- United States

- /

- Semiconductors

- /

- NasdaqGS:FORM

Has FormFactor’s 165.6% Three Year Surge Already Priced In AI Testing Optimism?

Reviewed by Bailey Pemberton

- If you are wondering whether FormFactor is still attractive after such a strong run, or if the easy money has already been made, you are not alone.

- The stock has climbed 2.8% over the past week, 15.3% in the last month, and is now up 28.8% year to date and 32.9% over the past year, adding to an impressive 165.6% gain over three years.

- Recent coverage has highlighted how demand for advanced semiconductor testing solutions is benefiting equipment providers like FormFactor, as chipmakers keep ramping up leading edge and specialty nodes. At the same time, investors are increasingly viewing test and measurement names as a leveraged play on the broader AI and high performance computing cycle, which helps explain some of the momentum in the share price.

- Despite that, our valuation framework gives FormFactor a value score of 0/6. This suggests it does not screen as undervalued on any of our standard checks. Next we will unpack what that means across different valuation methods and then circle back to an even better way to think about what the market is really pricing in.

FormFactor scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: FormFactor Discounted Cash Flow (DCF) Analysis

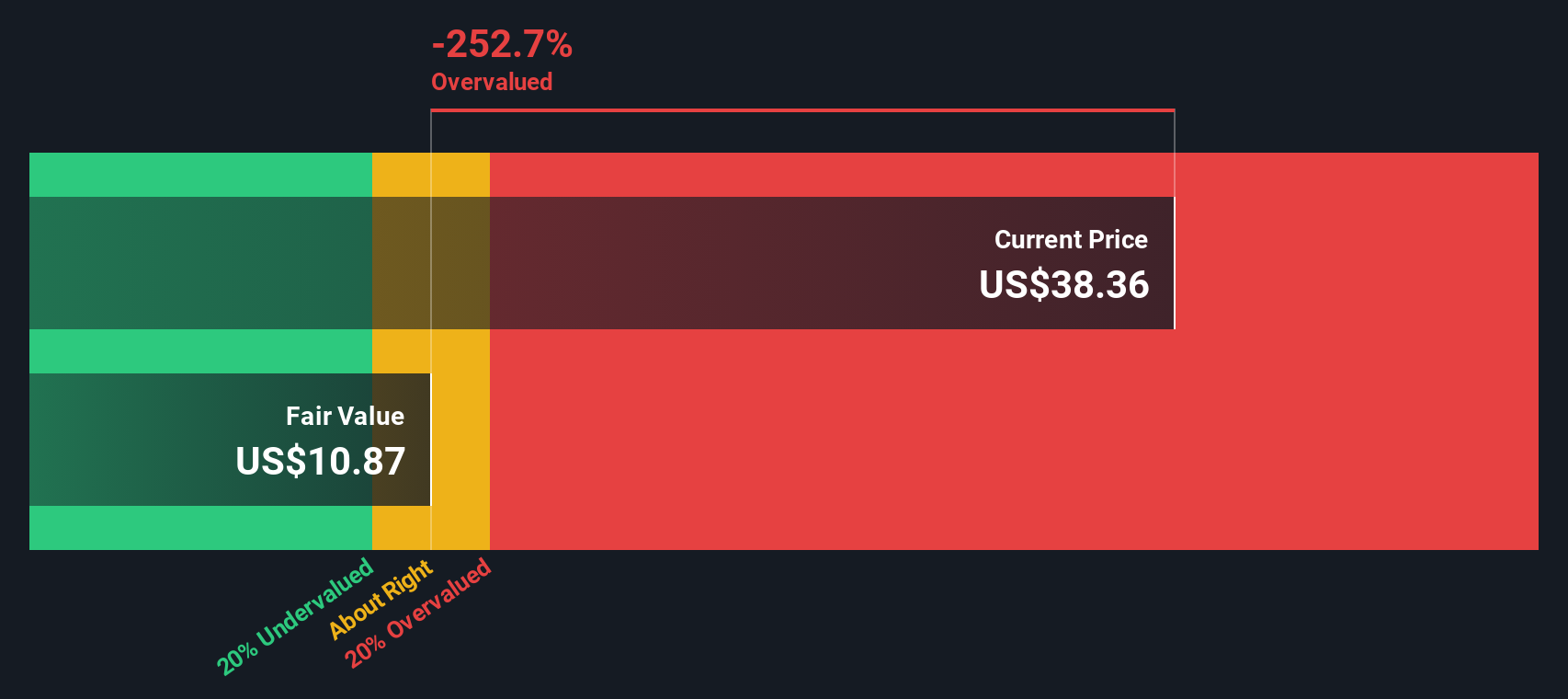

The Discounted Cash Flow model estimates what a company is worth today by projecting its future cash flows and discounting them back to their present value. For FormFactor, this 2 stage Free Cash Flow to Equity model starts from last twelve month free cash flow of about $30.5 Million, then applies analyst forecasts for the next few years and extrapolates further growth thereafter.

Analysts expect free cash flow to dip to around negative $26 Million in 2026 before recovering to $58 Million by 2027, with Simply Wall St extending this trajectory to roughly $118 Million by 2035. When all of these projected cash flows are discounted back, the model arrives at an intrinsic value of about $13.44 per share.

Compared to the current market price, this implies the stock is roughly 324.0% overvalued based on the DCF framework. This suggests that investor optimism is far ahead of the underlying cash flow outlook.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests FormFactor may be overvalued by 324.0%. Discover 911 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: FormFactor Price vs Earnings

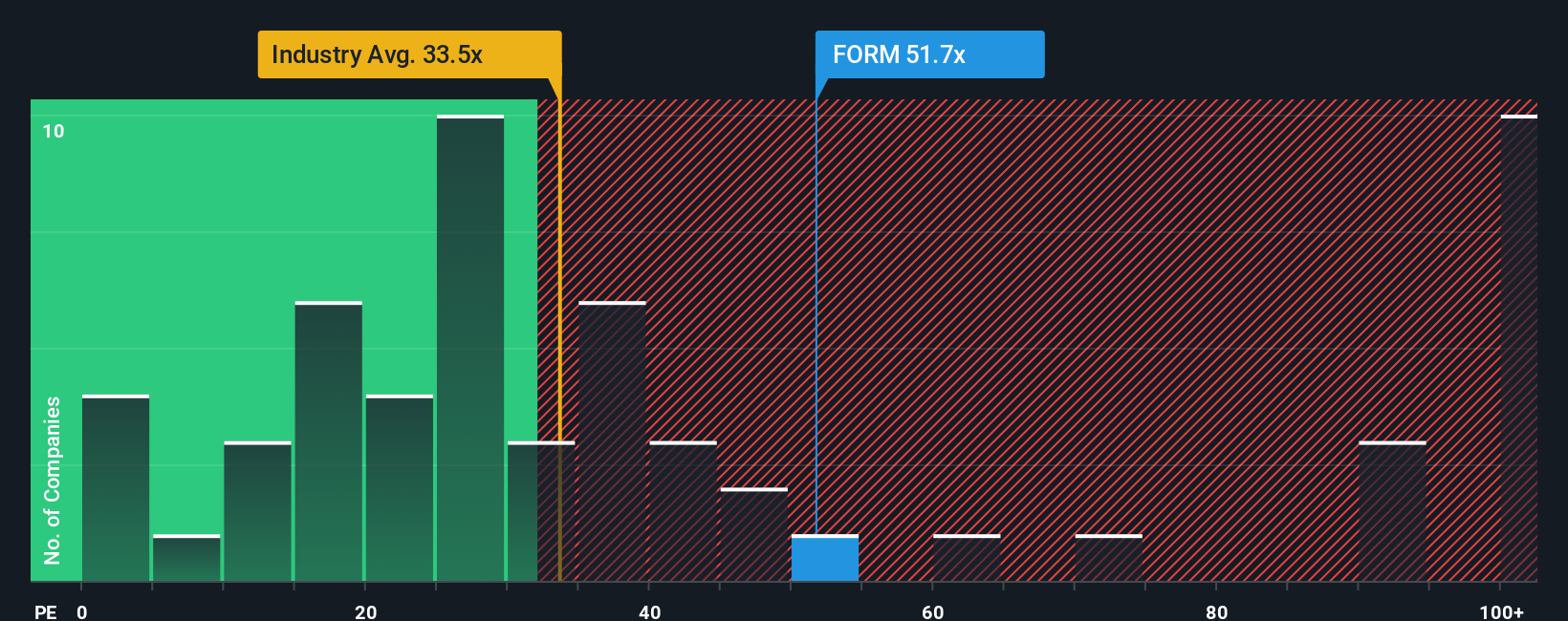

For profitable companies like FormFactor, the price to earnings (PE) ratio is a useful shorthand for how much investors are willing to pay for each dollar of current earnings. It helps link the share price back to the actual profits the business is generating today.

In general, faster growing and less risky businesses can justify a higher, or more expensive, PE multiple, while slower growing or riskier names tend to trade on lower, cheaper, PE ratios. With that in mind, FormFactor currently trades on a PE of about 108.1x, which is well above the Semiconductor industry average of roughly 36.8x and also ahead of its peer group average of around 46.3x.

Simply Wall St uses a proprietary Fair Ratio framework to estimate what multiple would be reasonable for a specific company, taking into account its earnings growth outlook, profitability, industry, market cap and risk profile. For FormFactor, this Fair PE Ratio is around 49.6x, which implies that, once those fundamentals are factored in, the stock still trades meaningfully above what would be considered fair on an earnings basis.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1463 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your FormFactor Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple way to connect your view of a company’s future to a clear fair value estimate. A Narrative is your story behind the numbers, where you set assumptions for FormFactor’s future revenue, earnings and margins, and link that story to a forecast and then to a fair value. On Simply Wall St, Narratives are an easy, accessible tool within the Community page that millions of investors use to decide whether to buy or sell by comparing their Fair Value to the current market price. Because Narratives are updated dynamically as new information, like news or earnings, is released, your view of FormFactor can adjust in real time without you rebuilding your whole thesis. For example, one investor might build a bullish FormFactor Narrative around a fair value near $62, assuming strong AI driven memory demand and margin expansion. Another might choose a more cautious Narrative closer to $23, focusing on margin pressure, customer concentration and execution risk.

Do you think there's more to the story for FormFactor? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:FORM

FormFactor

Designs, manufactures, and sells probe cards, analytical probes, probe stations, thermal systems, cryogenic systems, and related services in the United States and internationally.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion