- United States

- /

- Semiconductors

- /

- NasdaqGS:CSIQ

Is Rising Short Interest in CSIQ Revealing Shifts in Canadian Solar’s Competitive Positioning?

Reviewed by Sasha Jovanovic

- In the past week, Canadian Solar Inc saw its short interest as a percent of float rise by 12.09%, with 20.03% of its available shares sold short, more than double the sector average.

- This surge in short interest may signal a shift in investor sentiment, as Canadian Solar faces higher bearish positioning compared to its peers.

- We’ll now look at how a sharp increase in short interest could influence Canadian Solar’s investment narrative going forward.

Find companies with promising cash flow potential yet trading below their fair value.

Canadian Solar Investment Narrative Recap

Being a Canadian Solar shareholder means believing in the company’s ability to capitalize on global electrification trends and battery storage expansion, as well as successfully scaling next-gen solar modules. The recent surge in short interest is a clear sign of rising bearish sentiment, but it does not fundamentally change the current short-term catalyst, strong demand for storage solutions, nor does it materially alter the biggest risk, which remains sustained pressure on module margins due to rising costs.

Canadian Solar’s September 2025 launch of next-generation Low Carbon modules, featuring higher output and a reduced carbon footprint, marks an important step in product innovation. This release directly supports the company’s growth catalyst of winning higher-value projects and potentially protecting margins, even as near-term cost challenges persist.

By contrast, investors should be mindful of risks tied to policy changes and U.S. tax credit uncertainty, as these...

Read the full narrative on Canadian Solar (it's free!)

Canadian Solar's outlook calls for $8.0 billion in revenue and $201.9 million in earnings by 2028. This projection is based on a 10.4% annual revenue growth rate and an earnings increase of $208.8 million from current earnings of -$6.9 million.

Uncover how Canadian Solar's forecasts yield a $21.76 fair value, a 20% downside to its current price.

Exploring Other Perspectives

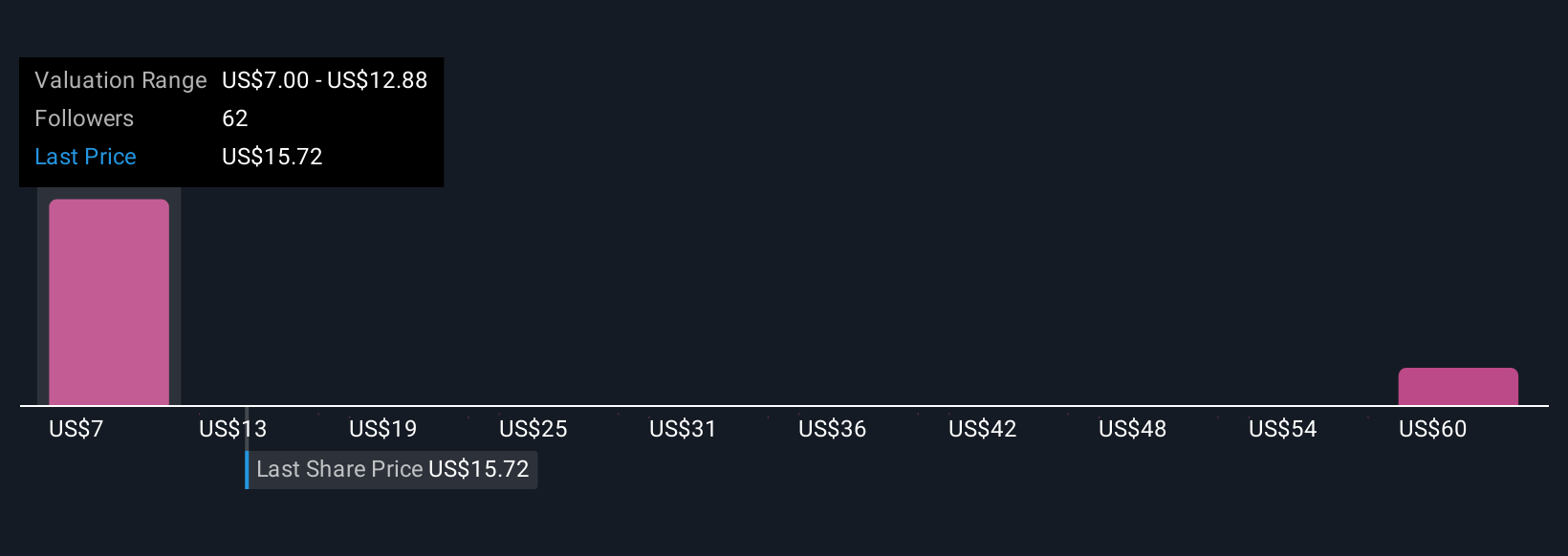

Five Simply Wall St Community members assigned fair values for Canadian Solar ranging from US$7 to US$58.42 per share. While these opinions differ, many highlight ongoing pressure on module profitability and margins as critical factors shaping future outcomes.

Explore 5 other fair value estimates on Canadian Solar - why the stock might be worth over 2x more than the current price!

Build Your Own Canadian Solar Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Canadian Solar research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Canadian Solar research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Canadian Solar's overall financial health at a glance.

Want Some Alternatives?

Our top stock finds are flying under the radar-for now. Get in early:

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CSIQ

Canadian Solar

Provides solar energy and battery energy storage products and solutions in Asia, the Americas, Europe, and internationally.

Reasonable growth potential with acceptable track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026