- United States

- /

- Semiconductors

- /

- NasdaqGS:DIOD

Could Diodes’ (DIOD) Latest LED Drivers Illuminate a Shift in Its Automotive Growth Strategy?

Reviewed by Sasha Jovanovic

- Diodes Incorporated recently introduced the AL58818Q and AL58812Q, automotive-compliant LED drivers designed for precise color mixing, brightness control, and advanced lighting effects, targeting applications in automotive lighting, infotainment displays, and interior ambience.

- This launch highlights Diodes' emphasis on expanding its automotive-grade LED solutions, aiming to serve more complex, energy-efficient lighting needs within next-generation vehicles and related electronic systems.

- We'll examine how this product rollout, with its enhanced automotive lighting control features, could influence Diodes' broader investment narrative.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Diodes Investment Narrative Recap

To be a shareholder in Diodes Incorporated, you need to believe that the company can successfully pivot beyond its exposure to cyclical consumer markets by capturing a larger share of higher-value, complex automotive and industrial applications. The launch of advanced automotive-grade LED drivers like the AL58818Q and AL58812Q supports this shift but does not materially change the near-term risk stemming from elevated inventory levels, which continue to weigh on future earnings visibility and could lead to write-downs if demand softens.

The most relevant recent announcement is the August 26 introduction of the AL5958Q, a 48-channel automotive-compliant LED driver. Together with the new AL58818Q and AL58812Q, this product line expansion underlines Diodes’ push to deepen its footprint in automotive electronics, supporting the catalyst of content growth per vehicle as industry electrification and infotainment needs accelerate.

In contrast, one issue that investors should be aware of is the risk if end-market demand slows and channels remain oversupplied...

Read the full narrative on Diodes (it's free!)

Diodes' narrative projects $1.8 billion revenue and $124.0 million earnings by 2028. This requires 8.7% yearly revenue growth and a $60.4 million earnings increase from $63.6 million.

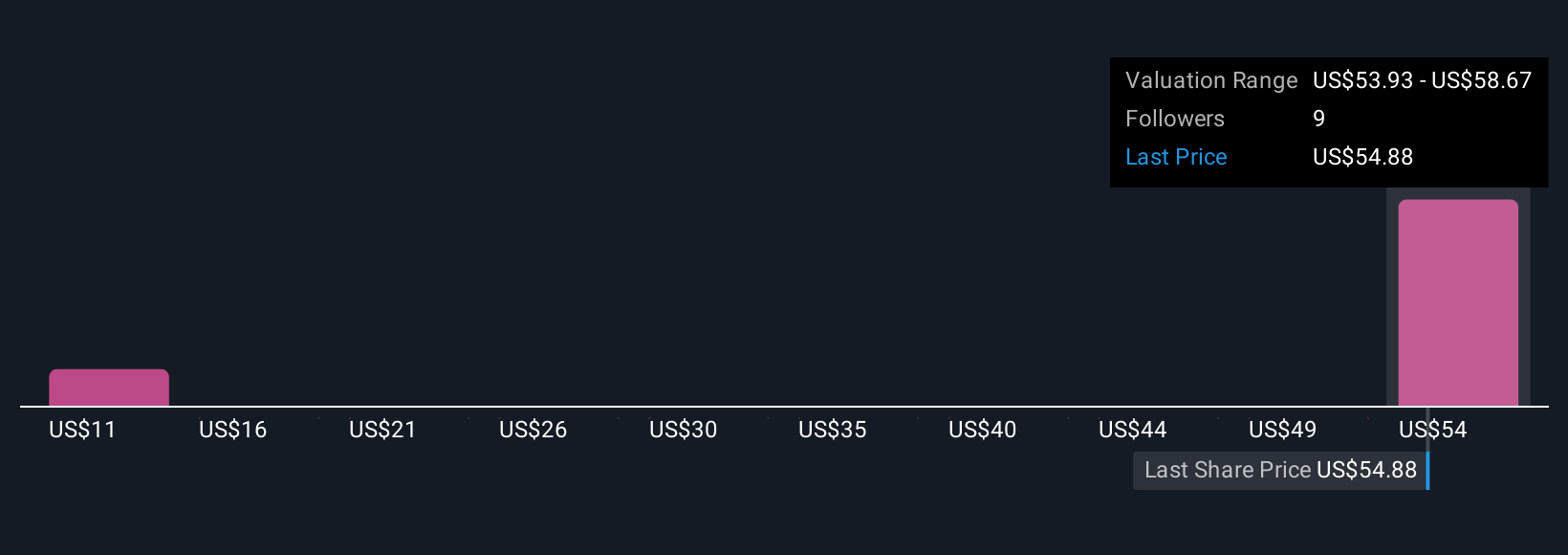

Uncover how Diodes' forecasts yield a $58.67 fair value, a 11% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members offer two sharply different fair value estimates for Diodes, ranging from US$11.17 to US$58.67 per share. While some see substantial upside, the company's still-high inventory levels highlight concerns about potential downside if demand does not keep pace, inviting you to review the fullest range of opinions and possible scenarios for Diodes’ outlook.

Explore 2 other fair value estimates on Diodes - why the stock might be worth as much as 11% more than the current price!

Build Your Own Diodes Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Diodes research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free Diodes research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Diodes' overall financial health at a glance.

Want Some Alternatives?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Find companies with promising cash flow potential yet trading below their fair value.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Rare earth metals are the new gold rush. Find out which 33 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:DIOD

Diodes

Manufactures and supplies application-specific standard products in the broad discrete, logic, analog, and mixed-signal semiconductor markets in Asia, Europe, and the Americas.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives