- United States

- /

- Semiconductors

- /

- NasdaqGS:CRDO

Why Investors Shouldn't Be Surprised By Credo Technology Group Holding Ltd's (NASDAQ:CRDO) 32% Share Price Surge

Despite an already strong run, Credo Technology Group Holding Ltd (NASDAQ:CRDO) shares have been powering on, with a gain of 32% in the last thirty days. The annual gain comes to 177% following the latest surge, making investors sit up and take notice.

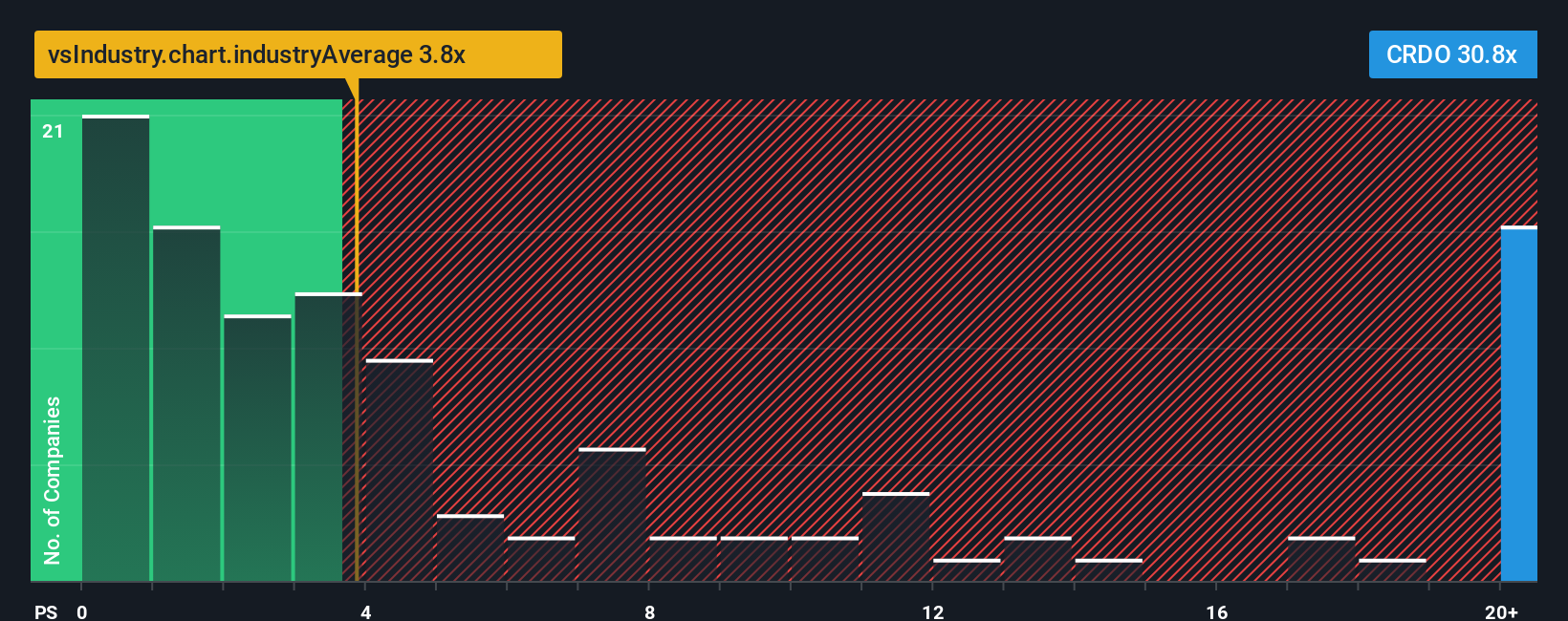

Following the firm bounce in price, Credo Technology Group Holding may be sending very bearish signals at the moment with a price-to-sales (or "P/S") ratio of 30.8x, since almost half of all companies in the Semiconductor industry in the United States have P/S ratios under 3.8x and even P/S lower than 1.7x are not unusual. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

See our latest analysis for Credo Technology Group Holding

What Does Credo Technology Group Holding's Recent Performance Look Like?

With revenue growth that's superior to most other companies of late, Credo Technology Group Holding has been doing relatively well. It seems that many are expecting the strong revenue performance to persist, which has raised the P/S. If not, then existing shareholders might be a little nervous about the viability of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Credo Technology Group Holding.How Is Credo Technology Group Holding's Revenue Growth Trending?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Credo Technology Group Holding's to be considered reasonable.

Taking a look back first, we see that the company grew revenue by an impressive 125% last year. The latest three year period has also seen an incredible overall rise in revenue, aided by its incredible short-term performance. Accordingly, shareholders would have been over the moon with those medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 84% during the coming year according to the eleven analysts following the company. With the industry only predicted to deliver 30%, the company is positioned for a stronger revenue result.

In light of this, it's understandable that Credo Technology Group Holding's P/S sits above the majority of other companies. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

What Does Credo Technology Group Holding's P/S Mean For Investors?

Credo Technology Group Holding's P/S has grown nicely over the last month thanks to a handy boost in the share price. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

As we suspected, our examination of Credo Technology Group Holding's analyst forecasts revealed that its superior revenue outlook is contributing to its high P/S. At this stage investors feel the potential for a deterioration in revenues is quite remote, justifying the elevated P/S ratio. Unless these conditions change, they will continue to provide strong support to the share price.

There are also other vital risk factors to consider before investing and we've discovered 2 warning signs for Credo Technology Group Holding that you should be aware of.

If you're unsure about the strength of Credo Technology Group Holding's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:CRDO

Credo Technology Group Holding

Provides various high-speed connectivity solutions for optical and electrical Ethernet, and PCIe applications in the United States, Taiwan, Mainland China, Hong Kong, and internationally.

Exceptional growth potential with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives