- United States

- /

- Semiconductors

- /

- NasdaqGS:FORM

Will FormFactor’s (FORM) Margin Pressure Challenge Its Advanced Packaging Ambitions?

Reviewed by Simply Wall St

- On July 29, 2025, FormFactor reported second-quarter revenue of US$195.8 million, surpassing its own outlook but missing on earnings expectations due to lower gross margins from product mix and ramp-up costs for new HBM DRAM customers.

- The company continues to see strong demand in advanced packaging and AI-driven markets, underpinned by investments in manufacturing capacity and new credit facilities supporting future growth and operational flexibility.

- We'll explore how FormFactor's revenue outperformance, paired with margin pressures, could shift its future earnings outlook and risk profile.

Outshine the giants: these 19 early-stage AI stocks could fund your retirement.

FormFactor Investment Narrative Recap

To have confidence in FormFactor as a shareholder, you need to believe in the long-term growth of AI and advanced packaging, particularly within high-bandwidth memory demand and probe card markets. The latest quarterly results reinforce this catalyst, with revenue outperforming guidance, but margin pressure and earnings shortfalls mean that near-term risks around profitability remain significant. The recent news does not materially change the central dynamic: short-term margin volatility versus long-term demand from AI and HBM.

Among recent announcements, the new $150 million revolving credit facility stands out for its potential to support working capital and investments as FormFactor ramps up capacity for HBM DRAM customers. Access to flexible financing could prove essential for navigating large growth opportunities or operational hurdles tied to shifting product mix and new technology rollouts.

By contrast, investors should be aware of ongoing margin pressures resulting from product ramp-up costs and...

Read the full narrative on FormFactor (it's free!)

FormFactor's narrative projects $948.2 million in revenue and $83.4 million in earnings by 2028. This requires 7.4% yearly revenue growth and a $29.2 million earnings increase from $54.2 million today.

Uncover how FormFactor's forecasts yield a $38.38 fair value, a 31% upside to its current price.

Exploring Other Perspectives

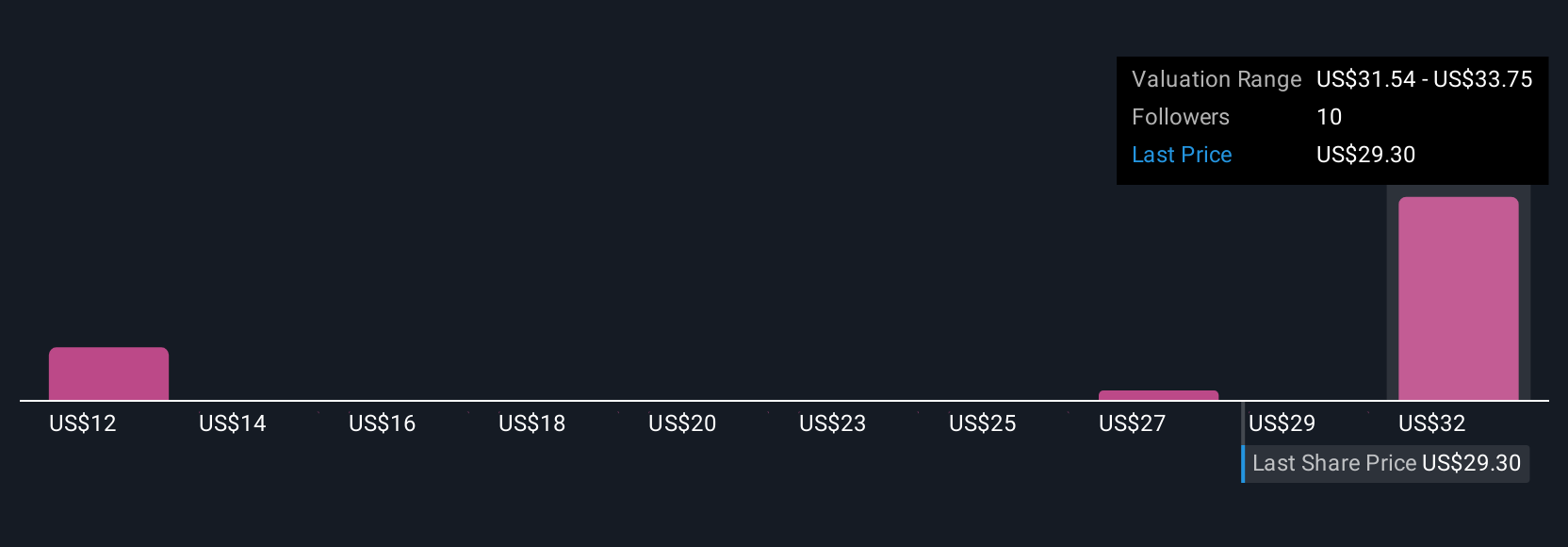

Three estimates from the Simply Wall St Community put fair value for FormFactor stock between US$11.67 and US$38.38. Many participants point to recent shifts in profit margins as having broader implications for future earnings and investor caution, so consider different viewpoints before deciding where you stand.

Explore 3 other fair value estimates on FormFactor - why the stock might be worth as much as 31% more than the current price!

Build Your Own FormFactor Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your FormFactor research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free FormFactor research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate FormFactor's overall financial health at a glance.

Curious About Other Options?

Our top stock finds are flying under the radar-for now. Get in early:

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- The end of cancer? These 25 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:FORM

FormFactor

Designs, manufactures, and sells probe cards, analytical probes, probe stations, thermal systems, cryogenic systems, and related services in the United States and internationally.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives