- United States

- /

- Semiconductors

- /

- NasdaqGS:AVGO

Broadcom (AVGO): Assessing Valuation After a Recent Pullback in a Long-Term Growth Story

Broadcom (AVGO) has quietly become one of the market’s steadier compounders, and the recent pullback after a strong year to date has investors asking whether this is a healthy reset or an early warning sign.

See our latest analysis for Broadcom.

The recent pullback leaves Broadcom trading at $350.22, with a powerful year to date share price return but a softer 1 month move suggesting momentum is pausing rather than breaking. Multi year total shareholder returns still point to a strong long term compounding story.

If Broadcom’s run has you rethinking your tech exposure, this is a good moment to scan other high growth tech and AI names using our high growth tech and AI stocks.

With growth roaring across semis and AI infrastructure, the real question now is whether Broadcom’s current valuation still leaves upside on the table or whether the market has already priced in its next leg of expansion.

Most Popular Narrative: 13.2% Undervalued

With the latest close at $350.22 versus a narrative fair value near $403.66, the current setup depends on how aggressively AI and software earnings scale from here.

Strong multi year bookings, a record $110 billion backlog (driven primarily by AI), and disciplined capital allocation (R&D investments, high free cash flow, and dividends) provide a foundation for continued earnings growth and per share expansion.

Want to see what kind of growth curve would justify that backlog driven upside? The narrative focuses on rapid AI fueled revenue expansion and the potential for higher long term profit margins. Curious how those assumptions translate into a premium future earnings multiple while still suggesting the shares are not fully priced? Review the full narrative to examine the numbers behind this fair value estimate.

Result: Fair Value of $403.66 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this upside depends heavily on a concentrated AI customer base and flawless VMware integration, where any stumble could quickly challenge today’s growth assumptions.

Find out about the key risks to this Broadcom narrative.

Another Lens on Valuation

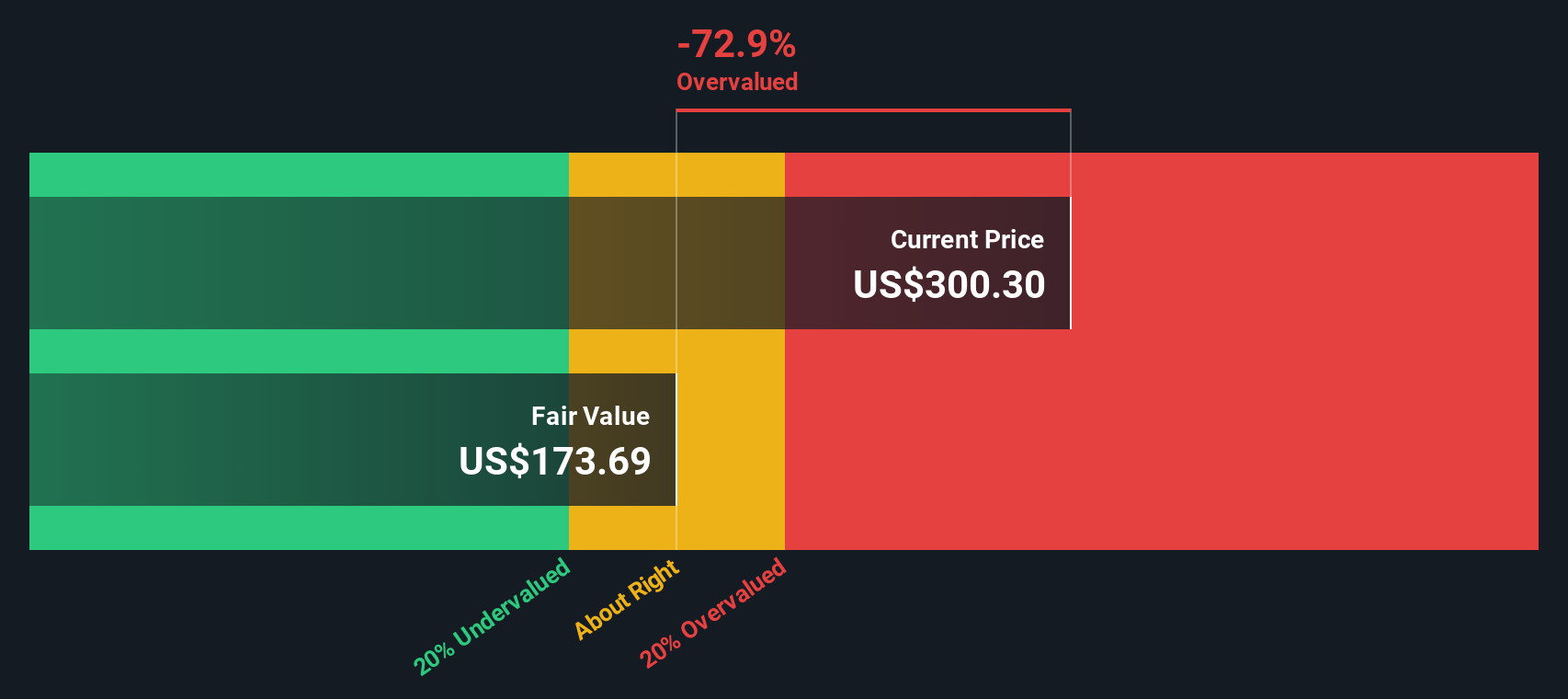

Analysts may see upside to $456.80, but our SWS DCF model paints a cooler picture, with fair value closer to $288.04, implying Broadcom is overvalued at $350.22. If cash flows are right and sentiment cools, how quickly could expectations reset?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Broadcom Narrative

If you see the story differently or want to stress test the assumptions with your own inputs, you can build a custom view in just minutes: Do it your way.

A great starting point for your Broadcom research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Ready for more investment ideas?

Broaden your opportunity set now by using the Simply Wall St Screener to uncover focused, data driven stock ideas before the market fully catches on.

- Capture mispriced quality by zeroing in on these 901 undervalued stocks based on cash flows that strong cash flow analysis suggests may be trading below their intrinsic worth.

- Ride the next structural growth wave by targeting these 24 AI penny stocks powering breakthroughs in automation, data processing, and intelligent software.

- Lock in potential income streams by scanning these 10 dividend stocks with yields > 3% that offer attractive yields supported by robust fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Broadcom might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AVGO

Broadcom

Designs, develops, and supplies various semiconductor devices and infrastructure software solutions internationally.

Exceptional growth potential with outstanding track record and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Looking to be second time lucky with a game-changing new product

PlaySide Studios: Market Is Sleeping on a Potential 10M+ Unit Breakout Year, FY26 Could Be the Rerate of the Decade

Inotiv NAMs Test Center

This isn’t speculation — this is confirmation.A Schedule 13G was filed, not a 13D, meaning this is passive institutional capital, not acti

Recently Updated Narratives

Xero: Growth Was Priced In — Execution Is Not

Rio Tinto (RIO): Cash Machine with a China Beta Problem — and a Copper Glow-Up

Inotiv NAMs Test Center

Popular Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks

The "Physical AI" Monopoly – A New Industrial Revolution

Trending Discussion