- United States

- /

- Semiconductors

- /

- NasdaqGS:COHU

Cohu, Inc.'s (NASDAQ:COHU) Business And Shares Still Trailing The Industry

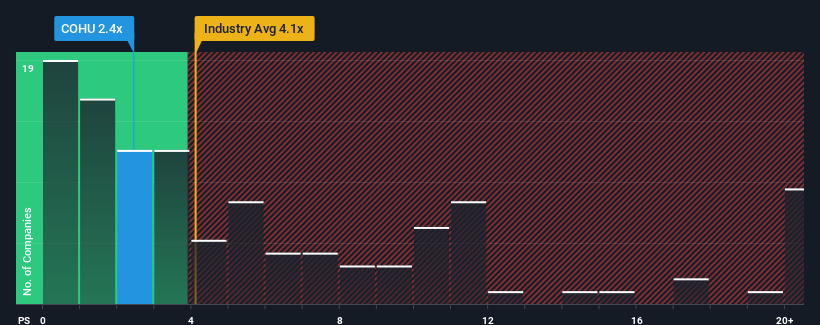

Cohu, Inc.'s (NASDAQ:COHU) price-to-sales (or "P/S") ratio of 2.4x might make it look like a buy right now compared to the Semiconductor industry in the United States, where around half of the companies have P/S ratios above 4.1x and even P/S above 11x are quite common. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

See our latest analysis for Cohu

What Does Cohu's Recent Performance Look Like?

While the industry has experienced revenue growth lately, Cohu's revenue has gone into reverse gear, which is not great. The P/S ratio is probably low because investors think this poor revenue performance isn't going to get any better. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value.

Want the full picture on analyst estimates for the company? Then our free report on Cohu will help you uncover what's on the horizon.Do Revenue Forecasts Match The Low P/S Ratio?

Cohu's P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

Retrospectively, the last year delivered a frustrating 33% decrease to the company's top line. As a result, revenue from three years ago have also fallen 39% overall. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Shifting to the future, estimates from the seven analysts covering the company suggest revenue growth is heading into negative territory, declining 6.5% over the next year. With the industry predicted to deliver 37% growth, that's a disappointing outcome.

With this in consideration, we find it intriguing that Cohu's P/S is closely matching its industry peers. Nonetheless, there's no guarantee the P/S has reached a floor yet with revenue going in reverse. Even just maintaining these prices could be difficult to achieve as the weak outlook is weighing down the shares.

What We Can Learn From Cohu's P/S?

Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As we suspected, our examination of Cohu's analyst forecasts revealed that its outlook for shrinking revenue is contributing to its low P/S. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. It's hard to see the share price rising strongly in the near future under these circumstances.

Many other vital risk factors can be found on the company's balance sheet. Our free balance sheet analysis for Cohu with six simple checks will allow you to discover any risks that could be an issue.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:COHU

Cohu

Through its subsidiaries, provides semiconductor test equipment and services in the United States, China, Malaysia, the Philippines, Singapore, and internationally.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives