- United States

- /

- Semiconductors

- /

- NasdaqGM:ENPH

Is Enphase Energy’s 59.8% Drop in 2025 Creating a Real Opportunity?

Reviewed by Bailey Pemberton

- Wondering if Enphase Energy is trading at an attractive price or if there’s still risk of a value trap? You’re not alone. With so much market noise, now is the perfect time to dig into what the numbers really say.

- After sliding 23.6% in the last month and 59.8% so far this year, Enphase’s recent price moves highlight how quickly investor sentiment has shifted, raising questions about both risk and recovery potential.

- Media coverage has focused on the broader solar and semiconductor sector volatility, along with evolving economic policies affecting green energy stocks. This context has amplified existing uncertainty and is shaping how investors are reacting to each market headline.

- On our six-point value check, Enphase scores a 5/6 for undervaluation, which signals there might be compelling value here. Next, we’ll break down how different valuation methods compare in the current market, and later in the article, a smarter approach for putting all these numbers in perspective will be discussed.

Find out why Enphase Energy's -51.8% return over the last year is lagging behind its peers.

Approach 1: Enphase Energy Discounted Cash Flow (DCF) Analysis

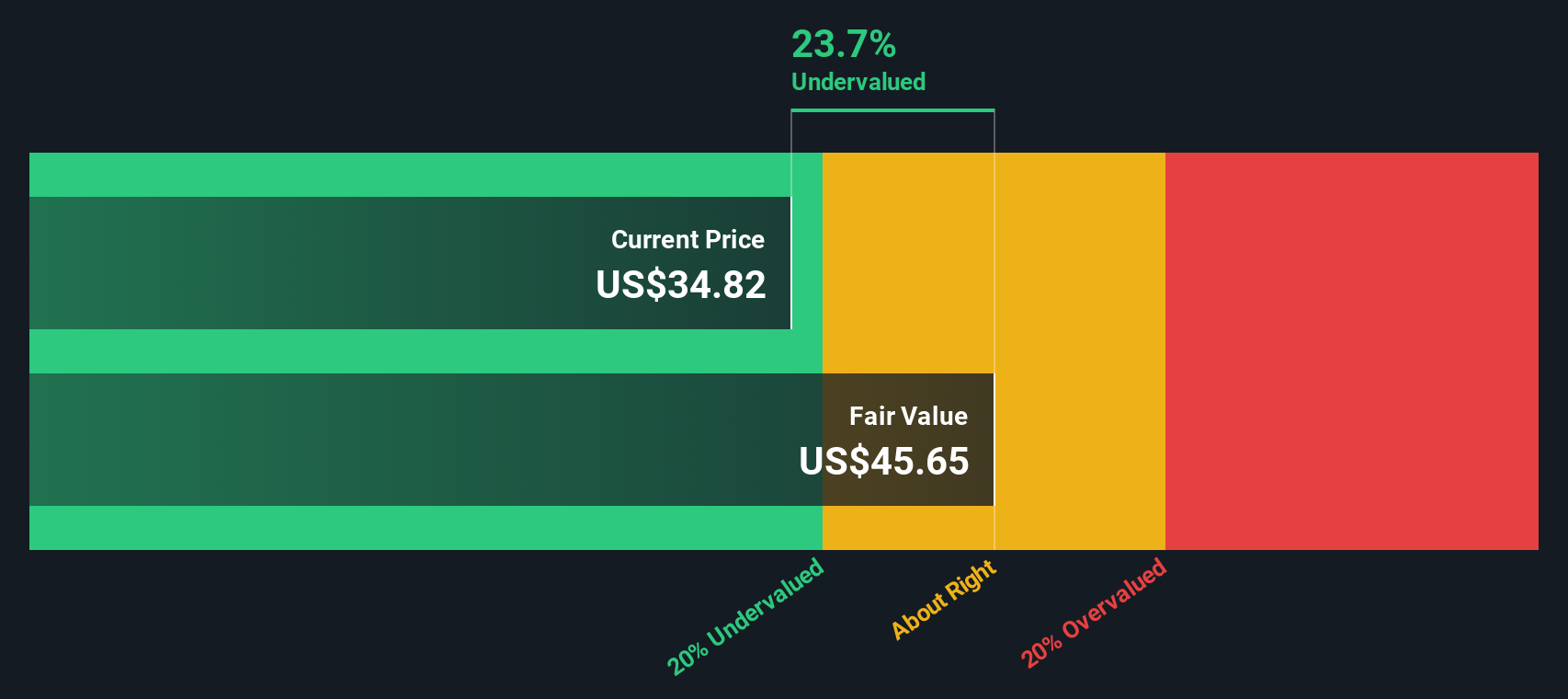

The Discounted Cash Flow (DCF) model works by projecting a company's future cash flows and discounting them back to today’s value. This provides an estimate of what the business is truly worth. For Enphase Energy, this approach uses current data and analyst estimates to build a picture of long-term value, even amid recent market swings.

Enphase’s latest trailing twelve-month Free Cash Flow stands at $203.41 million. Analyst projections cover the next five years and expect steady growth, with forecasted cash flow reaching $444.75 million by 2029. After that, values are extended using estimation methods, bringing projected Free Cash Flow to roughly $629.24 million in 2035. All cash flows are computed in US dollars ($).

According to our DCF analysis, the estimated intrinsic value per share comes out to $37.80. Compared to the current share price, this represents a significant discount of 24.1 percent, signaling that the stock is trading below its underlying value and could offer an opportunity for value-focused investors.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Enphase Energy is undervalued by 24.1%. Track this in your watchlist or portfolio, or discover 879 more undervalued stocks based on cash flows.

Approach 2: Enphase Energy Price vs Earnings

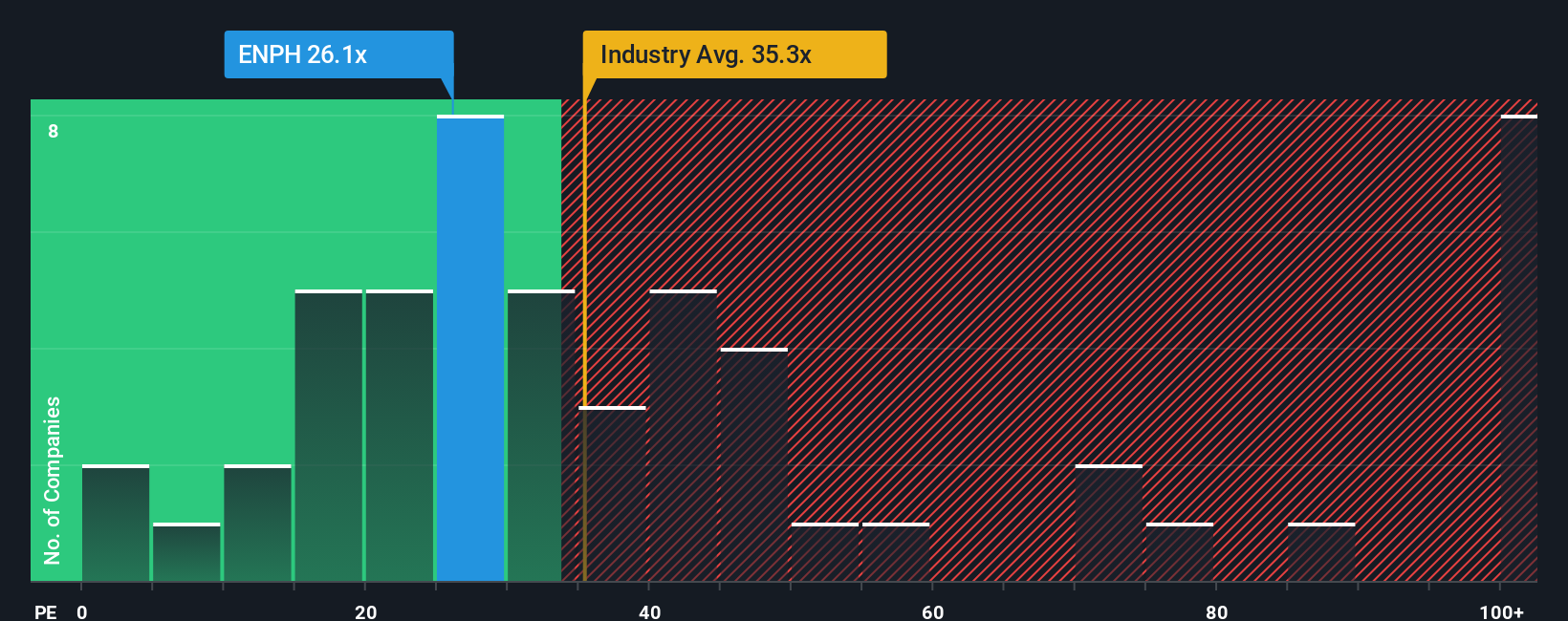

The Price-to-Earnings (PE) ratio is a preferred metric for valuing profitable companies like Enphase Energy because it directly compares a company’s current share price to its per-share earnings. This makes it a straightforward way to gauge whether the market is valuing future growth and profitability appropriately.

Typically, the “right” PE ratio depends on several factors. Companies with higher expected earnings growth or lower risk often trade at higher PE ratios, while those with flat or uncertain prospects tend to have lower ones. It’s important, then, to compare Enphase’s PE not only against its industry but also factoring in its own performance expectations.

Enphase currently trades at a PE ratio of 19.2x. For context, the semiconductor industry’s average is notably higher at 34x, and key peers average 43.8x. However, Simply Wall St’s Fair Ratio for Enphase is calculated at 19.6x, reflecting what a reasonable multiple should be, given Enphase’s specific earnings track record, growth outlook, market cap, and profit margins. While industry and peer comparisons provide useful benchmarks, the Fair Ratio offers a more tailored view because it incorporates Enphase’s own fundamentals and risk profile, rather than treating all companies in the sector the same.

With Enphase’s actual PE of 19.2x sitting very close to its Fair Ratio of 19.6x, the stock appears to be valued about right based on earnings.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1405 companies where insiders are betting big on explosive growth.

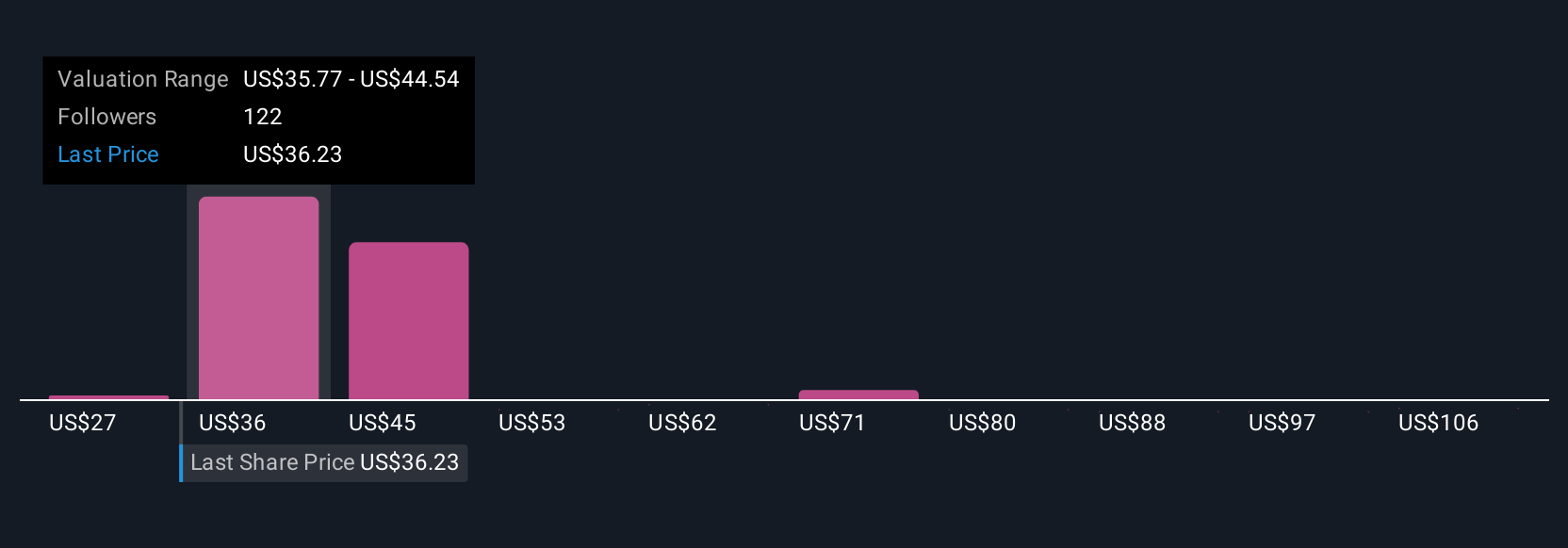

Upgrade Your Decision Making: Choose your Enphase Energy Narrative

Earlier, we mentioned there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative connects your view of Enphase’s business story, such as its new product launches, market expansion, and evolving risks, with your forecast for revenue, earnings, and margins. This ultimately leads to a fair value that reflects your personal perspective.

Rather than relying solely on traditional ratios, Narratives let you quickly build your own investment thesis in a few steps, directly on Simply Wall St’s Community page, where millions of investors are exchanging ideas. This tool makes it easy to translate your beliefs about Enphase’s future into numbers: you can estimate fair value, see if the current price offers a margin of safety, and track how your narrative compares with others in the community.

Because Narratives are dynamic, they update when fresh earnings, news, or forecasts arrive, helping you decide the right time to buy or sell as circumstances change. For example, some investors expect Enphase’s earnings and margins to surge on international growth, resulting in bullish price targets up to $85. Others foresee industry headwinds and more modest outcomes, leading to targets as low as $27. Narratives give you the flexibility to see both sides and make smarter, faster decisions with confidence.

Do you think there's more to the story for Enphase Energy? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Enphase Energy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:ENPH

Enphase Energy

Designs, develops, manufactures, and sells home energy solutions for the solar photovoltaic industry in the United States and internationally.

Undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives