- United States

- /

- Semiconductors

- /

- NasdaqGS:ENTG

Will Entegris' (ENTG) Global Expansion Offset Risks From Rising US-China Trade Tensions?

Reviewed by Sasha Jovanovic

- In the past week, the semiconductor sector saw heightened concern over US-China trade tensions, with fresh US tariff threats and Chinese countermeasures impacting industry sentiment and supply chains.

- Amid these challenges, Entegris advanced its global expansion with new manufacturing sites in Colorado, Taiwan, and South Korea, signaling an effort to diversify production and strengthen resilience against future trade disruptions.

- We'll examine how these facility investments and trade policy shifts could influence Entegris' investment narrative going forward.

Rare earth metals are the new gold rush. Find out which 36 stocks are leading the charge.

Entegris Investment Narrative Recap

To be a shareholder in Entegris, you need to believe in the long-term growth of the semiconductor sector and the company’s ability to offset global trade uncertainty through supply chain resiliency and serving high-demand chip markets. The recent escalation in US-China tariff threats has brought short-term volatility, but for now, the core catalysts and risks, namely, supply chain diversification and regulatory exposure, remain largely unchanged.

The newly announced Colorado manufacturing center stands out as directly relevant, aiming to reinforce Entegris’ position to weather supply disruptions and meet demand for advanced semiconductor materials. This expansion is also a signal that, even as the sector faces near-term shocks from trade tensions, investment in manufacturing capacity is viewed as critical to the company’s future growth prospects.

But, in contrast, it is essential that investors do not overlook the persistent risk that changes in global trade policies could...

Read the full narrative on Entegris (it's free!)

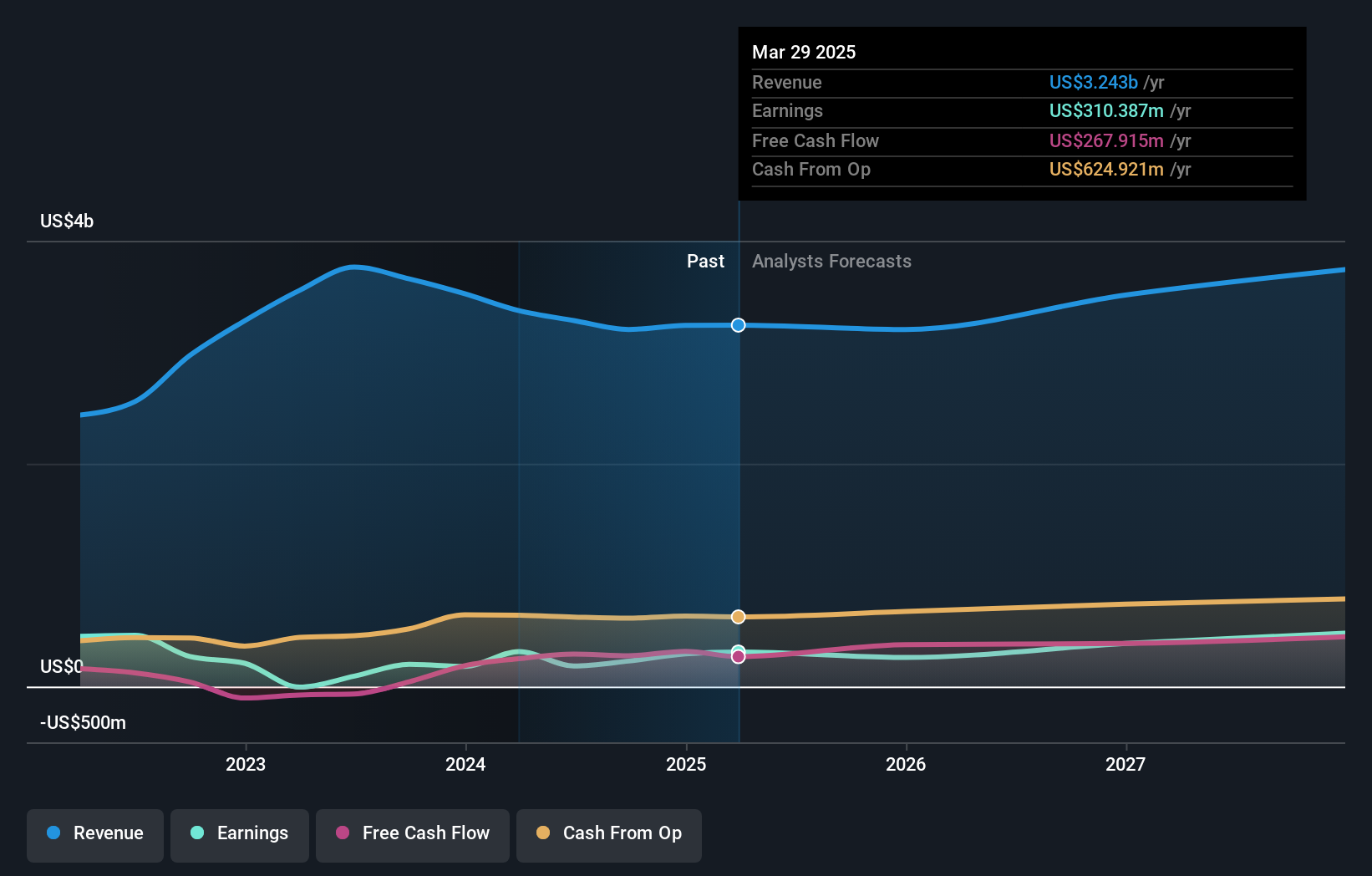

Entegris' narrative projects $3.9 billion in revenue and $502.7 million in earnings by 2028. This requires a 6.4% yearly revenue growth and a $207.2 million earnings increase from $295.5 million today.

Uncover how Entegris' forecasts yield a $100.75 fair value, a 10% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members have pegged Entegris’ fair value at a uniform US$100.75, reflecting just one perspective. Yet, persistent global trade volatility could challenge even the most confident outlooks and underscores why opinions differ so widely, explore several alternative viewpoints to broaden your understanding.

Explore another fair value estimate on Entegris - why the stock might be worth just $100.75!

Build Your Own Entegris Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Entegris research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Entegris research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Entegris' overall financial health at a glance.

Looking For Alternative Opportunities?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Entegris might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ENTG

Entegris

Provides advanced materials and process solutions for the semiconductor and other high-technology industries in North America, Taiwan, South Korea, Japan, China, Europe, and Southeast Asia.

Proven track record with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)