- United States

- /

- Semiconductors

- /

- NasdaqGS:COHU

A Fresh Look at Cohu (COHU) Valuation After Recent Share Price Dip and Sector Momentum

Reviewed by Kshitija Bhandaru

See our latest analysis for Cohu.

Cohu’s latest dip comes after a noticeable bounce earlier in the month, highlighting that momentum can be quick to shift in the semiconductor space. While the share price is still down 17.9% for the year to date, a solid 10.5% gain over the past 90 days suggests that sentiment may be stabilizing, even as its 1-year total shareholder return remains in the red.

If you’re keeping an eye on trends shaping the tech sector, this is a great chance to see the full list of opportunities in our See the full list for free..

With shares still trading below analyst price targets and recent gains offsetting earlier declines, the key question is whether Cohu is undervalued at today’s levels or if the stock has already accounted for any turnaround ahead.

Most Popular Narrative: 15.7% Undervalued

At $21.72, Cohu’s last closing price sits well below the popular narrative’s fair value estimate of $25.75, heating up debates on turnaround prospects versus actual worth.

Strategic diversification into automotive, industrial, precision analog, and display/AR markets (moving beyond traditional consumer electronics) is increasing the resilience and breadth of Cohu's revenue base. This is making earnings less vulnerable to cyclical downturns and customer concentration risks.

What’s fueling the optimism? This narrative banks on Cohu breaking free from industry slumps due to revenue mix changes and ambitious margin targets. Get ready to uncover which bold financial projections underpin this valuation.

Result: Fair Value of $25.75 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, there are still real risks. Cohu’s outlook relies on recovery in cyclical markets and smooth expansion with new, but concentrated, customer wins.

Find out about the key risks to this Cohu narrative.

Another View: Discounted Cash Flow Puts the Numbers to the Test

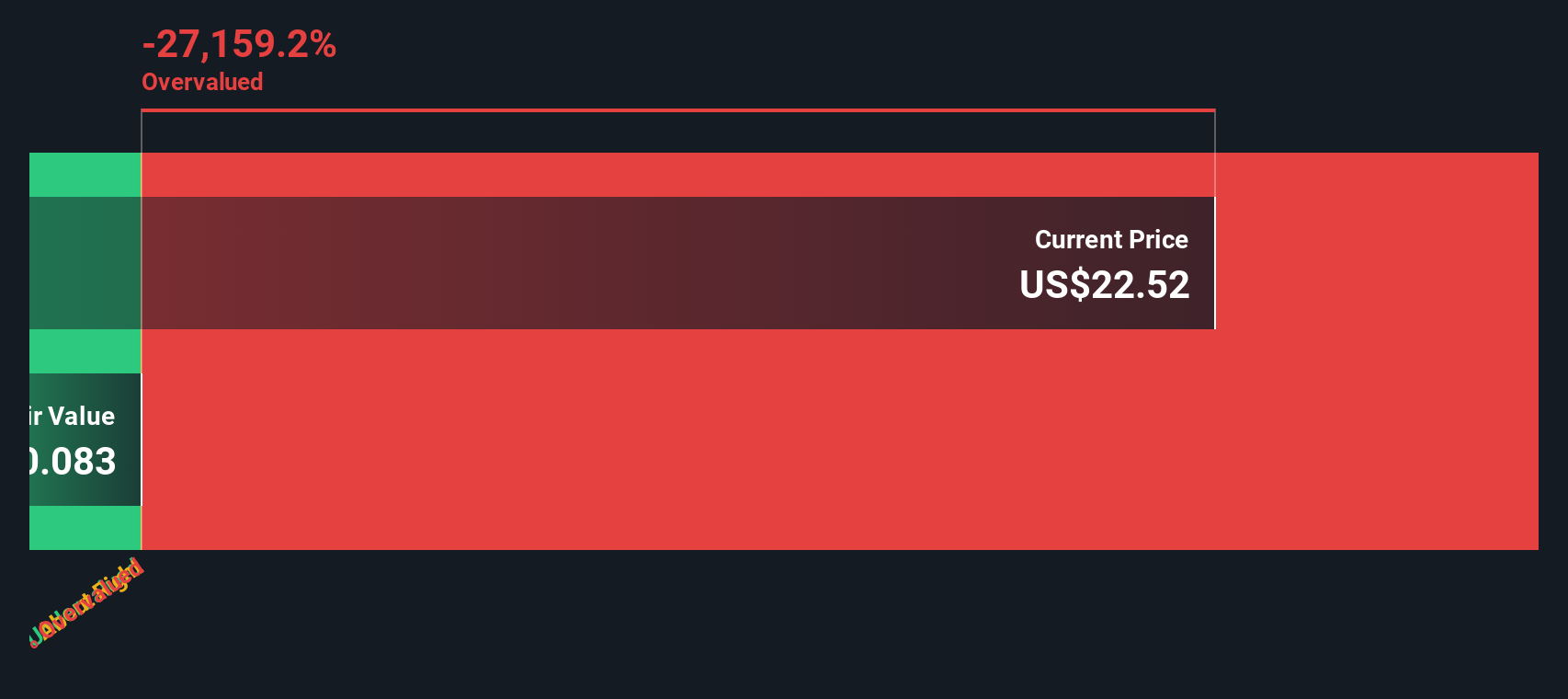

For a second opinion, our DCF model suggests that Cohu may actually be trading above its estimated fair value. This value is significantly lower than today’s price. This model challenges the upside seen in analyst targets and raises the question of whether optimism has run ahead of fundamentals.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Cohu for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Cohu Narrative

Not satisfied with the prevailing viewpoints, or want to dig into the figures personally? You can build and share your own take in just a few minutes: Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Cohu.

Looking for More Investment Ideas?

Smart investors always stay a step ahead by scouting fresh opportunities across different themes and sectors. Widen your perspective and spot what others might miss; these ideas could make the difference in your portfolio’s long-term growth.

- Catch attractive yields by reviewing these 20 dividend stocks with yields > 3% offering reliable income streams and outperforming inflation with strong payouts.

- Ride the tech revolution by tapping into the momentum with these 24 AI penny stocks shaping tomorrow’s industries using artificial intelligence and disruptive innovation.

- Capitalize on rapid market shifts by targeting these 868 undervalued stocks based on cash flows positioned for rebounds after pricing dislocations based on current cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:COHU

Cohu

Through its subsidiaries, provides semiconductor test equipment and services in the United States, China, Malaysia, the Philippines, Singapore, and internationally.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives