- United States

- /

- Life Sciences

- /

- NasdaqGS:AZTA

Brooks Automation, Inc. (NASDAQ:BRKS) Pays A US$0.10 Dividend In Just 2 Days

Readers hoping to buy Brooks Automation, Inc. (NASDAQ:BRKS) for its dividend will need to make their move shortly, as the stock is about to trade ex-dividend. You will need to purchase shares before the 5th of March to receive the dividend, which will be paid on the 27th of March.

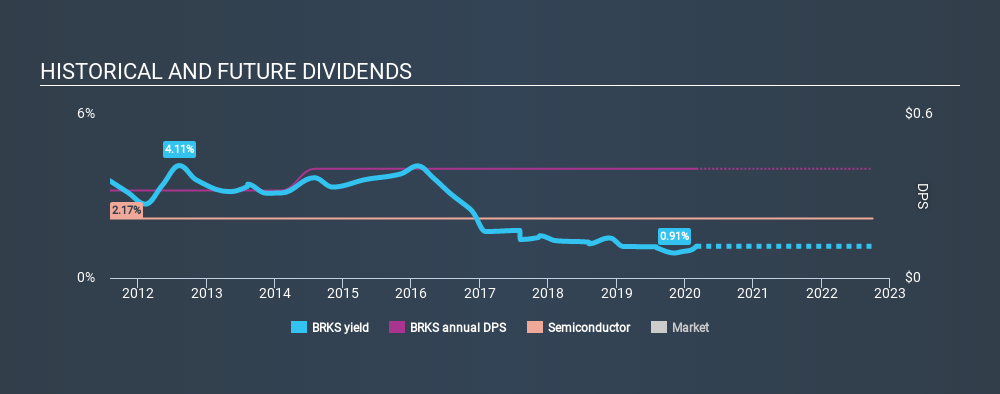

Brooks Automation's next dividend payment will be US$0.10 per share, on the back of last year when the company paid a total of US$0.40 to shareholders. Based on the last year's worth of payments, Brooks Automation stock has a trailing yield of around 1.2% on the current share price of $34.52. We love seeing companies pay a dividend, but it's also important to be sure that laying the golden eggs isn't going to kill our golden goose! So we need to investigate whether Brooks Automation can afford its dividend, and if the dividend could grow.

Check out our latest analysis for Brooks Automation

Dividends are typically paid from company earnings. If a company pays more in dividends than it earned in profit, then the dividend could be unsustainable. Brooks Automation distributed an unsustainably high 176% of its profit as dividends to shareholders last year. Without more sustainable payment behaviour, the dividend looks precarious. Yet cash flows are even more important than profits for assessing a dividend, so we need to see if the company generated enough cash to pay its distribution. It distributed 36% of its free cash flow as dividends, a comfortable payout level for most companies.

It's good to see that while Brooks Automation's dividends were not covered by profits, at least they are affordable from a cash perspective. If executives were to continue paying more in dividends than the company reported in profits, we'd view this as a warning sign. Very few companies are able to sustainably pay dividends larger than their reported earnings.

Click here to see the company's payout ratio, plus analyst estimates of its future dividends.

Have Earnings And Dividends Been Growing?

Stocks in companies that generate sustainable earnings growth often make the best dividend prospects, as it is easier to lift the dividend when earnings are rising. If earnings fall far enough, the company could be forced to cut its dividend. It's encouraging to see Brooks Automation has grown its earnings rapidly, up 62% a year for the past five years.

The main way most investors will assess a company's dividend prospects is by checking the historical rate of dividend growth. Since the start of our data, nine years ago, Brooks Automation has lifted its dividend by approximately 2.5% a year on average. It's good to see both earnings and the dividend have improved - although the former has been rising much quicker than the latter, possibly due to the company reinvesting more of its profits in growth.

The Bottom Line

Has Brooks Automation got what it takes to maintain its dividend payments? It's good to see earnings per share growing and low cashflow payout ratio, although we're uncomfortable with Brooks Automation's paying out such a high percentage of its profit. While it does have some good things going for it, we're a bit ambivalent and it would take more to convince us of Brooks Automation's dividend merits.

Wondering what the future holds for Brooks Automation? See what the five analysts we track are forecasting, with this visualisation of its historical and future estimated earnings and cash flow

A common investment mistake is buying the first interesting stock you see. Here you can find a list of promising dividend stocks with a greater than 2% yield and an upcoming dividend.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About NasdaqGS:AZTA

Azenta

Provides biological and chemical compound sample exploration and management solutions for the life sciences industry in the United States, China, the United Kingdom, rest of Europe, the Asia Pacific, and internationally.

Flawless balance sheet and slightly overvalued.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)