- United States

- /

- Semiconductors

- /

- NasdaqGS:FSLR

First Solar (FSLR): Assessing Valuation After New Tax Credit Transfer Deals Boost Financial Flexibility

Reviewed by Simply Wall St

First Solar (FSLR) has signed two tax credit transfer agreements with a major digital payments company. These deals are expected to provide significant liquidity and enhance the company’s financial flexibility over the next year.

See our latest analysis for First Solar.

First Solar’s latest tax credit initiatives come on the heels of a strong move up in its share price, with a 1-day gain of 5.42% and a nearly 10% 1-month share price return. Investor optimism is building around its ability to monetize federal incentives and expand its competitive edge. Over the past year, total shareholder return stands at 17.74%, underscoring both strong long-term performance and momentum picking up in recent months.

If First Solar’s surge has you rethinking what’s possible in tech-enabled energy, now’s the perfect time to discover See the full list for free.

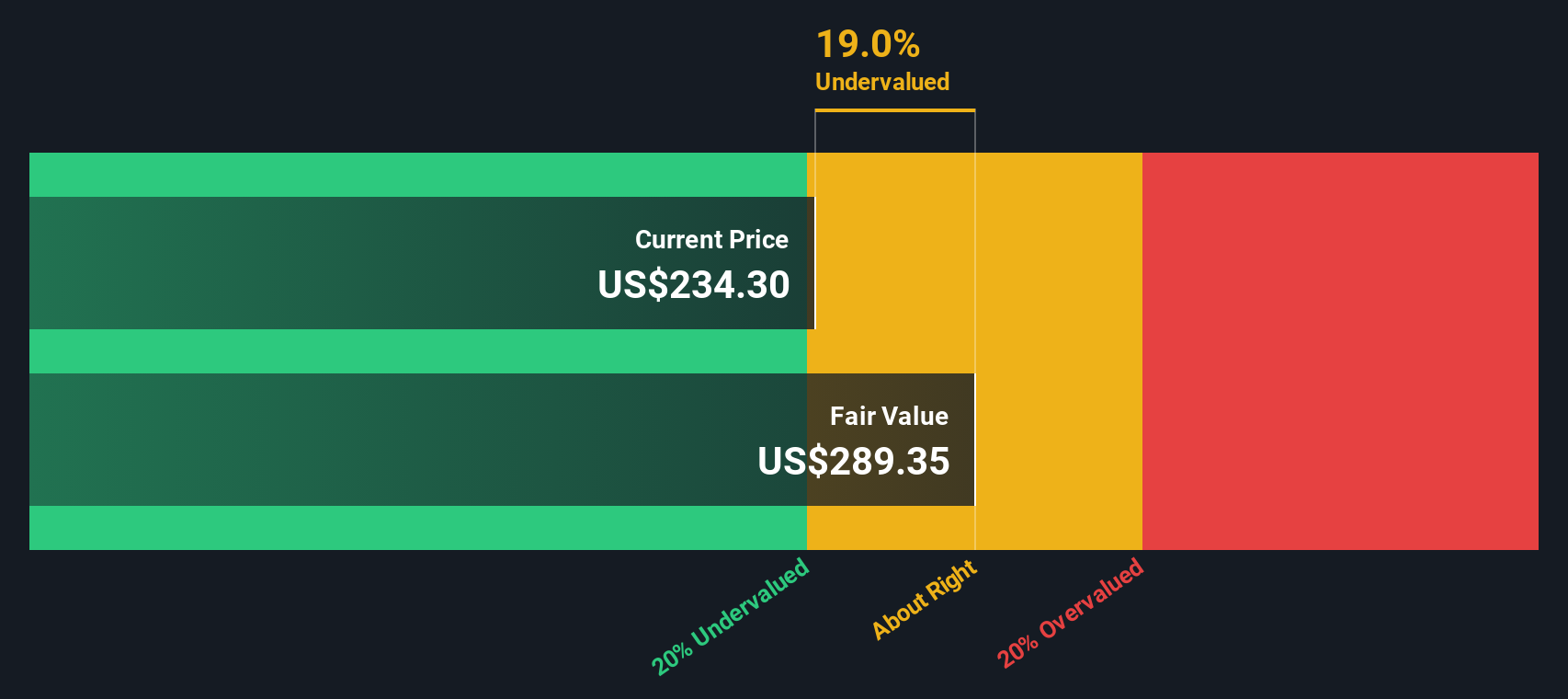

With shares trading just shy of analyst price targets despite rapid revenue and earnings growth, the debate heats up. Is First Solar offering a rare entry point, or is the market already anticipating its next phase of expansion?

Most Popular Narrative: Fairly Valued

First Solar's widely followed narrative pegs its fair value nearly in line with the market's last close of $241.41, suggesting analyst expectations are well-anchored by current prices.

Recent U.S. policy changes, specifically, strengthened incentives and tighter restrictions against foreign entities of concern (such as China) under the new reconciliation legislation, are boosting First Solar's competitive moat, supporting robust demand for domestically produced modules, and enabling the company to capture higher long-term contracted pricing, directly improving forward revenue visibility and gross margins.

Curious what market-shifting assumptions the analysts have baked in? There is a powerful blend of policy lifts, pricing power breakthroughs and margin forecasts behind this fair value. The details might surprise you. Uncover which growth bets are driving the narrative’s calculation.

Result: Fair Value of $238.59 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, shifting global trade policies or an unexpected drop in utility-scale solar demand could quickly test the resilience of First Solar’s positive outlook.

Find out about the key risks to this First Solar narrative.

Another View: Discounted Cash Flow Signals Undervaluation

While the market and analysts peg First Solar as fairly valued based on current prices and multiples, our DCF model delivers a very different message. It estimates a fair value of $399.80, which suggests the shares could be trading at a steep discount. Does this alternate perspective expose market skepticism or reveal a potential opportunity?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own First Solar Narrative

If you want a different angle or prefer to see the story through your own analysis, it only takes a few minutes to build your own view. Do it your way

A great starting point for your First Solar research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Why limit your opportunities to just one company? Expand your horizons now with handpicked investment ideas that could give your portfolio an edge.

- Tap into future-proof healthcare trends by checking out these 33 healthcare AI stocks, featuring companies using AI to transform medical outcomes and patient care.

- Target high-yield potential and steady income streams by accessing these 17 dividend stocks with yields > 3%, which highlights stocks with attractive dividends and robust fundamentals.

- Capitalize on the expanding universe of digital assets through these 80 cryptocurrency and blockchain stocks, showcasing businesses advancing blockchain technology and crypto innovation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:FSLR

First Solar

A solar technology company, provides photovoltaic (PV) solar energy solutions in the United States, France, India, Chile, and internationally.

Undervalued with high growth potential.

Similar Companies

Market Insights

Community Narratives