- United States

- /

- Semiconductors

- /

- NasdaqGS:ENTG

Why Entegris (ENTG) Is Up 5.5% After CHIPS Act Funding and AI-Driven Demand Momentum

Reviewed by Sasha Jovanovic

- In the past week, Entegris received a higher price target and ongoing analyst support as positive sector sentiment continued to build around AI-driven semiconductor demand and government funding initiatives, including a US$77 million award under the CHIPS Act for a new manufacturing center.

- The company's focus on advanced materials for next-generation chips and domestic manufacturing investments has heightened speculation about strengthened supply chain resilience and potential changes to shareholder returns.

- We'll explore how increasing demand for AI-enabled semiconductor materials could reshape Entegris' investment narrative and future growth outlook.

Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

Entegris Investment Narrative Recap

To be a shareholder in Entegris, you need to believe in the sustained global shift toward advanced chipmaking and the key role that material innovation will play in the AI and semiconductor ecosystem. While recent analyst support and a US$77 million CHIPS Act award affirm Entegris’ potential as a supplier to AI-driven markets, these events do not materially alter the biggest near-term catalyst, volume recovery in the semiconductor industry, or resolve the primary risk, which remains operational volatility tied to global demand and supply chain transitions.

Of the recent corporate updates, the US$77 million CHIPS Act funding for the new manufacturing center most closely aligns with the current surge in positive sentiment. This announcement reinforces Entegris’ ability to participate in onshoring critical semiconductor production capabilities, a factor that could partially offset trade-related uncertainties and potentially support supply chain stability if AI demand holds up.

Yet, despite the optimism, investors should also recognize the ongoing exposure to volatile customer demand and region-specific risks stemming from...

Read the full narrative on Entegris (it's free!)

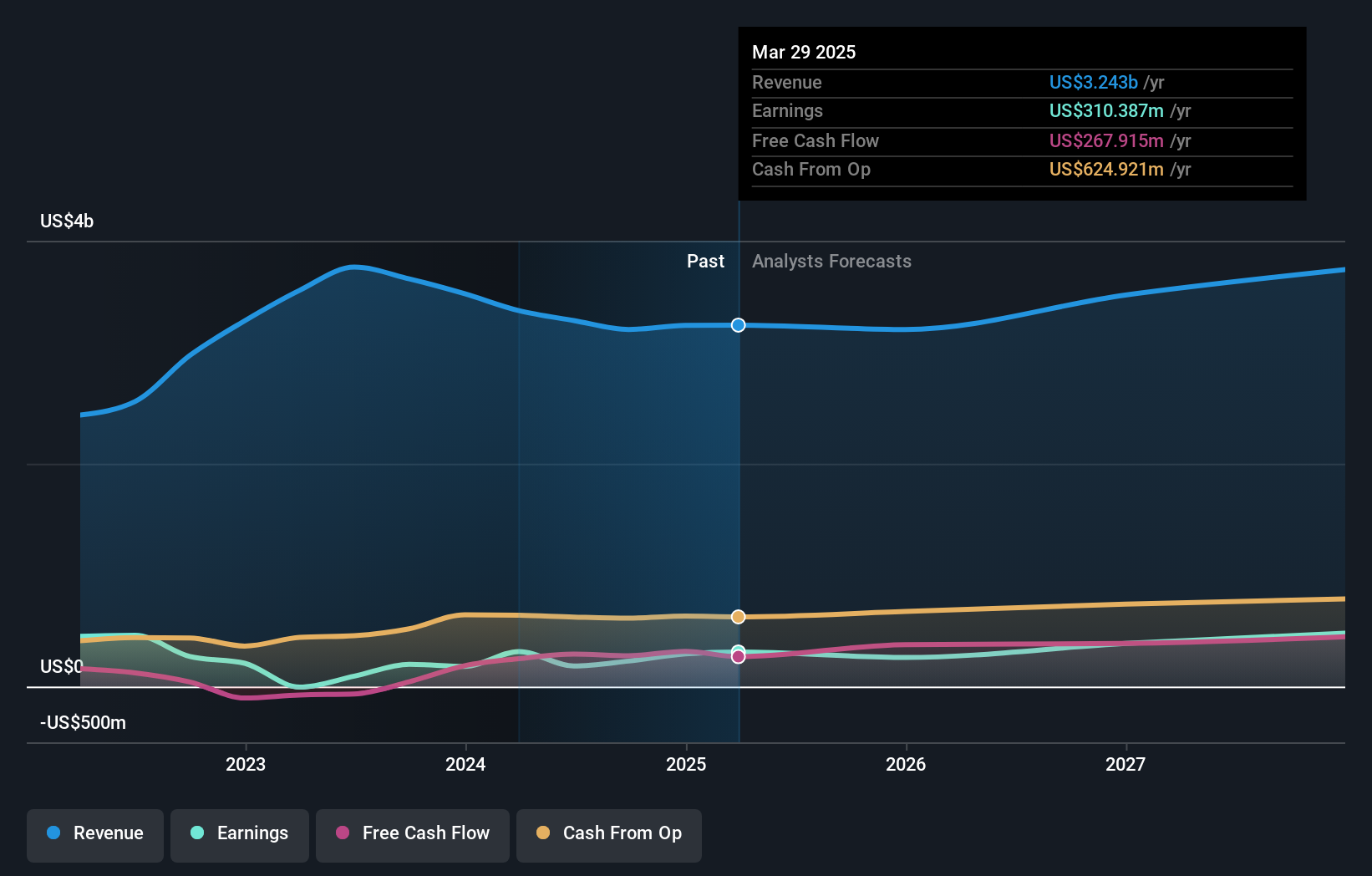

Entegris' narrative projects $3.9 billion revenue and $502.7 million earnings by 2028. This requires 6.4% yearly revenue growth and a $207.2 million earnings increase from $295.5 million today.

Uncover how Entegris' forecasts yield a $99.00 fair value, in line with its current price.

Exploring Other Perspectives

Community members on Simply Wall St posted a single fair value estimate of US$99 for Entegris stock, highlighting limited diversity in private investor outlooks. Broader market participants remain focused on the challenge of supply chain transitions and persistent end-market uncertainty, which could impact future revenue and earnings recovery, making it important to compare alternative views.

Explore another fair value estimate on Entegris - why the stock might be worth just $99.00!

Build Your Own Entegris Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Entegris research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Entegris research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Entegris' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 33 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Entegris might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ENTG

Entegris

Provides advanced materials and process solutions for the semiconductor and other high-technology industries in North America, Taiwan, South Korea, Japan, China, Europe, and Southeast Asia.

Proven track record with limited growth.

Similar Companies

Market Insights

Community Narratives