- United States

- /

- Semiconductors

- /

- NasdaqGS:CRDO

Why Investors Shouldn't Be Surprised By Credo Technology Group Holding Ltd's (NASDAQ:CRDO) 30% Share Price Surge

Those holding Credo Technology Group Holding Ltd (NASDAQ:CRDO) shares would be relieved that the share price has rebounded 30% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. The annual gain comes to 181% following the latest surge, making investors sit up and take notice.

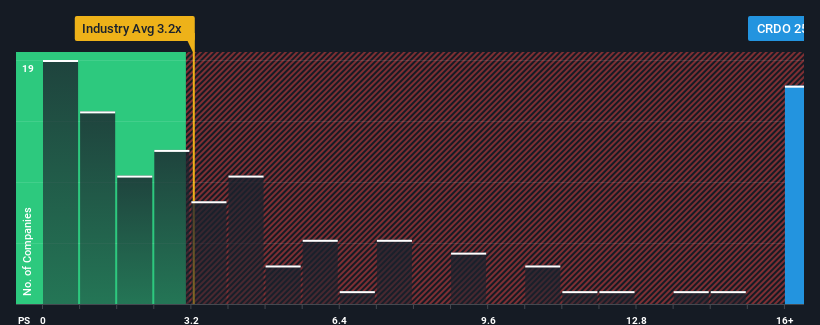

Since its price has surged higher, when almost half of the companies in the United States' Semiconductor industry have price-to-sales ratios (or "P/S") below 3.3x, you may consider Credo Technology Group Holding as a stock not worth researching with its 25x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

We've discovered 2 warning signs about Credo Technology Group Holding. View them for free.See our latest analysis for Credo Technology Group Holding

What Does Credo Technology Group Holding's Recent Performance Look Like?

Recent times have been advantageous for Credo Technology Group Holding as its revenues have been rising faster than most other companies. The P/S is probably high because investors think this strong revenue performance will continue. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on analyst estimates for the company? Then our free report on Credo Technology Group Holding will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The High P/S?

Credo Technology Group Holding's P/S ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the industry.

Retrospectively, the last year delivered an exceptional 97% gain to the company's top line. The strong recent performance means it was also able to grow revenue by 269% in total over the last three years. So we can start by confirming that the company has done a great job of growing revenue over that time.

Turning to the outlook, the next three years should generate growth of 41% each year as estimated by the twelve analysts watching the company. Meanwhile, the rest of the industry is forecast to only expand by 23% per year, which is noticeably less attractive.

With this in mind, it's not hard to understand why Credo Technology Group Holding's P/S is high relative to its industry peers. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

What We Can Learn From Credo Technology Group Holding's P/S?

Shares in Credo Technology Group Holding have seen a strong upwards swing lately, which has really helped boost its P/S figure. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As we suspected, our examination of Credo Technology Group Holding's analyst forecasts revealed that its superior revenue outlook is contributing to its high P/S. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. Unless the analysts have really missed the mark, these strong revenue forecasts should keep the share price buoyant.

We don't want to rain on the parade too much, but we did also find 2 warning signs for Credo Technology Group Holding that you need to be mindful of.

If you're unsure about the strength of Credo Technology Group Holding's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:CRDO

Credo Technology Group Holding

Provides various high-speed connectivity solutions for optical and electrical Ethernet, and PCIe applications in the United States, Taiwan, Mainland China, Hong Kong, and internationally.

Exceptional growth potential with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives