- United States

- /

- Semiconductors

- /

- NasdaqGS:AVGO

What Broadcom (AVGO)'s vSphere 7.x Support End Means for Shareholders

Reviewed by Sasha Jovanovic

- In September 2025, Broadcom announced it would end technical support, security patches, and updates for vSphere 7.x starting October 2, 2025, requiring customers to upgrade to newer versions to remain supported.

- This change could leave organizations running legacy systems at greater risk, spotlighting the increasing importance of staying current with software in enterprise IT infrastructure.

- We'll examine how Broadcom's move to end vSphere 7.x support impacts its investment narrative and ongoing shift toward recurring software revenue.

We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Broadcom Investment Narrative Recap

To own Broadcom, you need to believe in sustained demand for custom AI chips from hyperscale clients and that software-driven revenue, especially from VMware, will become a major, high-margin pillar for the business. The decision to end support for vSphere 7.x, while driving customers toward upgraded software, does not materially shift the main catalysts, AI-fueled semiconductor growth and VMware integration, or the current top risk around high customer concentration in AI contracts.

Of recent announcements, Broadcom’s accelerated partnership with OpenAI to deliver custom AI chips stands out. This reinforces the main investment catalyst: strong multi-year growth and a swelling backlog in AI semiconductors, even as execution on the software front remains a watch point in the wake of changes like the vSphere 7.x support sunset.

Yet, for those relying on this growth, it is important to consider that customer dependency remains a concern if...

Read the full narrative on Broadcom (it's free!)

Broadcom's narrative projects $119.6 billion in revenue and $50.8 billion in earnings by 2028. This requires 25.9% yearly revenue growth and a $32.0 billion earnings increase from $18.8 billion today.

Uncover how Broadcom's forecasts yield a $370.36 fair value, a 9% upside to its current price.

Exploring Other Perspectives

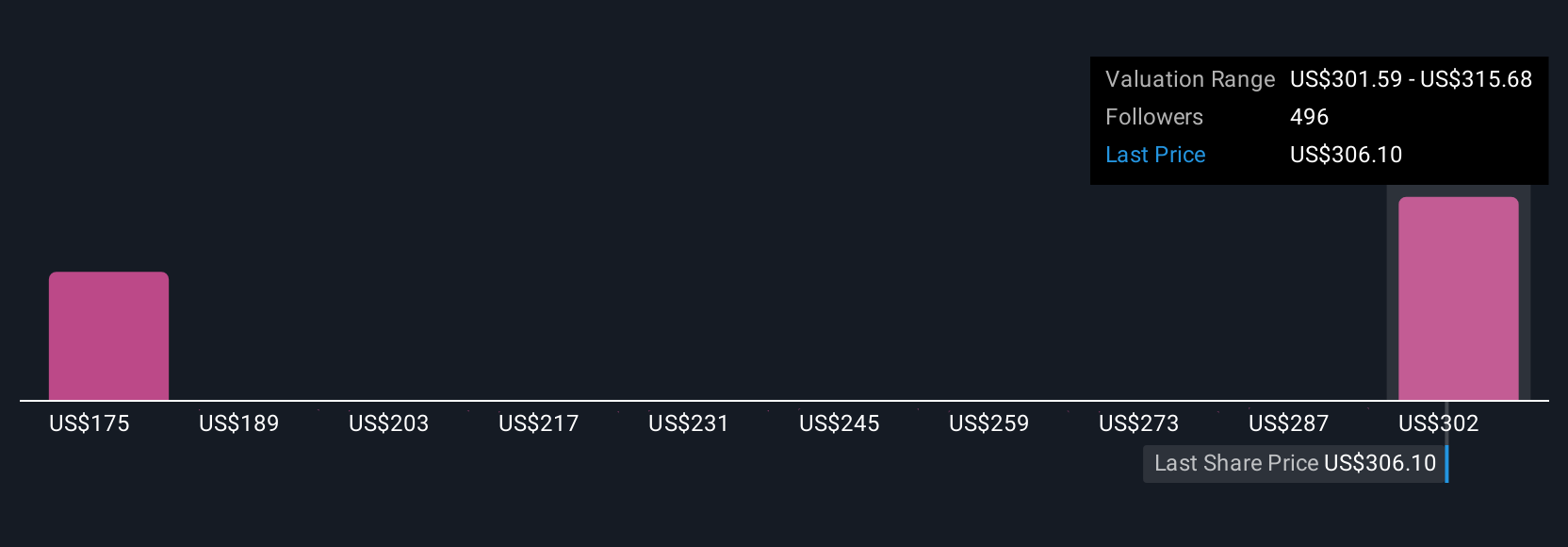

Simply Wall St Community members have shared 43 fair value estimates for Broadcom, from as low as US$214.18 to US$370.36. With so many views, consider that the company’s rapid AI growth depends on just a few key customers, which could shape future performance in unexpected ways.

Explore 43 other fair value estimates on Broadcom - why the stock might be worth 37% less than the current price!

Build Your Own Broadcom Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Broadcom research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Broadcom research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Broadcom's overall financial health at a glance.

Interested In Other Possibilities?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Find companies with promising cash flow potential yet trading below their fair value.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Broadcom might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AVGO

Broadcom

Designs, develops, and supplies various semiconductor devices and infrastructure software solutions internationally.

Exceptional growth potential with outstanding track record and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion