- United States

- /

- Semiconductors

- /

- NasdaqGS:AVGO

Broadcom (NasdaqGS:AVGO) Unveils VeloSky Converged Networking Solution For Enhanced Connectivity

Reviewed by Simply Wall St

Broadcom (NasdaqGS:AVGO) has made significant strides recently, with the introduction of VeloSky, a converged networking solution that likely contributed to its stock's 11% rise over the past quarter, despite broader market challenges such as the S&P 500's recent decline. This launch positioned the company as a leader in integrating fiber, 5G, and satellite connectivity. Another enhancement of its product line includes the PCIe Gen 6 Portfolio announcement, further reinforcing its market position. While global markets faced volatility due to tariffs influencing the S&P 500 and related sectors, Broadcom's innovations, such as the Emulex Secure Fibre Channel HBAs and Brocade G710 Switch, likely cushioned its performance against these external pressures. The downturn in major indexes due to tariffs might have overshadowed gains, yet Broadcom’s performance stands out against tech-heavy Nasdaq trends from the same period, thanks to its advancements in networking solutions.

Take a closer look at Broadcom's potential here.

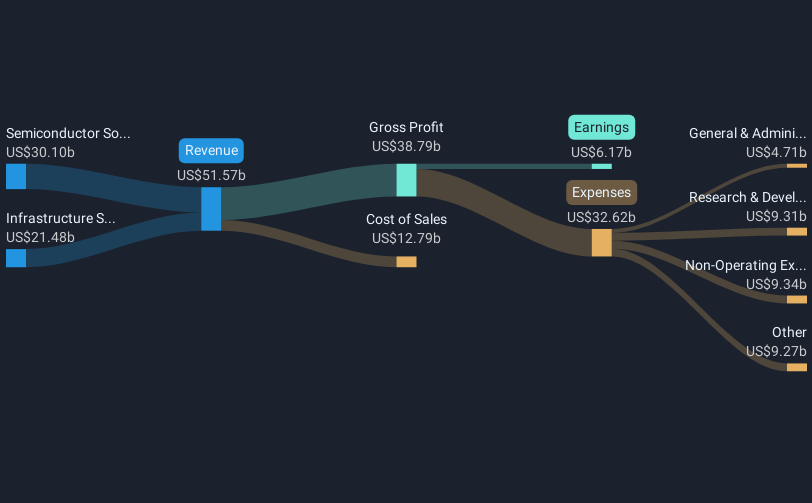

Over the past five years, Broadcom shares delivered a total return of 771.32%, reflecting a very large appreciation in value when including dividends. Key factors in this performance include significant earnings growth, with profits increasing at an average rate of 26% annually. The company maintained a strong market standing by exceeding both the US Semiconductor industry and the broader US market over the past year. Broadcom's strategic alliances, such as the partnership with Vultr to enhance AI infrastructure capabilities and collaborations in the AI space, have played a critical role in supporting this growth trajectory.

In addition to its growth initiatives, Broadcom's focus on shareholder returns through substantial dividends has also contributed to its stock performance. The recent dividends increased consistently throughout 2024, highlighting the company's commitment to returning capital to shareholders. Despite facing some challenges like being dropped from certain defensive indexes and highly volatile share prices, Broadcom's robust product innovation and market positioning have ensured continued investor confidence.

- Discover whether Broadcom is fairly priced, undervalued, or overvalued in our comprehensive valuation breakdown.

- Analyze the downside risks for Broadcom and understand their potential impact—click to learn more.

- Already own Broadcom? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Broadcom might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AVGO

Broadcom

Designs, develops, and supplies various semiconductor devices and infrastructure software solutions worldwide.

Exceptional growth potential with outstanding track record and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion