- United States

- /

- Semiconductors

- /

- NasdaqGS:DIOD

A Look at Diodes (DIOD) Valuation Following Launch of Advanced Automotive LED Drivers

Reviewed by Kshitija Bhandaru

Diodes (DIOD) just launched its AL58818Q and AL58812Q LED drivers, which are packed with features tailored for automotive lighting and display applications. This product debut highlights the company’s focus on innovation and flexibility in automotive electronics.

See our latest analysis for Diodes.

While Diodes is making technical strides in automotive lighting, its recent share price returns reflect investor caution, with little movement year-to-date and a negative 1-year total shareholder return of around 18%. The muted share price suggests the market is waiting to see if recent innovations can reignite momentum for the stock over the longer term.

If this kind of innovation piques your interest, it may be worth exploring other auto manufacturers shaping the future. See the full list with See the full list for free..

With shares still trading below analyst price targets despite solid annual revenue and profit growth, the question for investors is whether there is a buying opportunity now or if the market has already priced in Diodes’ future growth.

Most Popular Narrative: 10.4% Undervalued

Compared to Diodes' last closing price of $52.58, the widely followed narrative points to a higher fair value, reflecting confidence in the company's future earning power and industry positioning.

Rapid electrification in automotive, particularly EVs in China, is leading to growing content per vehicle and an expanding set of design wins for Diodes' automotive-qualified products (such as protection devices, LED controllers, and power management ICs). This is supporting higher average selling prices and future margin expansion. Strategic focus on new product introductions, especially in high-margin analog, mixed-signal, and power management segments, positions Diodes to benefit from product mix improvement. This should translate into structurally higher gross and operating margins over time.

What’s driving this ambitious outlook? The narrative leans heavily on key financial leaps and bold revenue projections, including margin shifts that could reshape Diodes’ earnings profile. Want a peek at the crucial forecasts and numbers steering this fair value? Dive in to uncover the full story and see what justifies the analysts' target.

Result: Fair Value of $58.67 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, heightened exposure to cyclical consumer demand and high inventory levels could disrupt Diodes' margin expansion outlook if market conditions weaken.

Find out about the key risks to this Diodes narrative.

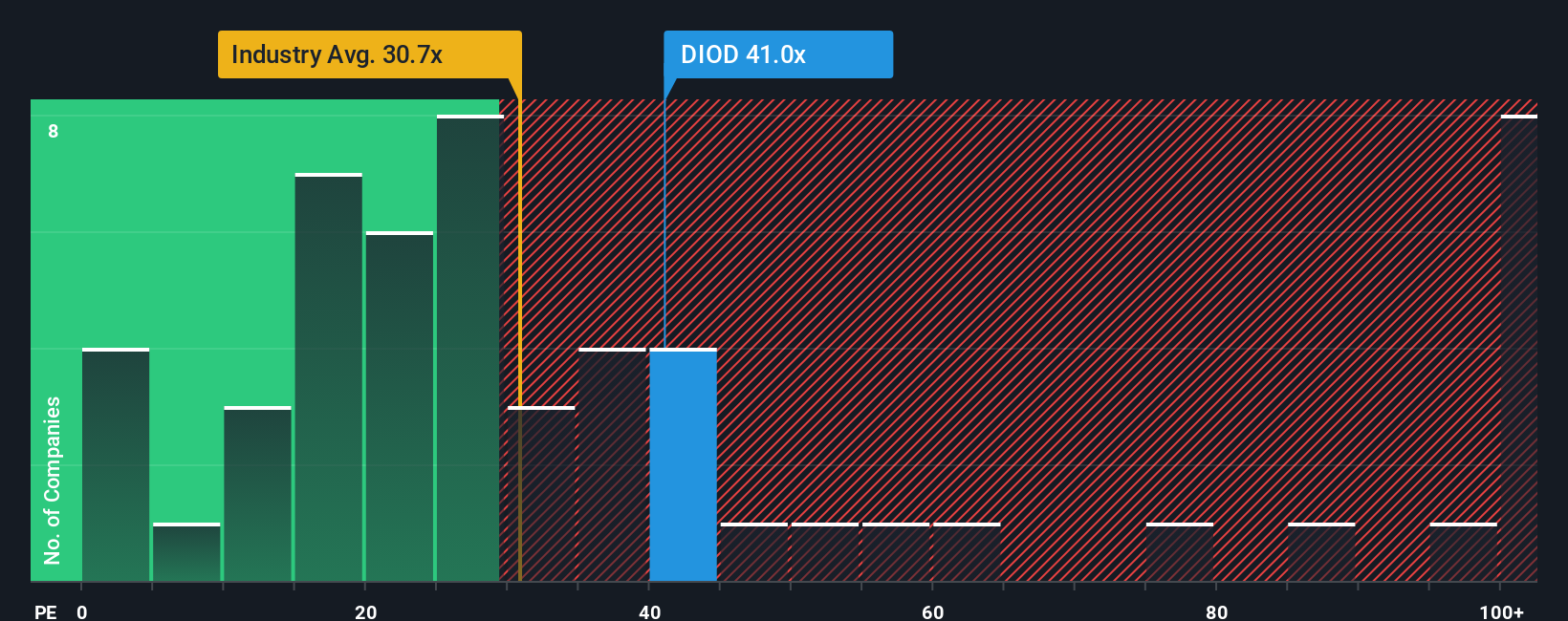

Another View: Multiples Signal Caution

While analysts see Diodes as undervalued based on their projections, the market is pricing the stock at a high earnings multiple of 38.4 times, which is above both the industry average of 37.1 and the fair ratio of 35.9. This premium suggests investors expect strong results, but it also raises the risk if the company fails to deliver. Could expectations be running ahead of reality?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Diodes Narrative

If you have a different perspective or want to dig into the numbers yourself, you can build your own view of Diodes' story in just a few minutes. Do it your way.

A great starting point for your Diodes research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Strengthen your portfolio by actively seeking out game-changing stocks. The market rewards action takers, so don't let these powerful opportunities slip by.

- Uncover potential high-flyers by checking out these 3562 penny stocks with strong financials making waves with impressive growth and bold innovation.

- Boost your returns with reliable cash flow from these 19 dividend stocks with yields > 3% offering yields above 3% and a track record of rewarding shareholders.

- Get ahead of the curve by targeting promising breakthroughs with these 31 healthcare AI stocks at the cutting edge of AI-driven healthcare solutions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:DIOD

Diodes

Manufactures and supplies application-specific standard products in the broad discrete, logic, analog, and mixed-signal semiconductor markets in Asia, Europe, and the Americas.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives