- United States

- /

- Semiconductors

- /

- NasdaqGS:CSIQ

Canadian Solar (NasdaqGS:CSIQ): Examining Valuation as Rising Costs and Regulatory Pressures Shape Outlook

Reviewed by Kshitija Bhandaru

Canadian Solar (NasdaqGS:CSIQ) has landed in the spotlight after JPMorgan flagged rising costs for key solar components and raised fresh concerns about meeting new U.S. regulatory rules, stirring investor debate around the stock’s near-term outlook.

See our latest analysis for Canadian Solar.

The market has responded quickly to the regulatory and cost headwinds, with Canadian Solar’s share price falling 16.2% in a single day and slipping nearly 12% over the past week. Even so, it has managed an impressive 23.6% share price return for the past month and remains up 11.1% for the year to date. This suggests that momentum has rebounded recently. However, its one-year total shareholder return is still negative, reflecting the longer-term challenges at play.

If this volatility has you interested in other opportunities, now is a smart time to branch out and discover fast growing stocks with high insider ownership

With share prices swinging sharply and fresh doubts emerging from Wall Street analysts, the key question now is whether Canadian Solar’s current valuation underestimates its future potential or if all risks and prospects have already been priced in.

Most Popular Narrative: 8% Overvalued

Canadian Solar’s last close of $13.38 is above the most-watched narrative’s fair value estimate of $12.37. The narrative considers recent sector headwinds, forward earnings growth, and shifting profit margins to justify its new target, emphasizing fundamental pressures ahead.

Bearish analysts highlight significant risk from potential retroactive AD/CVD (antidumping and countervailing duty) liabilities. These could exceed Canadian Solar’s market cap and cash on hand, creating significant financial uncertainty. Ongoing U.S. policy and trade actions are driving developers to reconsider panel vendors, potentially shifting market share away from Canadian Solar toward competitors not affected by the tariffs, such as First Solar.

The key to this narrative is bold bets on massive earnings recovery, margin expansion, and a leap in profit multiples. Want a look inside the high-stakes assumptions driving this forecast? Only the full narrative reveals exactly which future trends are powering the model’s price target.

Result: Fair Value of $12.37 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, fierce competition and rising supply chain costs could challenge the company’s margin recovery. This raises doubts about the long-term sustainability of its growth story.

Find out about the key risks to this Canadian Solar narrative.

Another View: Discounted Cash Flow Signals Deep Value

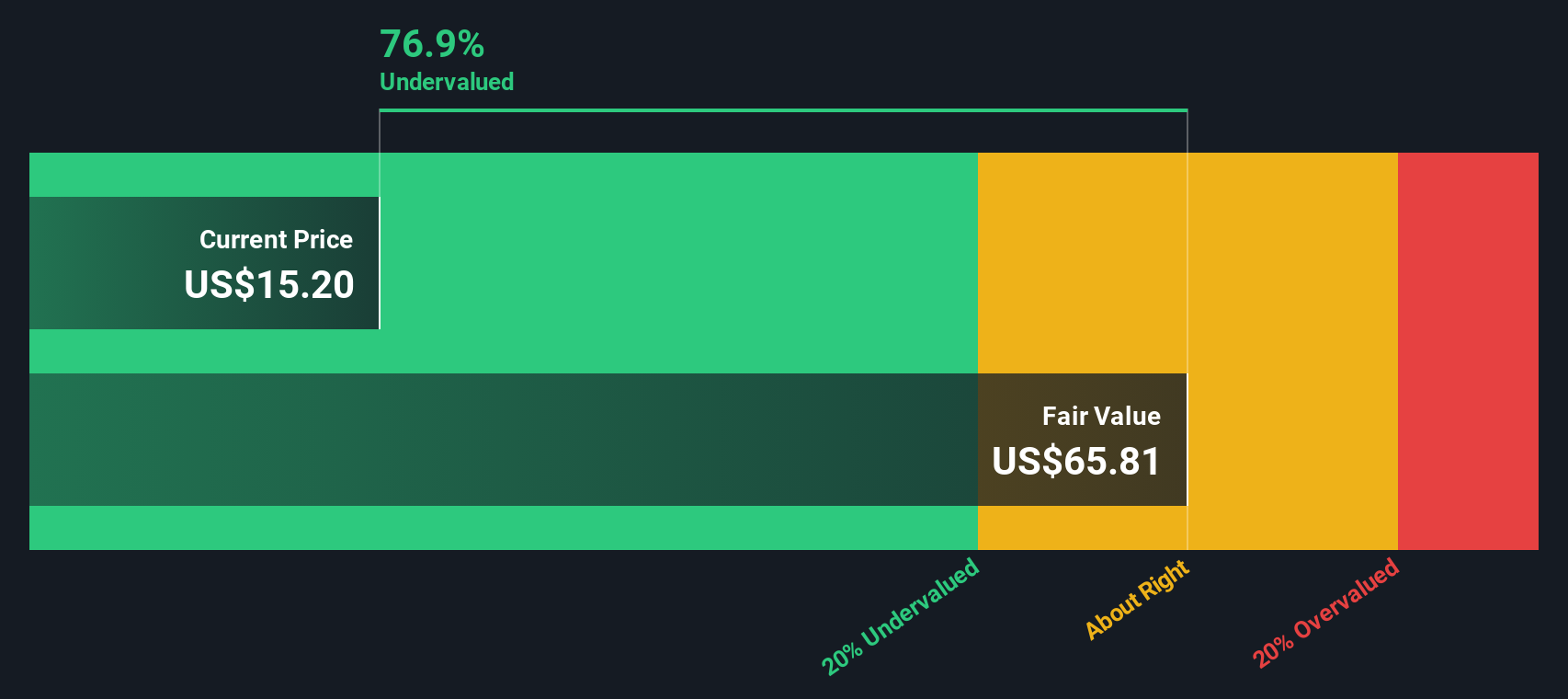

While the most-watched narrative points to Canadian Solar being overvalued against analyst targets, the SWS DCF model offers a starkly different perspective. According to our DCF approach, the stock trades nearly 80% below its calculated fair value. Is the market underestimating the longer-term cash flow story?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Canadian Solar Narrative

If you see things differently or want to dig deeper into the figures, you can craft your own take on Canadian Solar’s outlook in just a few short minutes. Do it your way

A great starting point for your Canadian Solar research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Stay ahead of the market by using the Simply Wall Street Screener and ensure you never overlook opportunities featuring standout growth, innovation, and value across sectors.

- Discover high-potential opportunities with these 3581 penny stocks with strong financials that show robust financials in volatile markets and times of rapid change.

- Capitalize on the AI revolution by targeting these 24 AI penny stocks positioned for breakthroughs in automation, data intelligence, and sector leadership.

- Maximize portfolio value by reviewing these 898 undervalued stocks based on cash flows supported by strong fundamentals and still trading at attractive prices today.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CSIQ

Canadian Solar

Provides solar energy and battery energy storage products and solutions in Asia, the Americas, Europe, and internationally.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives