- United States

- /

- Semiconductors

- /

- NasdaqGS:AVGO

Broadcom (NasdaqGS:AVGO) Sees Strong AI Revenue Growth and Challenges in Broadband Sector

Broadcom (NasdaqGS:AVGO) is navigating a period of significant growth and strategic challenges. Recent highlights include a 47% year-on-year increase in Q3 revenue and the successful integration of VMware, contrasted against a notable decline in broadband revenue and increased operating expenses. In the discussion that follows, we will delve into Broadcom's core advantages, financial weaknesses, strategic opportunities, and external threats to provide a comprehensive overview of the company's current business situation.

Delve into the full analysis report here for a deeper understanding of Broadcom

Strengths: Core Advantages Driving Sustained Success For Broadcom

Broadcom has demonstrated robust revenue growth, with consolidated net revenue reaching $13.1 billion in fiscal Q3 2024, marking a 47% year-on-year increase, as highlighted by CEO Hock Tan in the latest earnings call. The company's profitability is also notable, with operating profit up by 44% year-on-year. Broadcom's AI revenue continues to grow strongly, which is a significant driver for future growth. The successful integration of VMware has been a strategic advantage, enhancing the company's software capabilities and contributing to its high gross margins of 77.4% for the quarter, as noted by CFO Kirsten Spears. Additionally, the company generated strong free cash flow of $4.8 billion, representing 37% of revenues.

Weaknesses: Critical Issues Affecting Broadcom's Performance and Areas For Growth

Despite these strengths, AVGO is considered expensive based on its Price-To-Earnings Ratio (138.3x) compared to both the US Semiconductor industry average (26.6x) and the peer average (76x). Additionally, Broadcom faces several financial challenges, notably a significant decline in broadband revenue, which fell by 49% year-on-year to $557 million. To dive deeper into how AVGO's valuation metrics are shaping its market position, check out our detailed Valuation Report for AVGO.

Additionally, industrial resales dropped by 31% year-on-year, reflecting a broader issue in these segments. The company's high operating expenses, which increased due to the consolidation of VMware, also pose a challenge. Furthermore, Broadcom's current net profit margins have decreased to 11.7% from 39.1% last year, and its Return on Equity is considered low at 8.4%. These financial metrics highlight areas where the company lags behind industry standards.

Opportunities: Potential Strategies for Leveraging Growth and Competitive Advantage

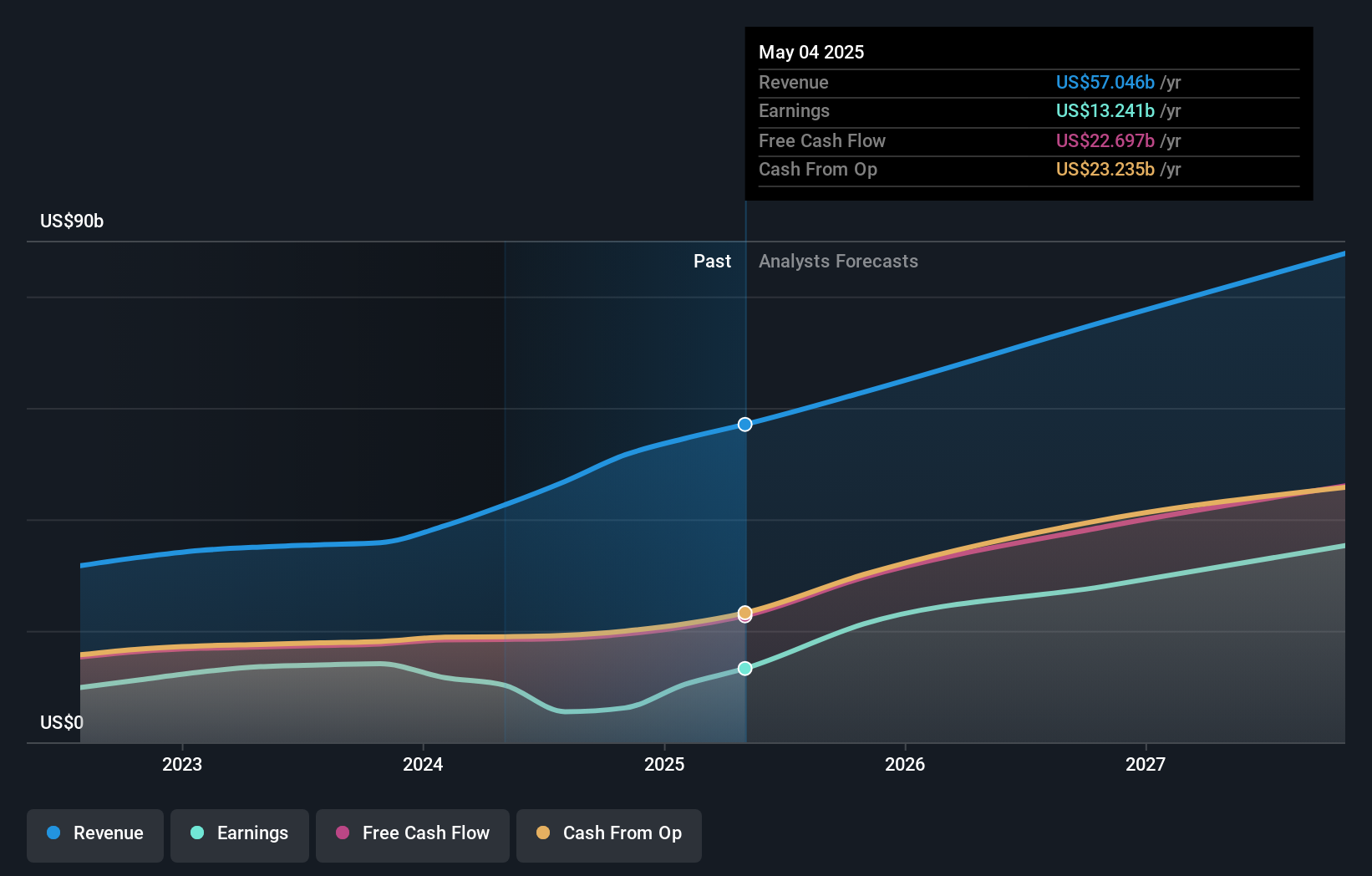

Broadcom has several strategic opportunities to enhance its market position. The rising demand for AI presents a significant growth avenue, with AI revenue expected to grow sequentially by 10% to over $3.5 billion in Q4, according to Hock Tan. The company also anticipates a market recovery, particularly in non-AI networking, which was up 17% sequentially in Q3. Expansion in the software segment, driven by the successful integration of VMware, is another promising opportunity. This trend is expected to continue into 2025, providing a stable revenue stream. Additionally, Broadcom's forecasted earnings growth of 43% per year is significantly higher than the US market average of 15.2% per year, indicating strong future potential. Learn more about how these opportunities could impact Broadcom's future growth by reviewing our analysis of Broadcom's Future Performance.

Threats: Key Risks and Challenges That Could Impact Broadcom's Success

Broadcom faces several external threats that could impact its growth. Market challenges in broadband persist, with a continued pause in telco and service provider spending. Competition in the AI sector is also intensifying, particularly as Broadcom focuses more on the AI or XPU side rather than the enterprise AI market. Economic factors, such as higher cash interest expenses from debt related to the VMware acquisition, have reduced free cash flow as a percentage of revenue. Additionally, regulatory issues, including higher taxes and restructuring costs due to the VMware acquisition, are expected to impact GAAP net income and cash flows in Q4. These factors collectively pose significant risks to Broadcom's long-term success.

Conclusion

Broadcom's strong revenue growth and profitability, driven by its expanding AI segment and successful integration of VMware, highlight its potential for sustained success. However, significant challenges such as declining broadband revenue, increased operating expenses, and reduced profit margins indicate areas needing improvement. The company's strategic opportunities in AI and software expansion are promising, but external threats like market competition and economic factors pose risks. Despite its high Price-To-Earnings Ratio of 138.3x compared to industry averages, Broadcom's forecasted earnings growth and strategic positioning suggest a cautiously optimistic outlook for future performance.

Have a stake in these AVGO? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports

Valuation is complex, but we're here to simplify it.

Discover if Broadcom might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Simply Wall St and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

About NasdaqGS:AVGO

Broadcom

Designs, develops, and supplies various semiconductor devices and infrastructure software solutions worldwide.

Exceptional growth potential with outstanding track record.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026