- United States

- /

- Semiconductors

- /

- NasdaqGS:FSLR

Did First Solar’s (FSLR) Strong Q2 and Raised Outlook Signal a Turning Point for Its U.S. Advantage?

Reviewed by Simply Wall St

- First Solar recently reported its second-quarter 2025 results, posting earnings and revenue that surpassed analyst expectations and raising its full-year sales outlook to between US$4.9 billion and US$5.7 billion.

- The company emphasized that recent U.S. industrial policy changes and new tariffs on foreign solar panels have further improved its competitive position in the domestic solar market.

- We'll explore how First Solar's upward revision of its 2025 sales guidance reflects strengthening demand for U.S.-manufactured solar modules and its investment narrative.

Find companies with promising cash flow potential yet trading below their fair value.

First Solar Investment Narrative Recap

Belief in First Solar rests on confidence that U.S. policy support and domestic manufacturing enable sustained demand and margin strength for American-made solar modules, especially as new tariffs pressure foreign competitors. The company's raised 2025 sales outlook points to near-term optimism, but the main short-term catalyst remains the impact of U.S. trade policy. While these developments are beneficial for domestic operations, risks related to international facility utilization and possible margin pressure due to tariff pass-through remain significant and have not been fully resolved by the recent news.

Among recent developments, First Solar's updated 2025 guidance, boosting projected net sales to between US$4.9 billion and US$5.7 billion, is directly aligned with the heightened demand for U.S.-manufactured solar modules. This announcement ties closely to current catalysts, offering investors greater clarity on anticipated revenue growth as policy shifts reshape the competitive field.

Yet, despite this positive outlook, investors should not overlook the ongoing risk that international production could face interruptions or lower utilization if global tariffs and trade uncertainties escalate...

Read the full narrative on First Solar (it's free!)

First Solar's outlook anticipates $6.9 billion in revenue and $3.1 billion in earnings by 2028. This projection is based on an annual revenue growth rate of 17.4% and an earnings increase of $1.8 billion from the current $1.3 billion.

Uncover how First Solar's forecasts yield a $204.38 fair value, a 11% upside to its current price.

Exploring Other Perspectives

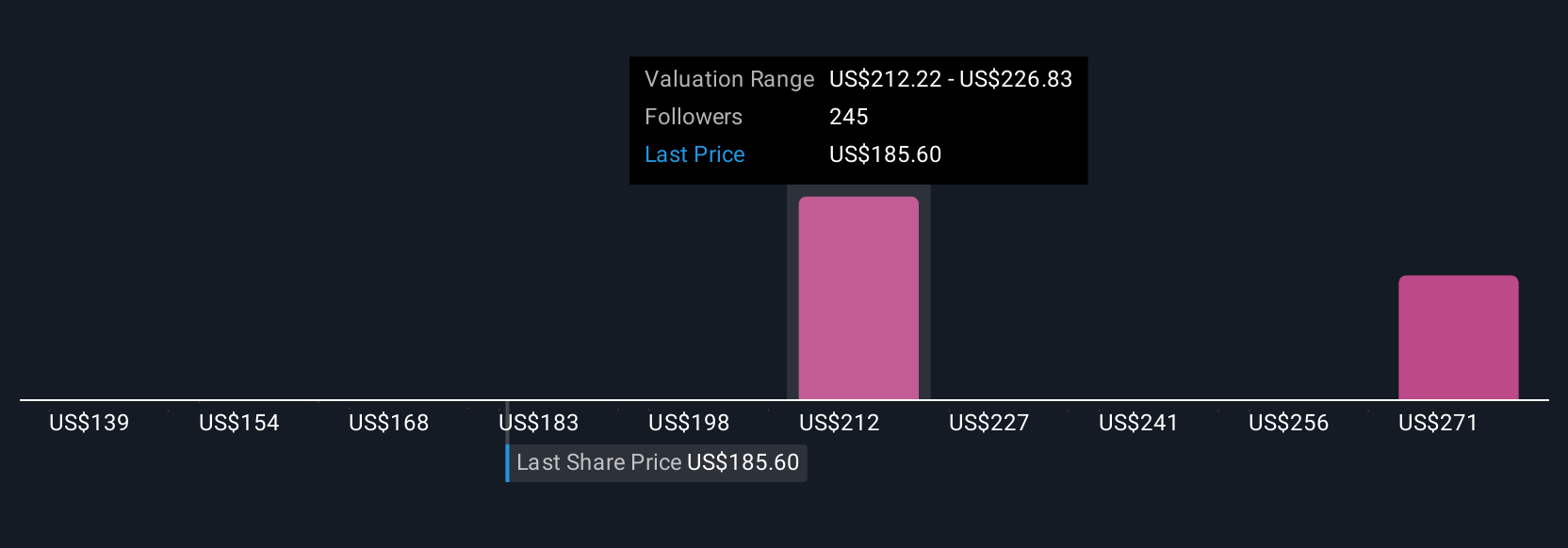

Fair value estimates from 23 members of the Simply Wall St Community range from US$139.15 to US$306.97. With expanding domestic capacity as a key catalyst, individual investors may weigh policy changes differently, so reviewing several viewpoints can sharpen your understanding.

Explore 23 other fair value estimates on First Solar - why the stock might be worth 24% less than the current price!

Build Your Own First Solar Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your First Solar research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free First Solar research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate First Solar's overall financial health at a glance.

No Opportunity In First Solar?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:FSLR

First Solar

A solar technology company, provides photovoltaic (PV) solar energy solutions in the United States, France, India, Chile, and internationally.

Undervalued with high growth potential.

Similar Companies

Market Insights

Community Narratives