- United States

- /

- Semiconductors

- /

- NasdaqGS:AVGO

How Broadcom’s (AVGO) $10 Billion OpenAI Chip Deal Could Reshape Its AI Leadership

Reviewed by Sasha Jovanovic

- Earlier this month, OpenAI and Broadcom announced a landmark partnership to co-develop and supply approximately US$10 billion worth of custom AI chips for data centers, accompanied by Broadcom's rollout of advanced hardware such as the Thor Ultra 800G AI Ethernet NIC and Wi-Fi 8 silicon solutions.

- This collaboration positions Broadcom as a significant competitor in the customized AI infrastructure market, reflecting increasing reliance on its custom chip and networking expertise by leading generative AI companies seeking alternatives to established GPU providers.

- We'll look at how Broadcom's multi-billion-dollar OpenAI partnership and AI chip launches reshape the company's long-term investment outlook.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Broadcom Investment Narrative Recap

To believe in Broadcom's long-term story, I think you need confidence in the strong, ongoing demand for custom AI chips and networking from hyperscalers, and resilient multi-year contracts powering its AI-driven growth. The $10 billion OpenAI partnership may reinforce Broadcom's leading role in this space, but it also intensifies exposure to customer concentration risk, the biggest near-term challenge if any hyperscaler slows orders or pivots to other suppliers.

One recent announcement particularly relevant is Broadcom’s debut of the Thor Ultra 800G AI Ethernet NIC, which directly targets the booming demand for high-performance, open-ecosystem networking in massive AI clusters. This launch amplifies Broadcom’s position as a key enabler of next-generation AI infrastructure, supporting its status as an essential supplier to world-class customers like OpenAI and others, a clear near-term growth catalyst.

But in contrast, shareholders should be aware that heavy reliance on just a handful of hyperscale clients leaves Broadcom especially exposed if spending patterns abruptly change...

Read the full narrative on Broadcom (it's free!)

Broadcom's narrative projects $119.6 billion in revenue and $50.8 billion in earnings by 2028. This requires a 25.9% yearly revenue growth and a $32.0 billion increase in earnings from the current $18.8 billion.

Uncover how Broadcom's forecasts yield a $386.68 fair value, a 7% upside to its current price.

Exploring Other Perspectives

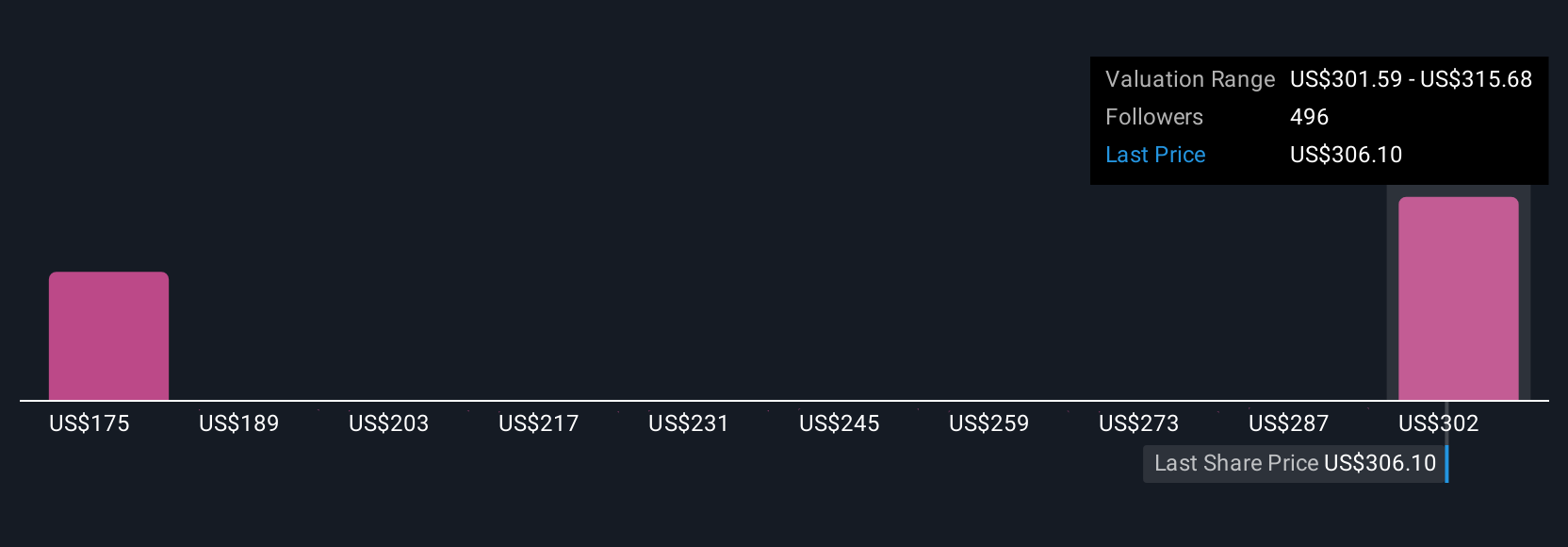

Forty separate fair value estimates from the Simply Wall St Community span from US$241.80 to US$392.38, showing wide-ranging opinions. While this diversity stands out, note that concentrated customer risk continues to shape broader expectations for Broadcom’s future results, explore several perspectives to see how your view compares.

Explore 40 other fair value estimates on Broadcom - why the stock might be worth 33% less than the current price!

Build Your Own Broadcom Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Broadcom research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Broadcom research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Broadcom's overall financial health at a glance.

No Opportunity In Broadcom?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- The end of cancer? These 27 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 27 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Broadcom might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AVGO

Broadcom

Designs, develops, and supplies various semiconductor devices and infrastructure software solutions worldwide.

Exceptional growth potential with outstanding track record.

Similar Companies

Market Insights

Community Narratives