- United States

- /

- Semiconductors

- /

- NasdaqGS:COHU

Evaluating Cohu’s (COHU) Valuation After Key Wins in AI and High-Performance Chip Testing

Reviewed by Kshitija Bhandaru

If you have been watching Cohu (COHU) lately, this week’s updates might have you leaning forward. The company announced its Eclipse platform was picked by a leading semiconductor manufacturer for testing next-generation processor devices. In addition, it just secured new orders for its Neon platform used to inspect high bandwidth memory devices central to artificial intelligence. With the company raising its HBM revenue outlook for 2025, investors are wondering if this could be a turning point for Cohu’s role in the world of cutting-edge chip production.

These moves come as the semiconductor industry, driven by AI and high-performance computing, continues to generate new demand for test and inspection solutions. While Cohu’s shares climbed 3% in response to the upbeat HBM forecast, the broader story is mixed. Recent momentum contrasts with a year-to-date decline, and the stock is down over the past twelve months, even as longer-term returns still point to growth for investors patient enough to weather volatility. A series of product wins may be building fresh optimism that market headwinds could be easing.

With Cohu gaining visibility in high-impact chip testing and AI markets, is this a genuine buying opportunity, or is the market already factoring in years of future growth at current share prices?

Most Popular Narrative: 12.5% Undervalued

The most widely followed narrative suggests that Cohu is currently undervalued, with analysts forecasting future growth and improved margins driving a higher fair value.

Cohu is capitalizing on the surge in high-performance computing and the complexity of modern semiconductors (AI infrastructure, GPUs, HBM, and display drivers) by rolling out advanced, configurable handler platforms and test solutions. This is positioning the company for market share gains and higher equipment sales, which directly impacts top-line revenue.

Ready to peek under the hood of this bold valuation? The core calculation is anchored by ambitious improvements in earnings and profit margins, along with a future market multiple that could signal big shifts ahead. Can Cohu pull off the turnaround implied by this narrative? Dive in to find out which key forecasts set this price target apart.

Result: Fair Value of $25.75 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, there are still uncertainties if key customers slow orders or if new products face delays. Either situation could challenge these positive forecasts.

Find out about the key risks to this Cohu narrative.Another View: Discounted Cash Flow Disagrees

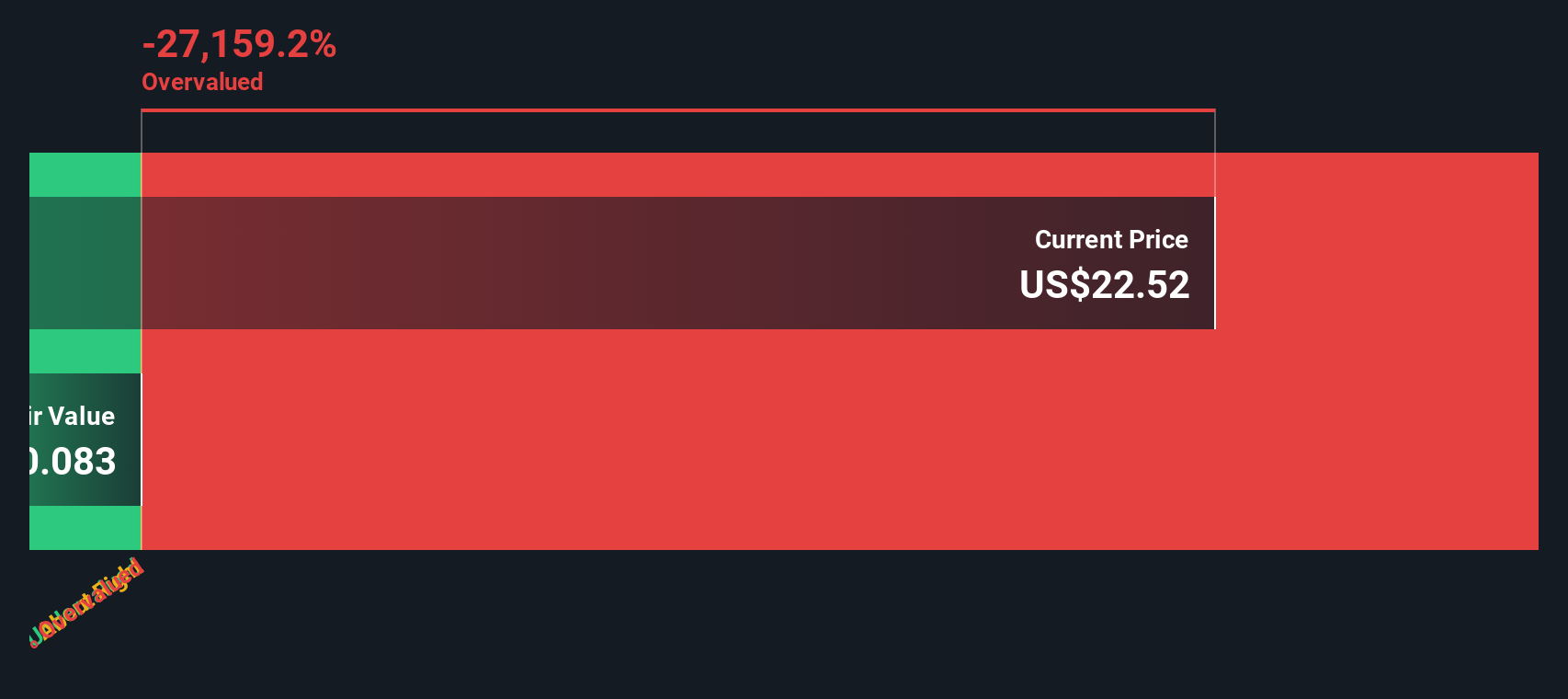

However, our DCF model offers a starkly different perspective. It indicates that Cohu’s current share price is above its fair value. Does this suggest that growth optimism is already fully baked into today’s price?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Cohu Narrative

If you want to dig deeper and draw your own conclusions, you can explore the key numbers, adjust the assumptions, and craft a narrative that fits your perspective. Do it your way.

A good starting point is our analysis highlighting 1 key reward investors are optimistic about regarding Cohu.

Looking for More Investment Ideas?

Don't let great opportunities slip by while you’re focused on just one stock. The market is full of potential. Make your next smart move with these standout stock shortlists:

- Boost your returns by targeting strong cash flow and price potential using our list of undervalued stocks based on cash flows.

- Tap into tomorrow’s tech leaders with our handpicked selection of AI penny stocks built for the AI-powered future.

- Secure reliable income by focusing on companies offering robust yields. Start with our curated lineup of dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:COHU

Cohu

Through its subsidiaries, provides semiconductor test equipment and services in the United States, China, Malaysia, the Philippines, Singapore, and internationally.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Meta’s Bold Bet on AI Pays Off

ADP Stock: Solid Fundamentals, But AI Investments Test Its Margin Resilience

Visa Stock: The Toll Booth at the Center of Global Commerce

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion