- United States

- /

- Semiconductors

- /

- NasdaqGS:FORM

FormFactor (FORM): Assessing Valuation After Q3 Earnings Decline and Updated Guidance

Reviewed by Simply Wall St

FormFactor (FORM) just released its third quarter results, showing both revenue and net income down from last year. The company also updated its guidance for the coming quarter, which puts investors’ focus squarely on its outlook.

See our latest analysis for FormFactor.

FormFactor’s updated guidance and softer quarterly results have certainly influenced investor sentiment, but momentum in the share price is building rapidly. Even with a challenging start to the year, the stock has delivered a 36.8% one-month share price return and a 24.1% total shareholder return over the past year, highlighting renewed optimism and strong long-term growth for shareholders.

If news-driven rallies like this have your attention, now is an ideal moment to broaden your investing search and discover fast growing stocks with high insider ownership

With FormFactor’s recent financials reflecting declines while its stock has surged in the past month, investors are left wondering whether the current momentum presents a rare buying opportunity or if future growth is already priced in.

Most Popular Narrative: 3.7% Undervalued

FormFactor's most widely followed narrative places fair value at $54.29, which is slightly higher than the last close of $52.25. This small premium indicates that bullish momentum is supported by specific growth drivers and positive margin trends. Investors may see potential upside just ahead of current levels.

“Expanding presence in AI and advanced chip markets, coupled with strategic manufacturing investments, enhances FormFactor's growth opportunities and long-term profitability. Diversification across customers and partnerships reduces earnings volatility and increases stability as demand shifts toward AI, custom ASICs, and connectivity solutions.”

Want to know the growth blueprint behind this high valuation? The key element of this narrative is record-breaking earnings and a future profit multiple usually associated with tech leaders. Interested in which bold financial projections support that price target? Dive deeper to see the surprising numbers that drive this fair value calculation.

Result: Fair Value of $54.29 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent cost pressures or slow adoption in emerging tech could create challenges for margin gains and limit FormFactor’s long-term growth narrative.

Find out about the key risks to this FormFactor narrative.

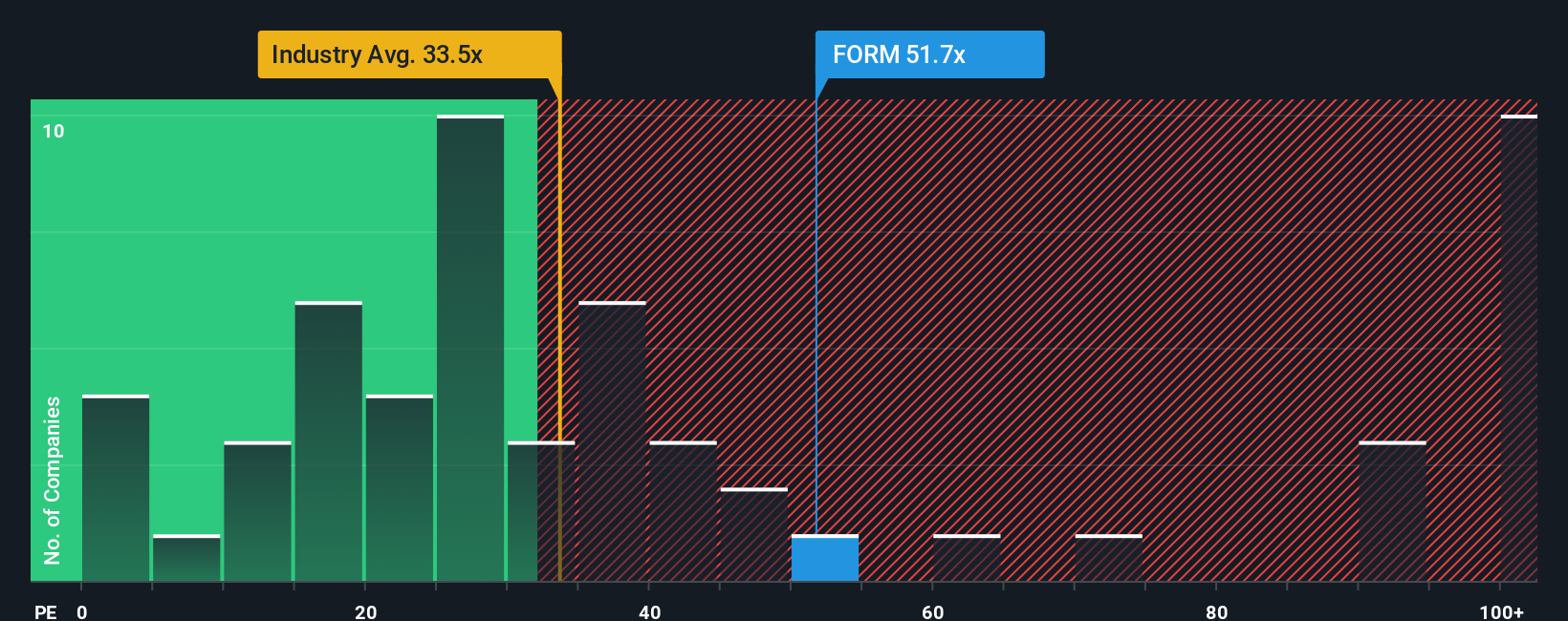

Another View: Multiples Tell a More Cautious Story

While optimism surrounds FormFactor’s fair value, a look at its price-to-earnings ratio paints a different picture. The current multiple sits much higher than both peers and industry averages, and it is also above the fair ratio estimate. This gap signals a risk that the market may eventually adjust, challenging the bullish outlook. Could sentiment be running ahead of fundamentals?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own FormFactor Narrative

If you'd rather chart your own path or dig deeper into the numbers, you can quickly build a personalized view based on your research. Do it your way.

A great starting point for your FormFactor research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for More Investment Opportunities?

Refocus your strategy and level up your portfolio with investment ideas that most investors overlook. Stay ahead by capitalizing on the trends shaping tomorrow’s markets; you don’t want to let these pass you by.

- Unlock untapped growth as you scan these 24 AI penny stocks powering artificial intelligence, automation, and the technologies set to transform your world.

- Boost your passive income stream when you target reliable payouts through these 16 dividend stocks with yields > 3% with yields over 3% and solid financials.

- Get a head start on the future of finance by tapping into these 82 cryptocurrency and blockchain stocks set to disrupt global transactions and digital infrastructure.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:FORM

FormFactor

Designs, manufactures, and sells probe cards, analytical probes, probe stations, thermal systems, cryogenic systems, and related services in the United States and internationally.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives