- United States

- /

- Semiconductors

- /

- NasdaqGM:ENPH

Enphase Energy (ENPH) Profit Margin Surge Reinforces Bullish Narratives Despite Slower Growth Outlook

Reviewed by Simply Wall St

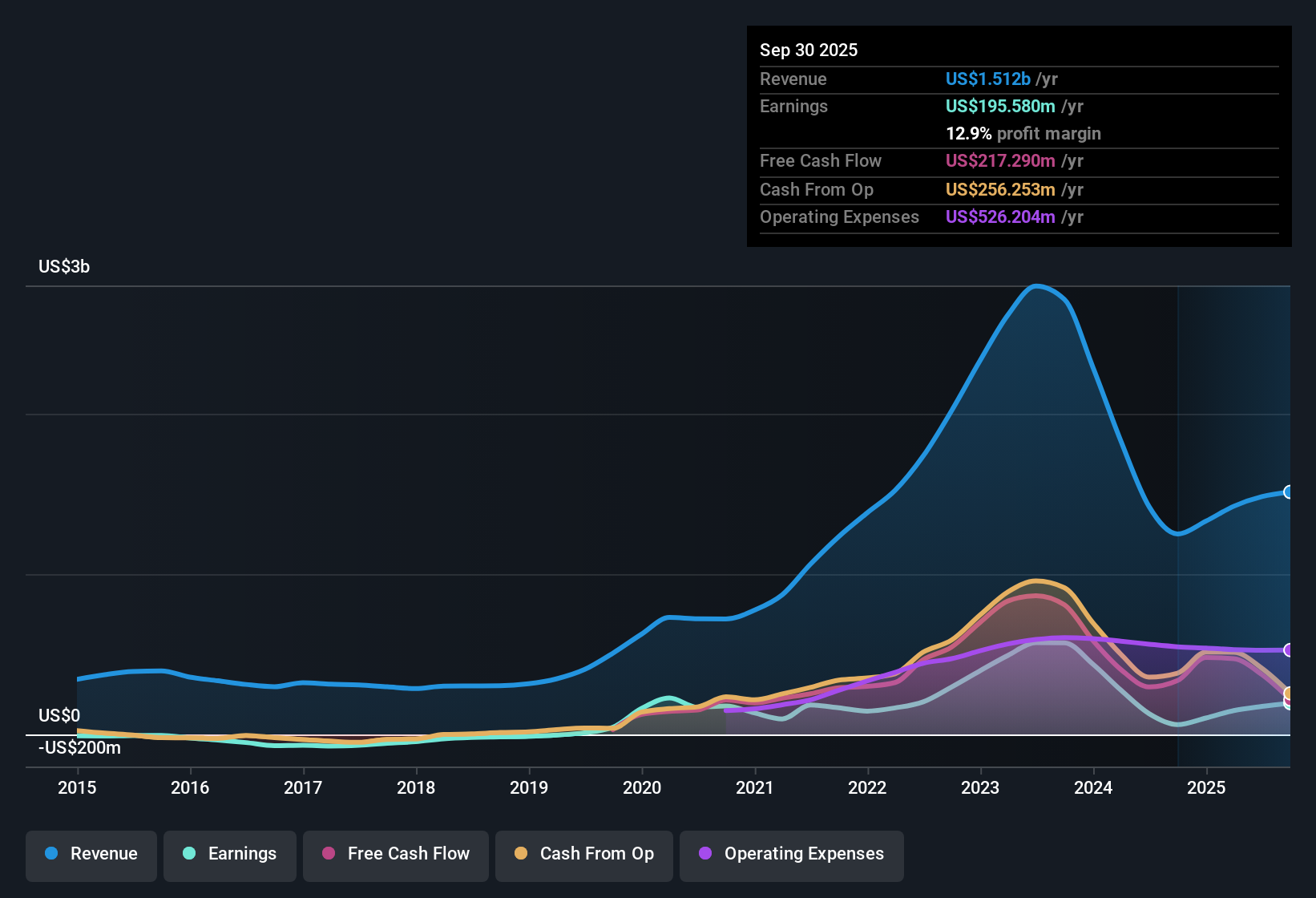

Enphase Energy (ENPH) posted a jump in net profit margin to 12.9%, up sharply from 4.9% a year ago. Year-over-year earnings growth reached 218.4%, easily surpassing its five-year earnings growth average of just 3.3% per year. At the same time, the stock trades at a Price-To-Earnings Ratio of 20.8x, notably below both the US semiconductor industry average of 39.8x and its peer group’s 46.9x. Shares are currently priced at $31.14, sitting under the estimated fair value of $38.49. Investors will note that while the company has delivered impressive margin improvement and profit acceleration, analyst forecasts point to more muted earnings growth and declining revenue in the years ahead. This sets the stage for mixed sentiment going forward.

See our full analysis for Enphase Energy.Next, we’ll see how these earnings figures hold up against the most widely discussed narratives and debates within the Simply Wall St community. Some views could be reinforced, while others might get challenged.

See what the community is saying about Enphase Energy

Margins Projected to Reach 14.3% by 2027

- Analysts expect Enphase’s profit margin to grow from its current 12.9% to 14.3% within three years, pointing to sustained efficiency gains even as top-line revenue slows.

- According to the analysts' consensus view, expanding profitability is underpinned by product innovation and international expansion. Margin headwinds from tariffs and new product execution risk remain top of mind.

- Consensus notes major catalysts include global electrification trends and policy support, which could boost high-margin recurring revenues.

- Bears argue that oversupply and expiring tax credits could offset these gains by pressuring margins and slowing adoption if replacement growth channels fall short.

What surprised analysts most? See how competing views are shaping the outlook in the full Consensus Narrative. 📊 Read the full Enphase Energy Consensus Narrative.

Revenue Expected to Decline 2.6% Annually

- The consensus predicts Enphase’s revenue will fall at an average rate of 2.6% per year over the next three years, despite growth ambitions in international markets.

- According to the analysts' consensus view, this looming dip in overall revenue is attributed to the expiration of key U.S. tax credits in 2026 and industry supply pressures.

- Consensus highlights growing international diversification and new launches may not be enough to fully absorb the contraction in core U.S. residential solar demand.

- Bears focus on U.S. market risk, arguing that new regions must scale rapidly to prevent a meaningful drag on group-level sales performance post-incentive roll-off.

Share Trades 46% Below Peer Price-to-Earnings

- Enphase’s current Price-To-Earnings ratio of 20.8x is not only below its DCF fair value of $38.49, but it also trades at a steep 46% discount to the U.S. semiconductor industry average of 39.8x and an even larger gap to its closest peer group at 46.9x.

- In the analysts' consensus view, this wide valuation gap suggests the market may be discounting future risks, but it also creates upside if Enphase can deliver on its new product roadmap and international scale-up.

- Consensus weighs the arguably attractive entry point for long-term holders against execution risk from anticipated market contraction and cost headwinds.

- If Enphase exceeds revenue or margin forecasts, particularly abroad, the multiple could re-rate closer to the peer average, reversing the current discount.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Enphase Energy on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a unique take on Enphase's numbers or outlook? Share your perspective and shape your own view in just a few minutes by Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Enphase Energy.

See What Else Is Out There

Despite impressive margin improvements, Enphase is facing declining revenue projections and muted growth expectations. These factors could limit its long-term performance.

If steadier results are a priority, use stable growth stocks screener (2122 results) to focus on companies consistently delivering reliable growth regardless of market conditions or short-term headwinds.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Enphase Energy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:ENPH

Enphase Energy

Designs, develops, manufactures, and sells home energy solutions for the solar photovoltaic industry in the United States and internationally.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives