- United States

- /

- Semiconductors

- /

- NasdaqGS:ARM

Arm Stock Jumps 29% in 2025 Is Growth Already Priced In?

Reviewed by Bailey Pemberton

If you are staring at Arm Holdings’ recent performance and weighing your next move, you are definitely not alone. A quick glance at the chart can feel like trying to catch your breath. The stock has climbed an impressive 29.3% year-to-date and has delivered a solid 16.4% gain over the past year. The past month tells an even more dramatic story, with shares up 14.7% before cooling ever so slightly over the last week, slipping by 2.9%. That kind of momentum makes people wonder if there is more room to run, or if the excitement is already built in.

Much of the buzz lately has been tied to Arm’s growing role in AI-powered chips and its licensing strategy, both areas where anticipation has outpaced what we have seen from competitors. Investors are now looking closely at every move Arm makes to see if it can hold onto its edge. The news cycle hasn’t introduced any dramatic plot twists, but talk about strategic partnerships across the tech ecosystem continues to frame Arm as a relevant player in the global chip landscape. This definitely influences how the market values the stock.

But let’s cut to the chase. Using common valuation checks, Arm gets a score of 0 out of 6 for being undervalued, implying the market has already priced in much of that future optimism. If you are trying to figure out what comes next, we are about to break down these different methods of valuing Arm Holdings, and will hint at an even more meaningful way to size up the company’s worth at the end of the article.

Arm Holdings scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Arm Holdings Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s value by projecting its future free cash flows and discounting them back to today’s dollars. This approach attempts to answer what Arm Holdings’ future potential is worth in the present moment, based on realistic growth and profitability assumptions.

Arm’s current Free Cash Flow stands at $774.5 Million. Analysts forecast rapid expansion, with Free Cash Flow projected to reach $2.20 Billion in 2026 and $4.97 Billion by 2030. For the years beyond analyst forecasts, cash flow projections are generated by Simply Wall St based on a reasonable deceleration in growth. All of these estimates are in US dollars.

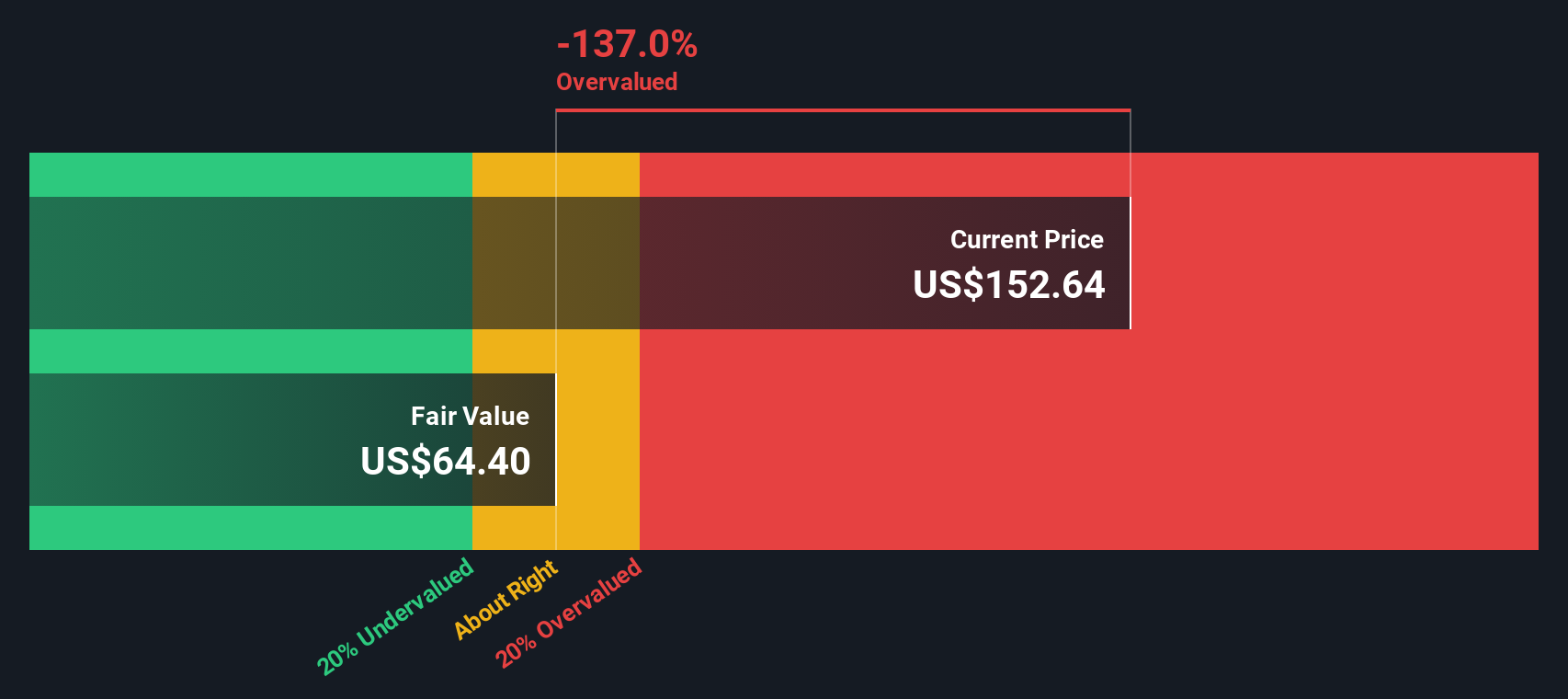

Based on this DCF model, Arm Holdings' intrinsic value per share is calculated at $64.67. When compared to the current market price, this suggests the share price is approximately 156.2% higher than its calculated fair value. This may indicate that the stock is substantially overvalued based on this cash flow analysis.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Arm Holdings may be overvalued by 156.2%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Arm Holdings Price vs Sales (P/S)

For rapidly growing technology companies that are able to turn significant revenue, the Price-to-Sales (P/S) ratio is a useful tool for investors. This metric is especially relevant when evaluating profitable growth companies like Arm Holdings because it sidesteps some of the volatility of earnings and focuses on the top-line sales that fuel future profitability.

Growth expectations play a big role in what counts as a “normal” or “fair” P/S ratio. Investors are usually willing to pay a higher multiple for companies generating strong sales growth and operating in industries with high margins, while also factoring in the unique risks involved.

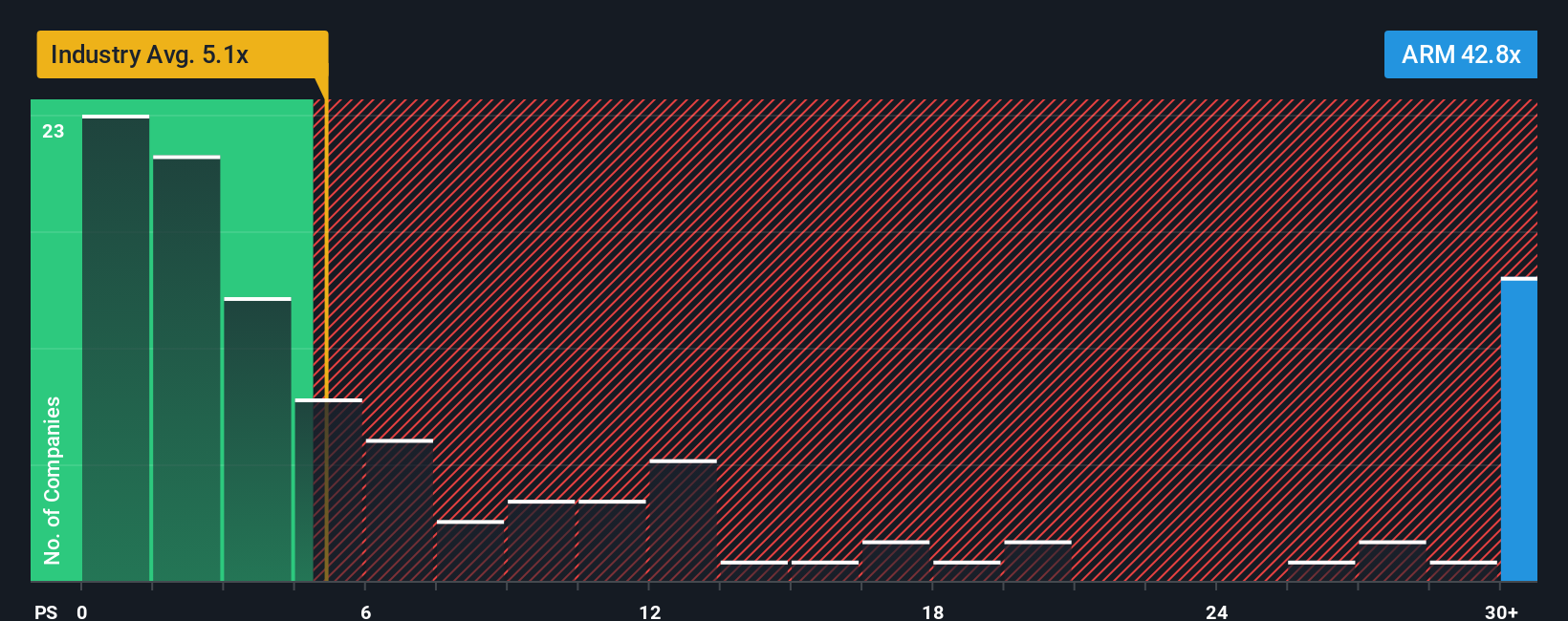

Arm Holdings currently trades at a striking 42.6x P/S, which is well above the average for both its semiconductor industry peers (5.6x) and the wider industry (5.1x). This suggests investors are pricing in exceptional growth or market dominance that sets Arm apart from the pack.

Instead of just relying on peer or industry averages, Simply Wall St’s proprietary “Fair Ratio” estimates what would be an appropriate multiple based on Arm’s specific profile. This takes into account the company’s sales growth, risk factors, profit margins, industry trends, and even its market capitalization. For Arm Holdings, the Fair P/S Ratio is calculated at 42.5x.

Comparing these numbers, Arm’s actual P/S ratio is almost an exact match with the Fair Ratio. This means the stock’s valuation looks ABOUT RIGHT, given its growth ambitions and market conditions.

