- United States

- /

- Semiconductors

- /

- NasdaqCM:CVV

Health Check: How Prudently Does CVD Equipment (NASDAQ:CVV) Use Debt?

Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. Importantly, CVD Equipment Corporation (NASDAQ:CVV) does carry debt. But the more important question is: how much risk is that debt creating?

What Risk Does Debt Bring?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. If things get really bad, the lenders can take control of the business. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. The first step when considering a company's debt levels is to consider its cash and debt together.

View our latest analysis for CVD Equipment

What Is CVD Equipment's Net Debt?

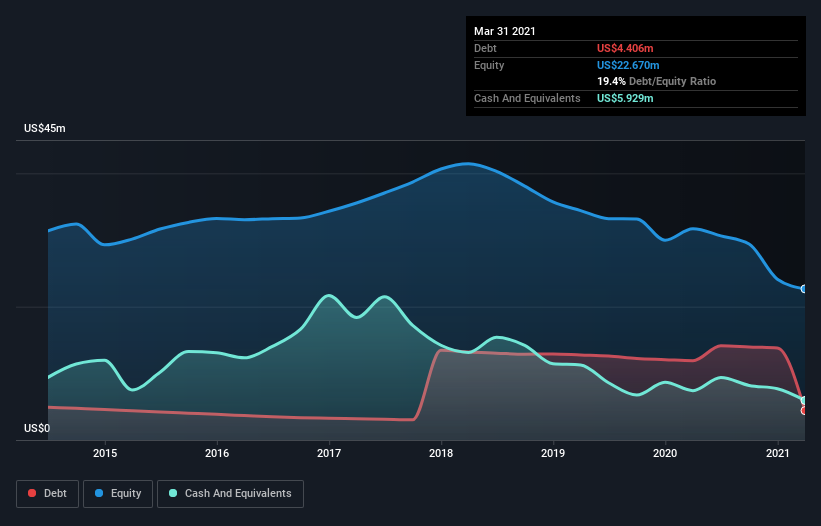

You can click the graphic below for the historical numbers, but it shows that CVD Equipment had US$4.41m of debt in March 2021, down from US$11.9m, one year before. But it also has US$5.93m in cash to offset that, meaning it has US$1.52m net cash.

How Strong Is CVD Equipment's Balance Sheet?

The latest balance sheet data shows that CVD Equipment had liabilities of US$14.1m due within a year, and liabilities of US$2.42m falling due after that. Offsetting this, it had US$5.93m in cash and US$2.56m in receivables that were due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by US$8.04m.

CVD Equipment has a market capitalization of US$28.7m, so it could very likely raise cash to ameliorate its balance sheet, if the need arose. But we definitely want to keep our eyes open to indications that its debt is bringing too much risk. Despite its noteworthy liabilities, CVD Equipment boasts net cash, so it's fair to say it does not have a heavy debt load! There's no doubt that we learn most about debt from the balance sheet. But you can't view debt in total isolation; since CVD Equipment will need earnings to service that debt. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Over 12 months, CVD Equipment made a loss at the EBIT level, and saw its revenue drop to US$14m, which is a fall of 36%. That makes us nervous, to say the least.

So How Risky Is CVD Equipment?

By their very nature companies that are losing money are more risky than those with a long history of profitability. And we do note that CVD Equipment had an earnings before interest and tax (EBIT) loss, over the last year. And over the same period it saw negative free cash outflow of US$3.2m and booked a US$9.2m accounting loss. However, it has net cash of US$1.52m, so it has a bit of time before it will need more capital. Summing up, we're a little skeptical of this one, as it seems fairly risky in the absence of free cashflow. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately, every company can contain risks that exist outside of the balance sheet. Case in point: We've spotted 3 warning signs for CVD Equipment you should be aware of, and 1 of them is a bit unpleasant.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

When trading CVD Equipment or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqCM:CVV

CVD Equipment

Designs, develops, manufactures, and sells equipment to develop and manufacture materials and coatings in the United States, North America, Europe, the Middle East, Europe, Africa, and the Asia Pacific.

Flawless balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives