- United States

- /

- Semiconductors

- /

- NasdaqGS:ASML

Does ASML Still Have Room to Run After Three-Year 153% Rally in 2025?

Reviewed by Bailey Pemberton

If you've been keeping an eye on ASML Holding, you're probably asking yourself the same question a lot of investors are right now: is there still room for this stock to run, or are we looking at a moment to take some profits off the table? With the shares closing at $936.19 most recently and notching a stunning 153.0% jump over three years, just let that number sink in, it's understandable that confidence around ASML is running high. But the story isn’t just about soaring numbers. In the past month alone, the stock climbed a solid 15.0%, even after giving up 9.3% this past week, which reflects a market that is trying to find its footing as global semiconductor trends shift and investors recalibrate their long-term expectations.

Smart investors know that not every surge is sustainable and that sometimes, a stellar price history can mask underlying valuation risks. That's where a closer look comes in handy. ASML's value score currently sits at 2, meaning it checks the box for being undervalued in just 2 out of 6 key valuation methods. That might sound cautious, but it's exactly the kind of nuance we'll unpack here. We will look past simple momentum and dig into the numbers. Get ready to explore some of the classic valuation approaches, and stick around, because I'll share a perspective at the end that could make evaluating ASML's real worth even clearer.

ASML Holding scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: ASML Holding Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company's true value by projecting its future cash flows and discounting them to present-day terms. This approach helps investors look beyond current earnings and market hype, focusing instead on the business’s potential to generate free cash over time.

For ASML Holding, the latest Free Cash Flow (FCF) reported stands at approximately €8.89 Billion. Analyst forecasts see this figure growing steadily, with projections reaching about €15.09 Billion by 2029. While estimates are more concrete for the first five years, subsequent forecasts are extrapolated to provide a longer-term outlook for the business’s ability to produce cash.

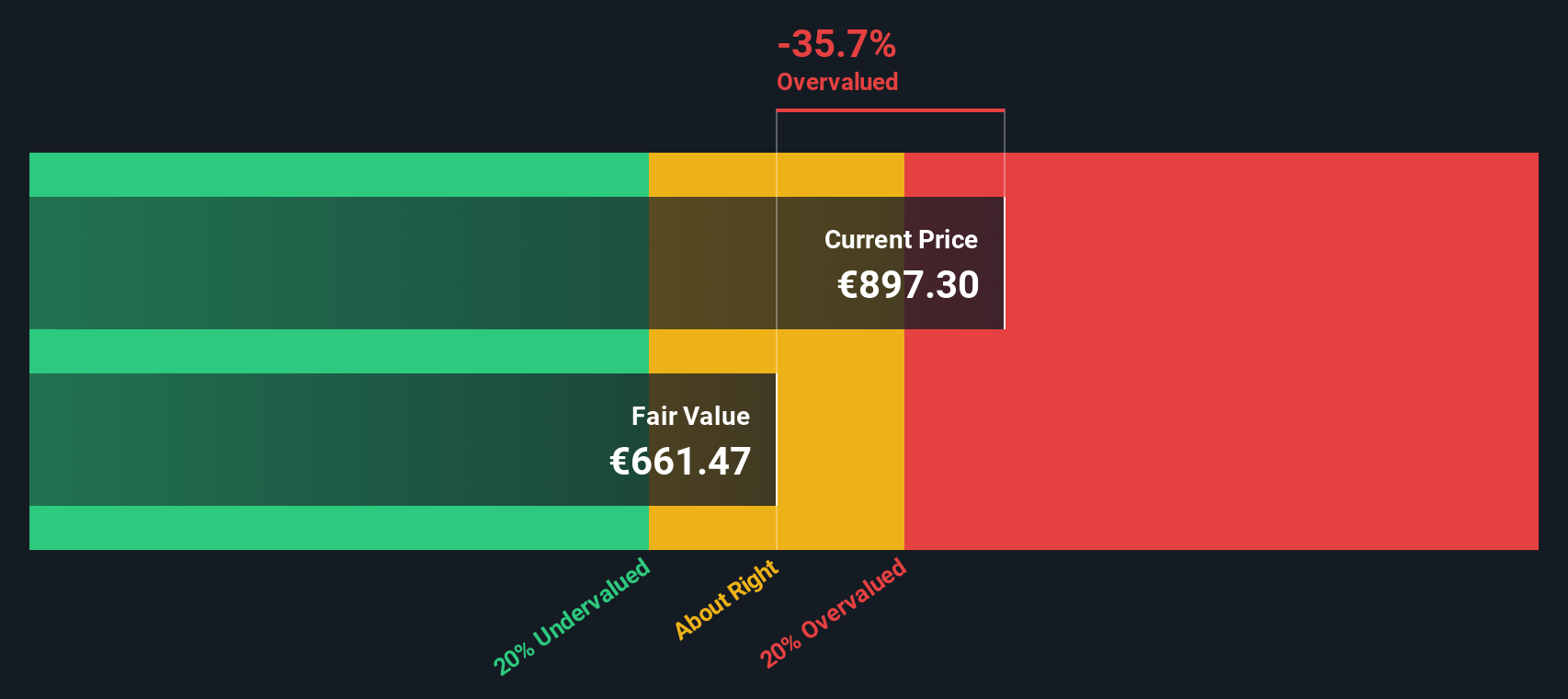

Based on these cash flow projections, the DCF model delivers an intrinsic value of €698.72 per share. When compared to the recent share price of $936.19, the analysis suggests the stock is trading at a 34.0% premium to its calculated fair value. On this measure, it appears significantly overvalued.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests ASML Holding may be overvalued by 34.0%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: ASML Holding Price vs Earnings

For established, profitable companies like ASML Holding, the price-to-earnings (PE) ratio is a straightforward and popular valuation tool. It helps investors assess how much they are paying for each dollar of earnings, making it easier to see if a stock's current price aligns with its growth prospects and risk profile.

Growth expectations and risk play a big role in determining what counts as a “normal” or fair PE ratio. Rapidly growing companies typically deserve higher multiples, as investors are willing to pay up for future profit expansion. In contrast, more mature or riskier companies usually warrant lower PE multiples.

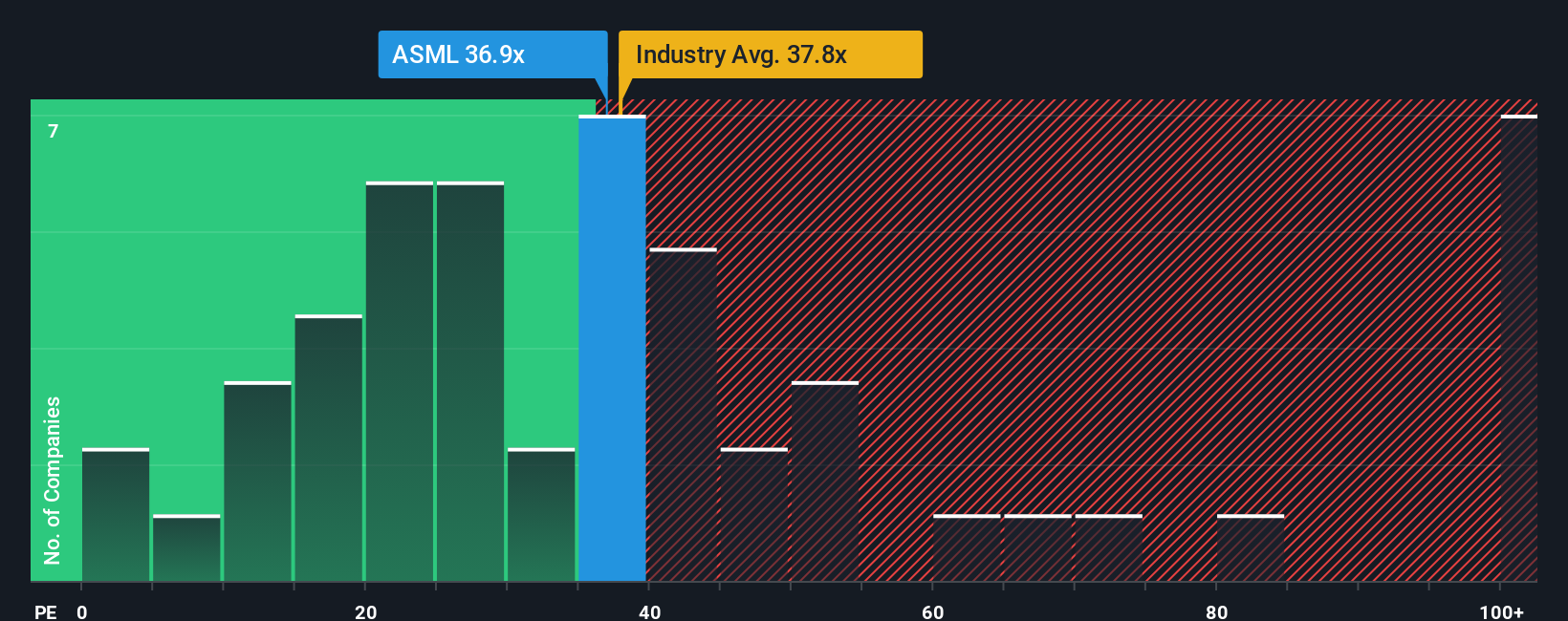

ASML's current PE sits at 33.5x, just a touch above its peer average of 33.0x and slightly below the broader semiconductor industry average of 35.3x. Simply Wall St’s proprietary “Fair Ratio” for ASML is 34.7x, calculated by factoring in the company’s unique blend of earnings growth, profitability, industry standing, and overall risk. Unlike standard comparisons to peers or industry averages, the Fair Ratio provides a more individualized and accurate benchmark, since it directly considers ASML’s specific prospects and finances.

Looking at the Fair Ratio alongside ASML’s actual PE, the difference is very small. This suggests that, on a price-to-earnings basis, the stock is trading right in line with what would be reasonable given its fundamentals.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your ASML Holding Narrative

Earlier we mentioned that there is an even better way to understand valuation. Let’s introduce you to Narratives. A Narrative is simply your take on a company, combining the story you believe about its future with your assumptions for fair value, future revenues, earnings, and margins. It serves as a bridge between your expectations and the numbers behind them.

Unlike static models, Narratives connect a company's story directly to a financial forecast and a resulting fair value. This provides a powerful way to evaluate or explain your investment decisions. Narratives are easy to use and available to everyone in the Simply Wall St Community, where millions of investors update and share them every day.

With Narratives, you can quickly see if your view of fair value is above or below the market price, helping you decide if now is the time to buy, hold, or sell. They automatically update every time new data such as company news, earnings, or macroeconomic shifts are released, so your investment thesis can always reflect the latest information.

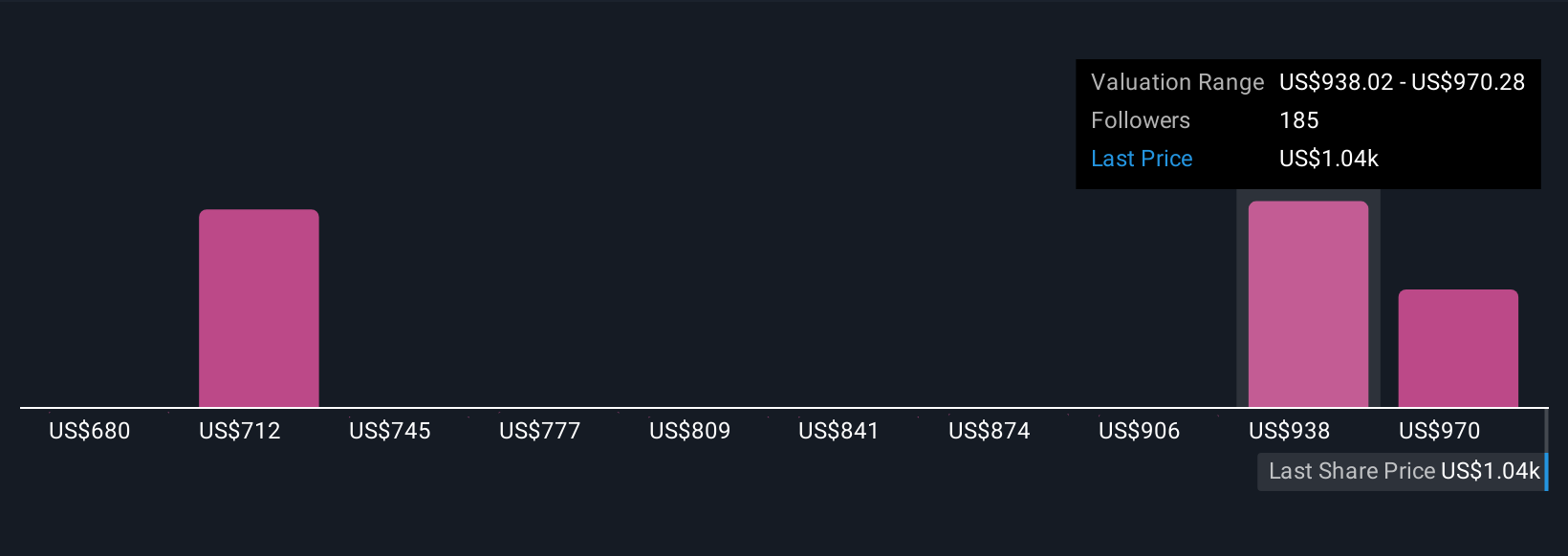

For ASML, for example, one investor’s Narrative could put fair value at $1,002 per share based on continued market leadership, while another might set it as low as $699 per share, expecting growth to slow.

Do you think there's more to the story for ASML Holding? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ASML

ASML Holding

Provides lithography solutions for the development, production, marketing, sales, upgrading, and servicing of advanced semiconductor equipment systems.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026