- United States

- /

- Semiconductors

- /

- NasdaqGS:ARM

Arm Holdings (NasdaqGS:ARM): Assessing Valuation After Court Ruling Favors Qualcomm in License Dispute

Reviewed by Kshitija Bhandaru

A U.S. court’s recent decision favored Qualcomm in its dispute with Arm Holdings (NasdaqGS:ARM), fully dismissing Arm’s license breach claims. As a result, Arm’s immediate ability to pursue new licensing fees from Qualcomm is restricted.

See our latest analysis for Arm Holdings.

Arm Holdings’ legal blow comes amid a stretch of renewed investor attention, with the stock’s momentum simmering down after this year’s initial surge. The 1-year total shareholder return sits at just 0.10%, reflecting a pause in gains as markets digest shifting risks and Arm works to solidify its broader partnerships in areas like AI and data centers. Optimism about Arm’s long-term growth story persists, but the share price has leveled out. This indicates investors are in wait-and-see mode following headline-grabbing events.

If you’re keeping an eye on how legal twists affect industry leaders, it could be a great moment to discover See the full list for free.

With the legal overhang temporarily resolved and shares trading close to analyst targets, investors have to weigh whether Arm is trading at fair value or if there is hidden upside, making this a real buying opportunity.

Most Popular Narrative: Fairly Valued

With Arm Holdings closing at $152.15 and the most widely followed narrative setting a fair value at $152.59, market pricing appears remarkably in sync with analyst consensus right now. This equilibrium spotlights what is driving sentiment toward “fully valued,” setting up an interesting perspective from those closest to the story.

Ongoing premiumization of Arm's IP, evidenced by rising royalty rates from v8 (approximately 2.5% to 3%), to v9 (around 5%), to CSS (now exceeding 10%), is increasing per-chip monetization. This is setting up strong net margin and earnings gains as customers adopt next-generation solutions.

Want to know what is fueling this precise valuation call? Analysts are betting on soaring royalties and next-generation products, but the real clincher is a much higher profit margin in just a few years. The projections behind this price could surprise you—take a look to see how it all adds up.

Result: Fair Value of $152.59 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, a slowdown in premium smartphone demand or unforeseen execution challenges in Arm's expansion efforts could quickly change the current growth outlook.

Find out about the key risks to this Arm Holdings narrative.

Another View: SWS DCF Model Challenges the Narrative

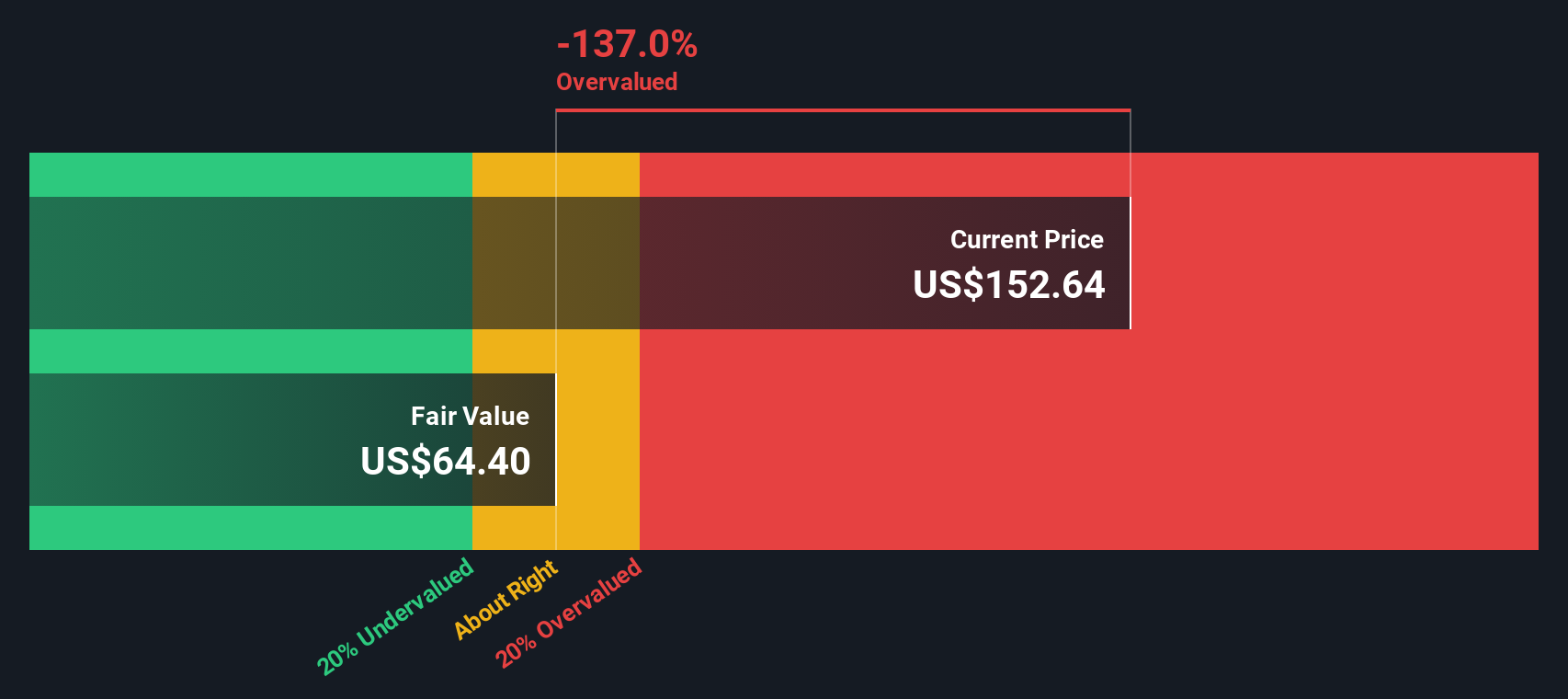

While analyst consensus pins Arm Holdings at fair value, the SWS DCF model offers a starkly different perspective. It flags the stock as potentially overvalued. Our DCF estimate for Arm sits far below current prices, suggesting the market is pricing in much stronger growth. Could investors be betting too much on blue-sky scenarios?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Arm Holdings for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Arm Holdings Narrative

If you have a different take on Arm Holdings or want to investigate the numbers firsthand, you can easily craft your own perspective in just a few minutes. Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Arm Holdings.

Looking for more investment ideas?

Take control of your portfolio by checking out other standout opportunities in today’s shifting market. Smart moves are just a click away. Don’t let these potential winners pass you by.

- Zero in on undervalued companies and get ahead of the crowd by evaluating these 909 undervalued stocks based on cash flows that are backed by solid cash flows and attractive entry points.

- Capture growing dividends and boost your income stream by examining these 19 dividend stocks with yields > 3% with yields above 3%, perfect for building consistent returns.

- Tap into breakthroughs in medicine and technology with these 31 healthcare AI stocks to see innovative firms on the front lines of healthcare's transformation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ARM

Arm Holdings

Arm Holdings plc architects, develops, and licenses central processing unit products and related technologies for semiconductor companies and original equipment manufacturers.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives