- United States

- /

- Semiconductors

- /

- NasdaqGS:ENTG

Entegris (ENTG): Valuation Perspectives as AI Partnerships Fuel Semiconductor Sector Optimism

Reviewed by Kshitija Bhandaru

Following OpenAI’s high-profile partnerships with SK Hynix and Samsung for a major AI infrastructure project, investor sentiment received a fresh boost across the semiconductor sector. Entegris (ENTG) is one of the stocks catching that wave of optimism.

See our latest analysis for Entegris.

Entegris has seen pockets of momentum alongside the AI-fueled rally in semiconductors, but its 1-year total shareholder return is still just below flat, even as enthusiasm returned on news of major chip demand drivers like OpenAI’s new partnerships. While recent headlines helped sentiment, investors are watching to see if the renewed optimism translates to stronger sustained gains from here on out.

If the AI build-out has you on the hunt for what’s next in tech hardware, now may be a good time to explore See the full list for free.

With Entegris trading just shy of analyst price targets after a period of underperformance, the big question is whether investors are looking at an undervalued entry or if anticipation for future AI growth has already been reflected in the price.

Most Popular Narrative: 0.4% Undervalued

Entegris last closed at $98.61, extremely close to the fair value estimate according to the most widely followed narrative. This setup frames a debate, with the stock’s price almost matching what is calculated from growth projections and risk factors.

Investments and leadership in advanced materials for next-generation nodes, including CMP slurries, selective etch, and deposition materials, position Entegris to capitalize on upcoming node transitions (for example, advanced logic, 3D NAND, HBM) and increasing semiconductor complexity, supporting higher ASPs and improved gross margins.

Want to see what makes bulls believe Entegris can keep justifying its premium? The narrative leans on aggressive future growth and margin confidence for 2028. Curious exactly what is fueling such optimism? Find out which bold numbers transformed this price target.

Result: Fair Value of $99 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent global trade uncertainties and ongoing operational inefficiencies could easily challenge the optimistic outlook that many analysts currently hold for Entegris.

Find out about the key risks to this Entegris narrative.

Another View: Looking Through the Lens of Price Ratios

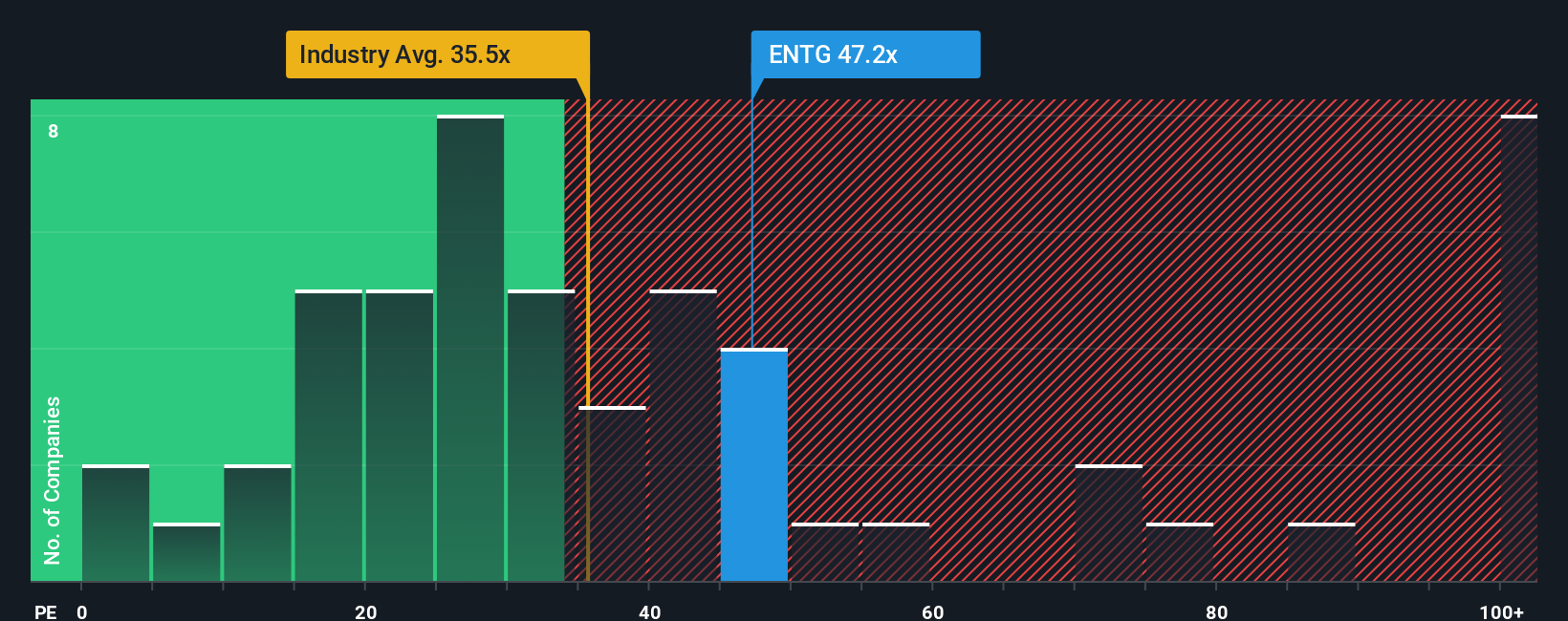

While many investors use projected earnings to set fair value, a closer look at Entegris’s price-to-earnings ratio paints a different picture. Trading at 50.6 times earnings, Entegris stands well above the industry average of 37.7 and its fair ratio of 32.3. This suggests the stock could be priced for perfection. Does this premium reflect genuine growth strengths, or does it expose investors to higher risks if market expectations shift?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Entegris Narrative

If you have a different take or want to dive deeper into the numbers, you can craft your own Entegris story in just a few minutes. Do it your way.

A great starting point for your Entegris research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

You could be missing out on the strongest opportunities just beyond the obvious choices. Put yourself ahead of the crowd and start searching smarter.

- Capture explosive potential by scanning these 24 AI penny stocks, which are fueling the AI revolution through innovation and bold market moves.

- Maximize your returns by targeting these 896 undervalued stocks based on cash flows, where the market may have overlooked enduring fundamentals and future growth drivers.

- Boost your income stream by evaluating these 19 dividend stocks with yields > 3%, a group of companies delivering consistent yields above 3% for financial stability you can count on.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Entegris might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ENTG

Entegris

Provides advanced materials and process solutions for the semiconductor and other high-technology industries in North America, Taiwan, South Korea, Japan, China, Europe, and Southeast Asia.

Proven track record with limited growth.

Similar Companies

Market Insights

Community Narratives