- United States

- /

- Semiconductors

- /

- NasdaqGS:DIOD

A Fresh Look at Diodes (DIOD) Valuation as Automotive Connectivity Innovations Drive Growth Potential

Reviewed by Simply Wall St

Diodes (DIOD) just announced the PI7C9X762Q, targeting next-generation automotive and electric vehicle systems. The new UART bridge focuses on energy efficiency and flexible connectivity in advanced automotive applications.

See our latest analysis for Diodes.

Diodes’ announcement builds on a year shaped by innovation but also volatility. After a tough stretch earlier this year, recent momentum is palpable, with an 11% share price return over the last 90 days and solid gains this week. Still, one-year total shareholder return sits at -8%, highlighting that longer-term performance has lagged even as optimism rebuilds around new product launches and growth opportunities in automotive tech.

If Diodes’ latest move got you watching the auto space, you can explore even more opportunities with our curated list of automaker and supplier stocks in See the full list for free.

With strong recent gains but lackluster long-term returns, the key question now is whether Diodes offers real value at current levels or if the market is already anticipating the company’s next wave of growth.

Most Popular Narrative: Fairly Valued

Diodes’ latest fair value estimate of $58.67 sits just above the current share price of $58.38, signaling that expectations are closely in line with today’s valuation. With this narrow gap, all eyes are on the strategic bets powering the company’s outlook.

Strategic focus on new product introductions, especially in high-margin analog, mixed-signal, and power management segments, positions Diodes to benefit from product mix improvement. This should translate into structurally higher gross and operating margins over time. Increasing vertical integration and qualification of in-house wafer fabrication are expected to reduce reliance on costlier outsourced production, improve supply reliability, and lower costs. These efforts will help drive better net margin and earnings stability as utilization rises.

Want to uncover how Diodes plans to turn product innovation and manufacturing shifts into long-term profit expansion? The secret hinges on ambitious targets for margin growth and a fresh approach to sector leadership. Which core financial levers could push the stock’s next phase? Read the full narrative for the deeper story behind these bold projections.

Result: Fair Value of $58.67 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent exposure to cyclical consumer demand and high inventory levels could quickly undermine the current optimism and the earnings outlook for Diodes.

Find out about the key risks to this Diodes narrative.

Another View: What Do Market Ratios Say?

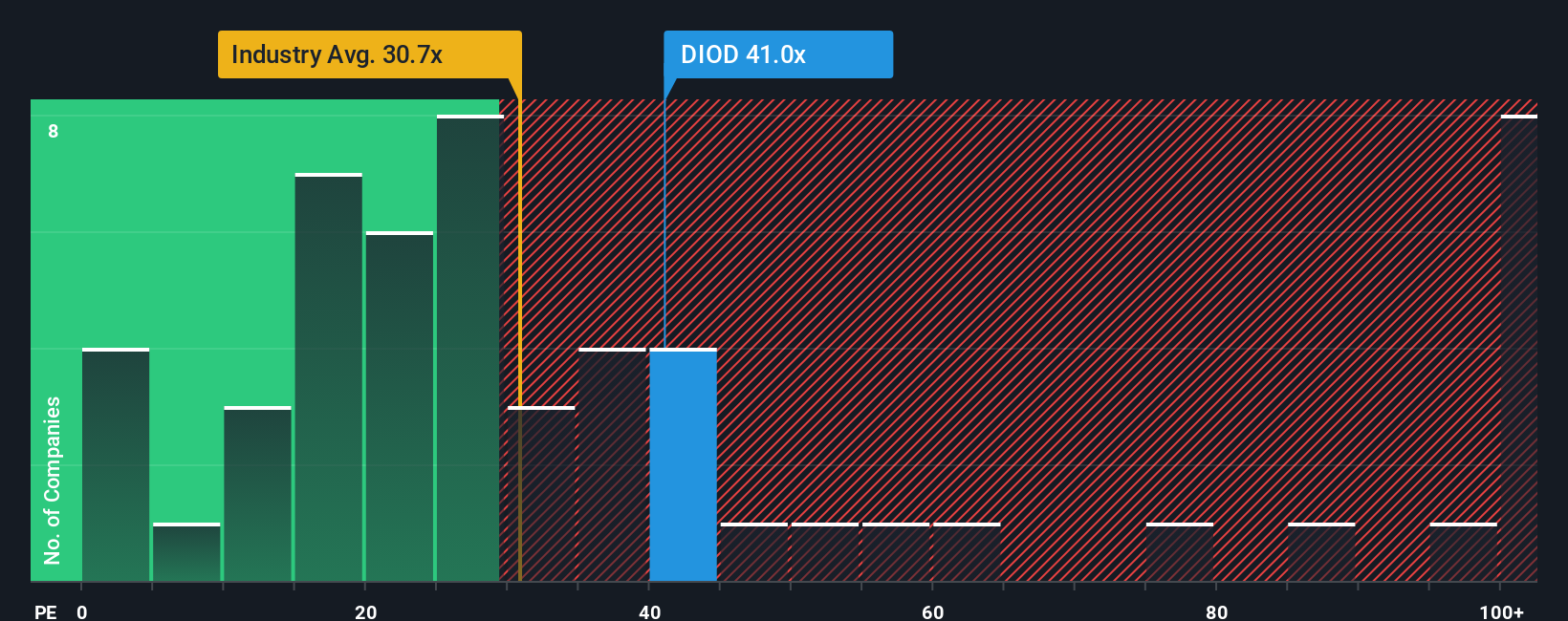

Looking at Diodes through the lens of price-to-earnings ratios provides a different angle. The shares currently trade at 42.6 times earnings, which is above both the US Semiconductor industry average of 37.4x and the fair ratio of 36.5x that the market could eventually adjust toward. This suggests investors may be pricing in higher growth or quality, but it comes with added valuation risk if results do not measure up in the future. Could optimism be running ahead of fundamentals?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Diodes Narrative

If you see the story differently or want to test your own assumptions, you can dive into the numbers and build your own narrative in just minutes with Do it your way.

A great starting point for your Diodes research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t just watch from the sidelines. Seize your chance to get ahead with powerful investment themes on Simply Wall St’s screener. There are gems waiting to be found.

- Access reliable income streams when you review these 17 dividend stocks with yields > 3% offering yields greater than 3% in today’s market.

- Spot the potential in future AI leaders by checking out these 24 AI penny stocks reshaping innovation and smart automation.

- Catch value before the crowd does by acting on these 877 undervalued stocks based on cash flows handpicked for their strong fundamentals and attractive pricing.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:DIOD

Diodes

Manufactures and supplies application-specific standard products in the broad discrete, logic, analog, and mixed-signal semiconductor markets in Asia, Europe, and the Americas.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives