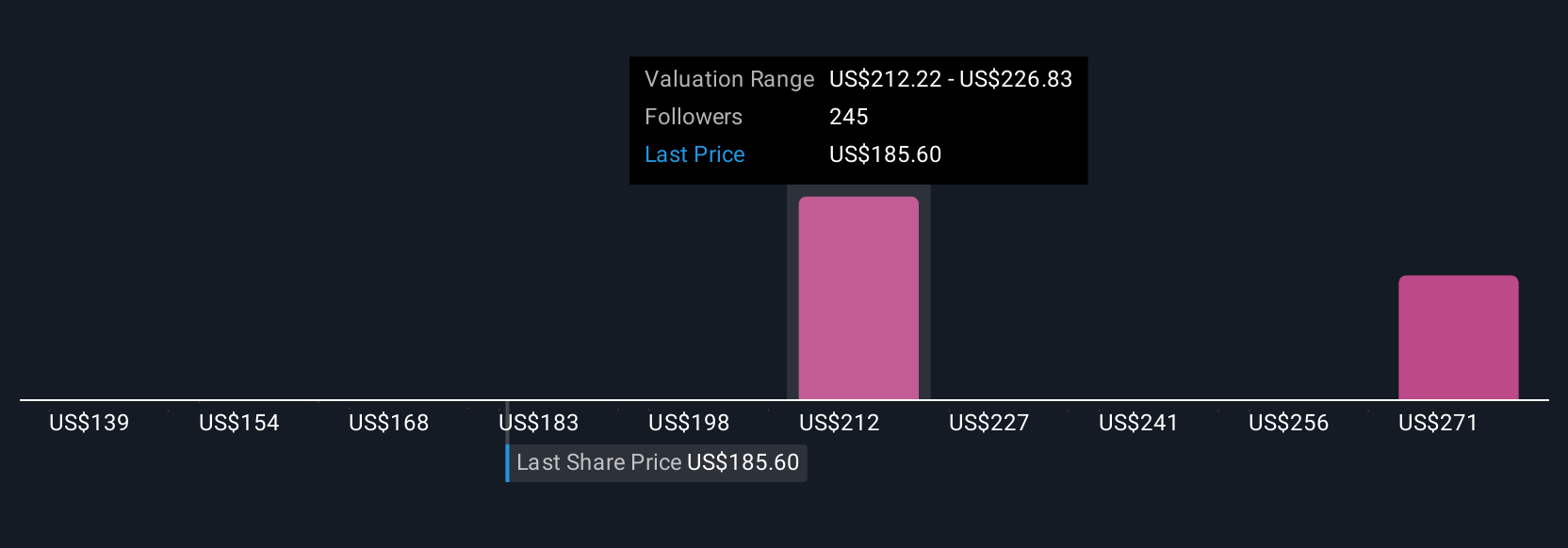

The Simply Wall St Community contributed 28 fair value estimates for First Solar, ranging from US$142 to US$489 per share, reflecting varied growth assumptions and risk outlooks. With U.S. policy support standing out as a pivotal catalyst, your own perspective on policy changes could sharply affect your view of the company’s future.

Explore 28 other fair value estimates on First Solar - why the stock might be worth as much as 79% more than the current price!

Build Your Own First Solar Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your First Solar research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free First Solar research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate First Solar's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:FSLR

First Solar

A solar technology company, provides photovoltaic (PV) solar energy solutions in the United States, France, India, Chile, and internationally.

Undervalued with high growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026