Result: ABOUT RIGHT

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Arm Holdings Narrative

Earlier, we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is a simple, personalized story you create about a company’s future, describing where you think it’s headed and why. This connects your assumptions about revenue, margins, and risks directly to a forecast and a fair value estimate.

This approach bridges the gap between company news, financial projections, and actionable investing decisions, helping you understand not just “what” a company is worth, but “why.” Narratives are highly accessible and featured within the Simply Wall St Community page, where millions of investors can see, create, and update their own views about Arm Holdings and other stocks.

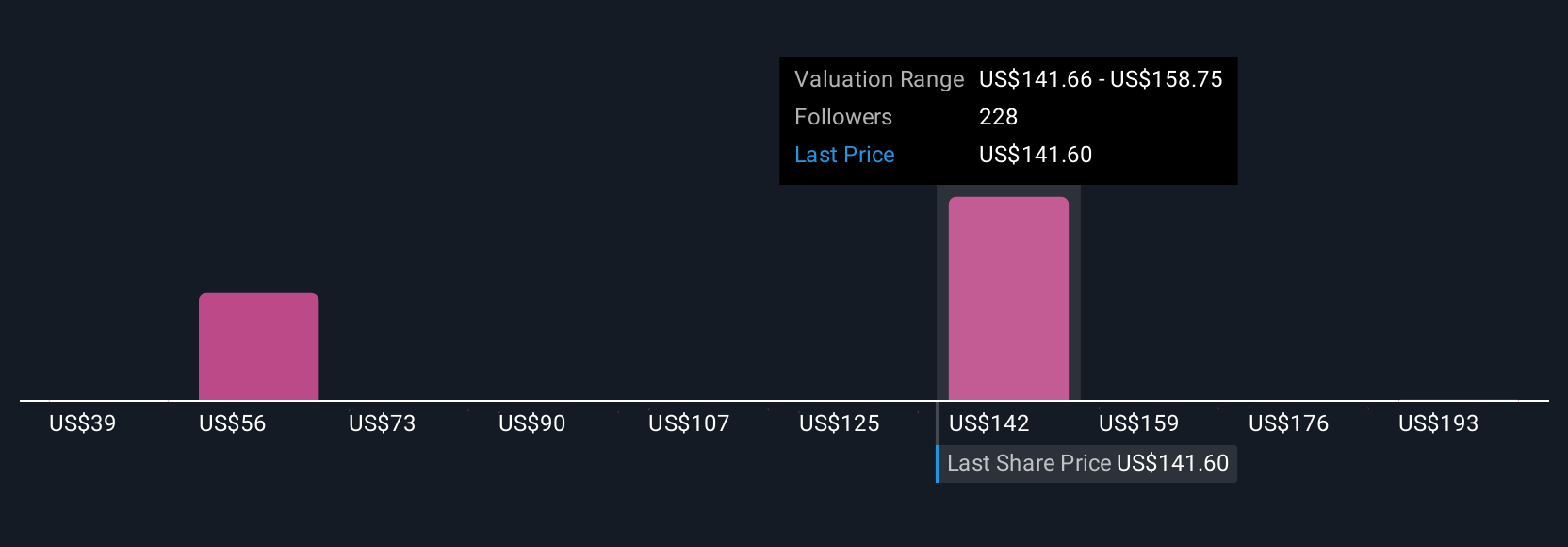

Narratives make it easy to compare your fair value to the current share price, so you know when it might be time to buy, sell, or stay put. You can adapt your narrative dynamically as new earnings or news emerge. For example, some investors believe Arm Holdings is worth $210 because of explosive AI growth potential, while others see $70 as fair value given interest rate headwinds. This allows you to explore different perspectives and decide which best matches your outlook.

For Arm Holdings, however, we'll make it really easy for you with previews of two leading Arm Holdings Narratives:

Fair Value: $210.00

Current price discount: -21.0%

Expected Revenue Growth: 27.7%

- Predicts explosive revenue and margin expansion as Arm's data center market share increases and higher royalty rates from new chip technologies boost profitability.

- Argues Arm’s leadership in edge AI and its large software ecosystem will create durable, compounding high-margin earnings across industries such as automotive and IoT.

- Cites risks from alternative architectures (like RISC-V), customer self-sufficiency, geopolitical headwinds, and rising R&D costs, but concludes the bullish outlook is justified if growth drivers remain strong.

Fair Value: $155.61

Current price premium: 6.5%

Expected Revenue Growth: 21.6%

- Attributes growth to strong royalty and earnings gains from custom silicon, premium IP monetization, and expansion into AI, IoT, and the edge market.

- Highlights increased R&D spending, expansion beyond core platforms, and dependence on flagship smartphones as potential risks to margins and earnings stability.

- Points out that the current share price is above the consensus fair value, indicating that upside could be limited unless higher growth or margin expansion occurs.

Do you think there's more to the story for Arm Holdings? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ARM

Arm Holdings

Arm Holdings plc architects, develops, and licenses central processing unit products and related technologies for semiconductor companies and original equipment manufacturers.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives