- United States

- /

- Semiconductors

- /

- NasdaqGS:ENTG

Despite the downward trend in earnings at Entegris (NASDAQ:ENTG) the stock rallies 7.8%, bringing five-year gains to 177%

While Entegris, Inc. (NASDAQ:ENTG) shareholders are probably generally happy, the stock hasn't had particularly good run recently, with the share price falling 14% in the last quarter. But that scarcely detracts from the really solid long term returns generated by the company over five years. Indeed, the share price is up an impressive 172% in that time. Generally speaking the long term returns will give you a better idea of business quality than short periods can. Ultimately business performance will determine whether the stock price continues the positive long term trend.

On the back of a solid 7-day performance, let's check what role the company's fundamentals have played in driving long term shareholder returns.

View our latest analysis for Entegris

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During five years of share price growth, Entegris actually saw its EPS drop 10% per year.

Essentially, it doesn't seem likely that investors are focused on EPS. Because earnings per share don't seem to match up with the share price, we'll take a look at other metrics instead.

We doubt the modest 0.4% dividend yield is attracting many buyers to the stock. In contrast revenue growth of 20% per year is probably viewed as evidence that Entegris is growing, a real positive. In that case, the company may be sacrificing current earnings per share to drive growth.

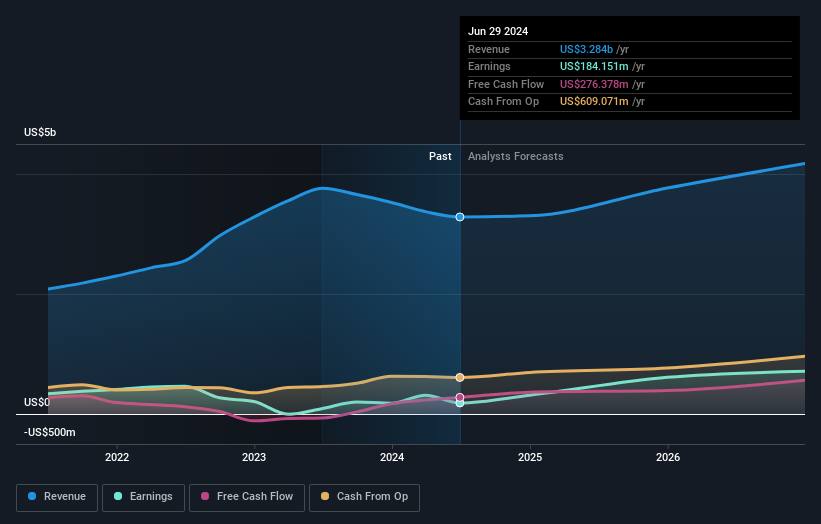

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

Entegris is well known by investors, and plenty of clever analysts have tried to predict the future profit levels. If you are thinking of buying or selling Entegris stock, you should check out this free report showing analyst consensus estimates for future profits.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. As it happens, Entegris' TSR for the last 5 years was 177%, which exceeds the share price return mentioned earlier. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

Entegris shareholders gained a total return of 16% during the year. But that return falls short of the market. On the bright side, the longer term returns (running at about 23% a year, over half a decade) look better. Maybe the share price is just taking a breather while the business executes on its growth strategy. It's always interesting to track share price performance over the longer term. But to understand Entegris better, we need to consider many other factors. For instance, we've identified 2 warning signs for Entegris (1 is a bit unpleasant) that you should be aware of.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Entegris might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:ENTG

Entegris

Provides advanced materials and process solutions for the semiconductor and other high-technology industries in North America, Taiwan, South Korea, Japan, China, Europe, and Southeast Asia.

Limited growth with questionable track record.

Similar Companies

Market Insights

Community Narratives