- United States

- /

- Semiconductors

- /

- NasdaqGS:ASML

Assessing ASML Stock After a 42% Surge and Growing Demand for Chip Equipment

Reviewed by Bailey Pemberton

Thinking about what to do with ASML Holding stock? You are definitely not alone. This market heavyweight often prompts debate among investors trying to figure out if this is the right time to buy, hold, or look elsewhere. With numbers like an 8.5% gain in just the last week and a stunning 41.9% surge over the past month, it is easy to see why ASML is drawing so much attention. Even year-to-date, the stock is up 47.1%, and over the past five years, it has delivered a remarkable 181.5% climb. These kinds of returns naturally raise questions: Has the easy money already been made, or is there more room to run?

Part of ASML’s recent momentum comes as investors reassess global semiconductor demand and the company’s unique role in supplying the machines that chipmakers rely on. Improvements in market sentiment about the chip sector have helped lift the stock, with optimism building around future tech adoption and supply chain stabilization. Yet despite the notable rallies, is the stock still undervalued? According to one commonly cited valuation scoring method, ASML earns a score of just 2 out of 6, indicating the company is undervalued on only 2 of 6 major checks.

However, numbers like these rarely tell the full story. Next, let’s look at the individual valuation methods, see how ASML compares by each approach, and explore why a different perspective on valuation might provide the clearest answer yet.

ASML Holding scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: ASML Holding Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s intrinsic value by projecting its future cash flows and then discounting them back to today's value. For ASML Holding, this approach takes into account both near-term analyst forecasts and longer-term projections to provide a comprehensive picture of the company's financial outlook.

Currently, ASML generates free cash flow of approximately €8.89 billion. Analyst expectations see this figure growing steadily over the next five years, rising to €15.2 billion by 2029. Projections beyond the analyst window, extending out to 2035, suggest ASML's FCF could continue climbing, although at a slowing pace, with these estimates relying more heavily on extrapolation.

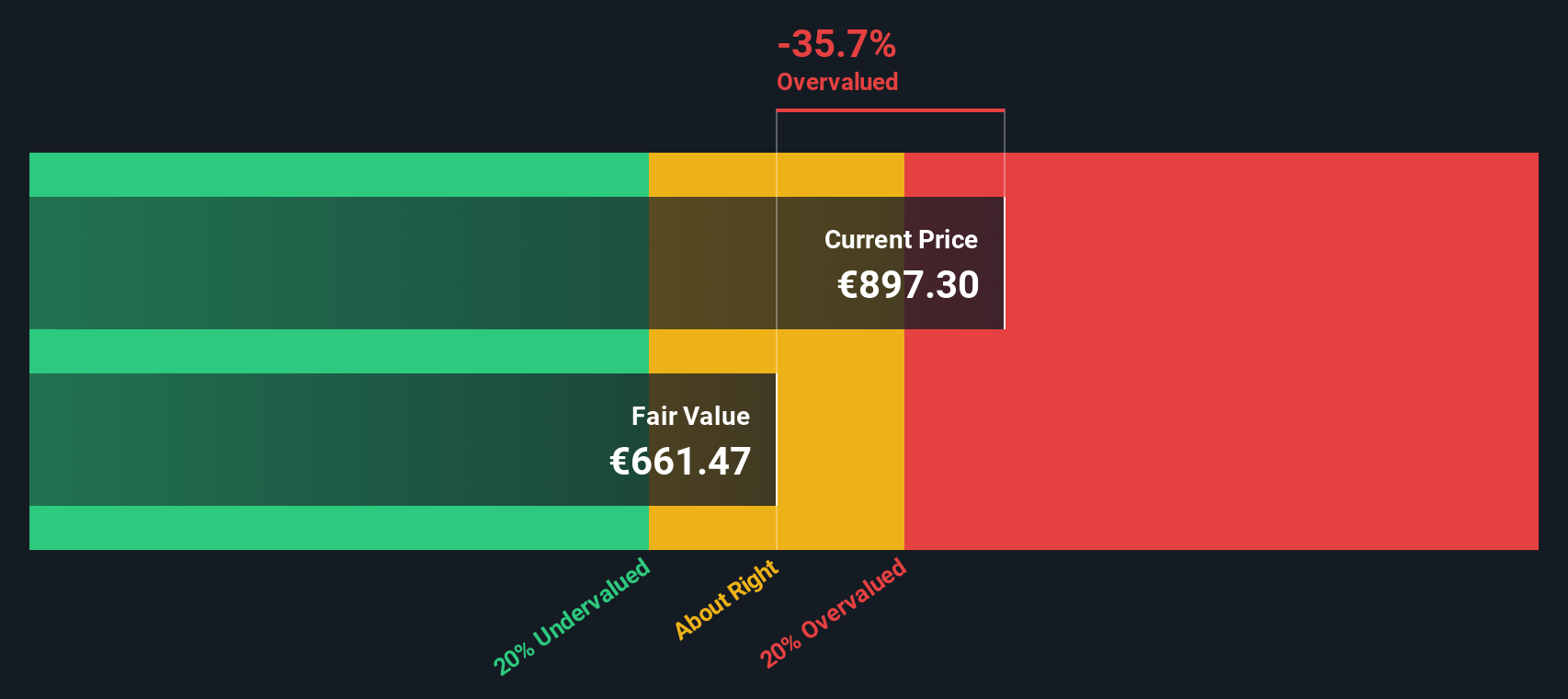

Based on these cash flow projections, the DCF model values ASML at €728.31 per share. Compared to the current share price, the calculation implies the stock is trading at a significant 41.4% premium to its intrinsic value. This indicates the market price is well above what the fundamentals might justify at present.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests ASML Holding may be overvalued by 41.4%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: ASML Holding Price vs Earnings (PE Ratio)

The Price-to-Earnings (PE) ratio is a widely used valuation tool for profitable companies like ASML Holding, as it reflects how much investors are willing to pay for each euro of the company’s earnings. The PE ratio is often favored when a business generates consistent profits because it quickly connects share price to actual bottom-line performance.

Growth expectations and perceived risks are key drivers that influence what counts as a “normal” or “fair” PE ratio. Companies with stronger outlooks or more reliable business models typically command higher PE multiples. Those facing more risk or lower growth tend to be valued more conservatively.

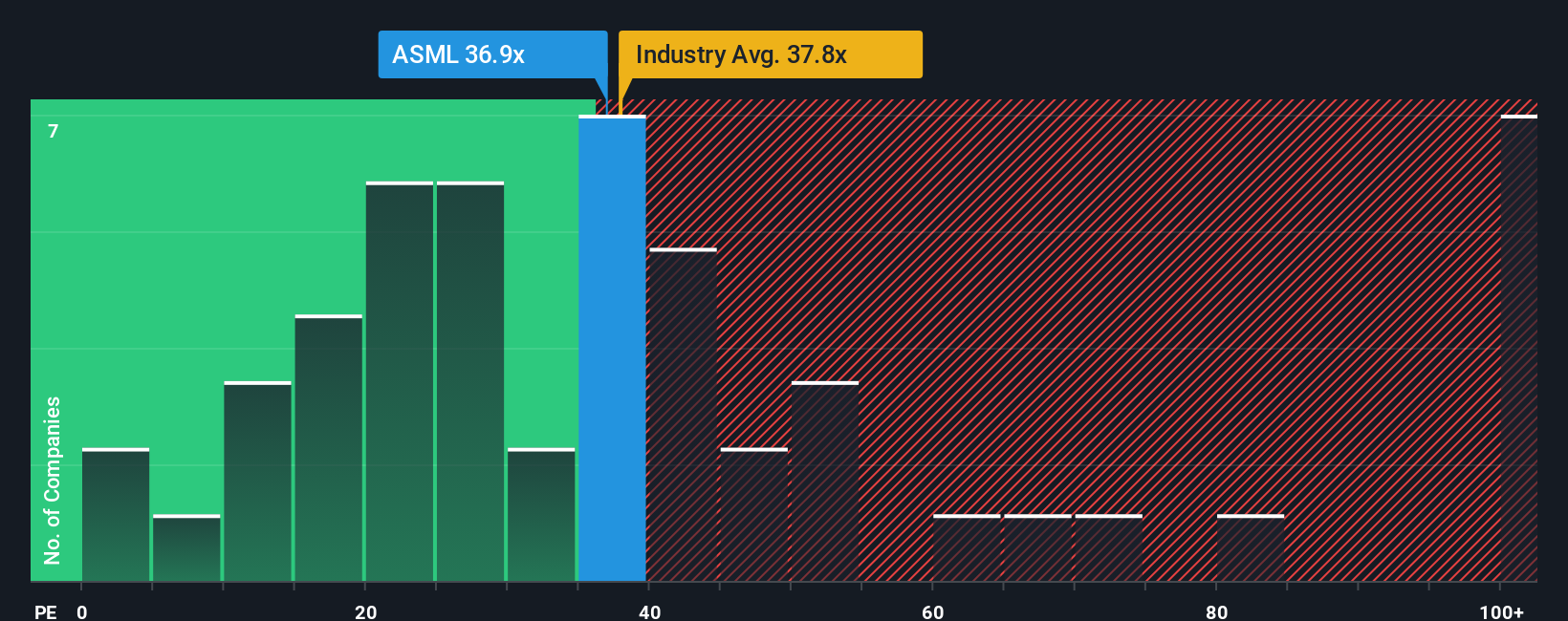

ASML currently trades at a PE ratio of 36.1x, which is just below the peer group average of 36.7x and the broader semiconductor industry average of 37.7x. This suggests the stock’s valuation is broadly in line with its market and industry peers.

The “Fair Ratio” provides a more nuanced perspective. Developed by Simply Wall St, it incorporates factors like earnings growth, industry trends, profit margins, company size, and risk to generate a tailored benchmark for ASML. This proprietary measure aims to provide a more accurate valuation anchor than a simple industry or peer comparison and can highlight company-specific strengths or vulnerabilities.

For ASML, the fair PE ratio stands at 35.0x. Compared to the current market PE, the difference of just 1.1x signals that ASML shares are trading very close to their fair value based on fundamentals and outlook.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your ASML Holding Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is your unique perspective on a company, combining your story and expectations, such as assumed fair value and future estimates for revenue or profit margins, with the hard numbers. Narratives connect what is happening at ASML Holding to a personalized financial forecast, giving you not just a fair value estimate but also the reasoning behind it.

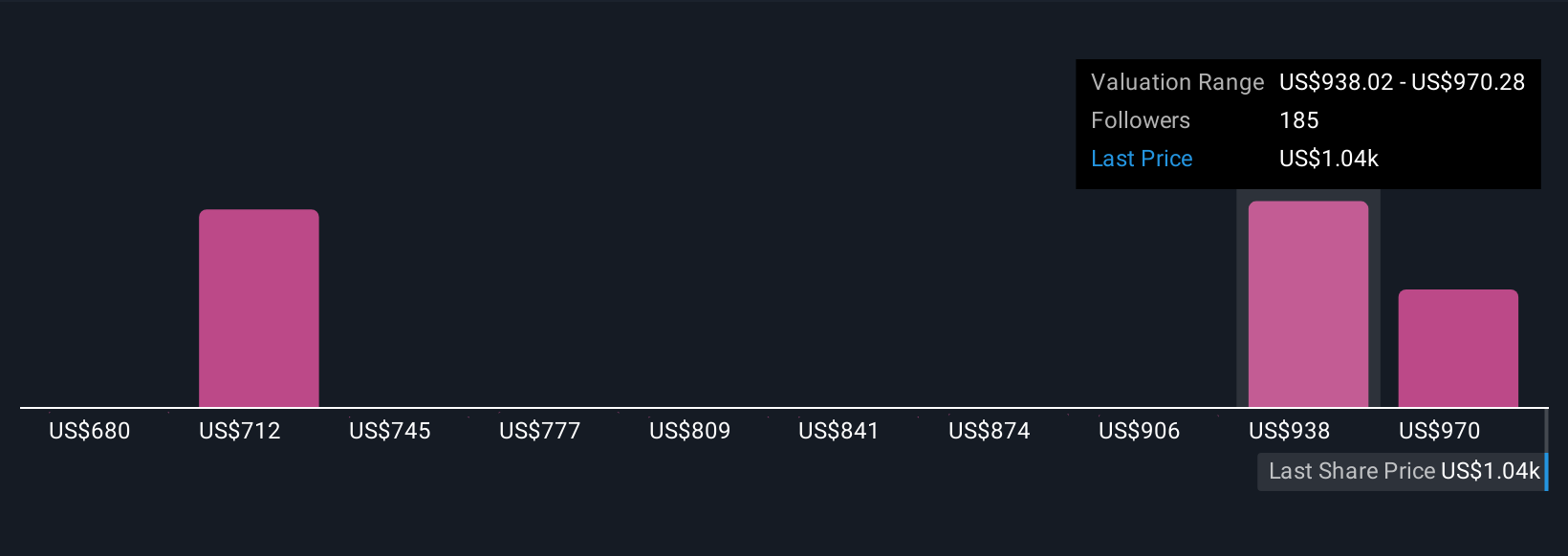

This approach is not only simple and intuitive, it is also available right now within the Community page on Simply Wall St, where millions of investors share and compare their views. Narratives help guide your decisions on whether to buy or sell by linking your fair value calculation directly to the current market price. Whenever news breaks or quarterly earnings are released, Narratives update in real time so your perspective always reflects the latest information. For example, one investor might see ASML's fair value as high as €1,002 based on rapid tech adoption, while another tracking different risks sets it closer to €728. By using Narratives, you can anchor your investments in your own story and update that story as the facts change.

Do you think there's more to the story for ASML Holding? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ASML

ASML Holding

Provides lithography solutions for the development, production, marketing, sales, upgrading, and servicing of advanced semiconductor equipment systems.

Outstanding track record with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives