- United States

- /

- Semiconductors

- /

- NasdaqGS:FORM

Does FormFactor (NASDAQ:FORM) Have A Healthy Balance Sheet?

The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. Importantly, FormFactor, Inc. (NASDAQ:FORM) does carry debt. But the real question is whether this debt is making the company risky.

Why Does Debt Bring Risk?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. If things get really bad, the lenders can take control of the business. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Of course, plenty of companies use debt to fund growth, without any negative consequences. When we examine debt levels, we first consider both cash and debt levels, together.

Check out our latest analysis for FormFactor

What Is FormFactor's Debt?

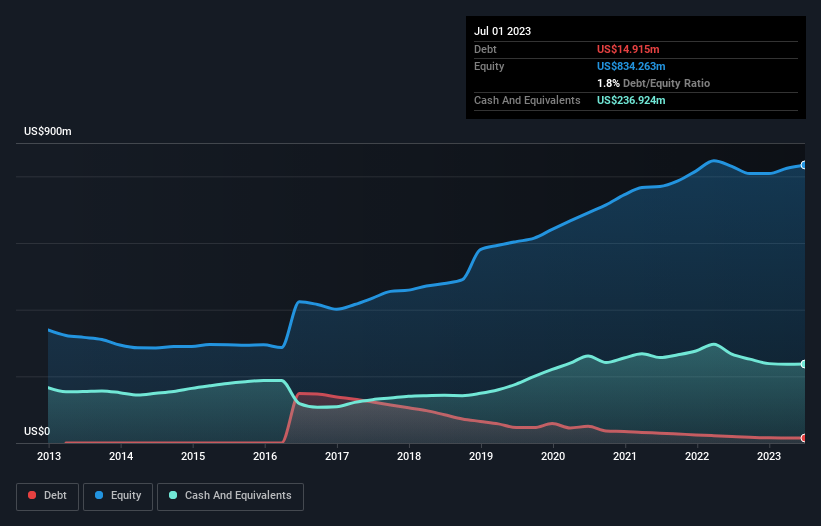

You can click the graphic below for the historical numbers, but it shows that FormFactor had US$14.9m of debt in July 2023, down from US$19.6m, one year before. However, its balance sheet shows it holds US$236.9m in cash, so it actually has US$222.0m net cash.

A Look At FormFactor's Liabilities

The latest balance sheet data shows that FormFactor had liabilities of US$124.1m due within a year, and liabilities of US$66.8m falling due after that. On the other hand, it had cash of US$236.9m and US$98.1m worth of receivables due within a year. So it can boast US$144.2m more liquid assets than total liabilities.

This surplus suggests that FormFactor has a conservative balance sheet, and could probably eliminate its debt without much difficulty. Simply put, the fact that FormFactor has more cash than debt is arguably a good indication that it can manage its debt safely.

The modesty of its debt load may become crucial for FormFactor if management cannot prevent a repeat of the 97% cut to EBIT over the last year. When a company sees its earnings tank, it can sometimes find its relationships with its lenders turn sour. The balance sheet is clearly the area to focus on when you are analysing debt. But it is future earnings, more than anything, that will determine FormFactor's ability to maintain a healthy balance sheet going forward. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. FormFactor may have net cash on the balance sheet, but it is still interesting to look at how well the business converts its earnings before interest and tax (EBIT) to free cash flow, because that will influence both its need for, and its capacity to manage debt. Over the last three years, FormFactor recorded free cash flow worth a fulsome 92% of its EBIT, which is stronger than we'd usually expect. That positions it well to pay down debt if desirable to do so.

Summing Up

While it is always sensible to investigate a company's debt, in this case FormFactor has US$222.0m in net cash and a decent-looking balance sheet. The cherry on top was that in converted 92% of that EBIT to free cash flow, bringing in US$4.5m. So we don't have any problem with FormFactor's use of debt. Of course, we wouldn't say no to the extra confidence that we'd gain if we knew that FormFactor insiders have been buying shares: if you're on the same wavelength, you can find out if insiders are buying by clicking this link.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:FORM

FormFactor

Designs, manufactures, and sells probe cards, analytical probes, probe stations, thermal systems, cryogenic systems, and related services in the United States and internationally.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion