- United States

- /

- Semiconductors

- /

- NasdaqGS:ARM

Arm Holdings (ARM) Stock Surges 17% In One Week

Reviewed by Simply Wall St

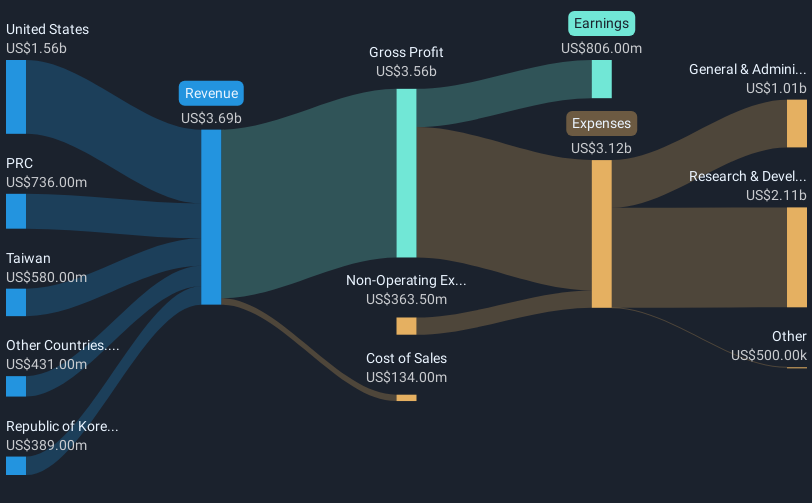

Arm Holdings (ARM) is set to host its Annual General Meeting on September 9, 2025, potentially impacting investor sentiment. Over the past week, Arm saw a 17% increase in share price, a move seemingly aligned with broader market enthusiasm as major U.S. stock indexes reached record highs, bolstered by expectations of interest rate cuts following cooling inflation data. While upcoming strategic updates discussed at the AGM might have added weight to the price increase, the overall market conditions played a significant role in propelling Arm's stock performance during the period.

Buy, Hold or Sell Arm Holdings? View our complete analysis and fair value estimate and you decide.

The upcoming Annual General Meeting for Arm Holdings could significantly influence the company's narrative by enhancing investor sentiment and potentially bolstering future revenue and earnings forecasts. The recent 17% rise in share price indicates strong market confidence, possibly anticipating favorable strategic updates that may further support Arm's growth trajectory in data centers and edge AI markets.

Over the last year, Arm Holdings delivered a total shareholder return of 9.85%, although this underperformed compared to the US Semiconductor industry, which returned 45.1% during the same period. This 1-year perspective shows that while the company has made progress, it trails behind both a buoyant market and its peers. The broader market's rally, driven by expectations of interest rate cuts, also contextualizes Arm's price movement as part of a larger positive sentiment.

Despite a strong bullish narrative from some analysts, the current share price of US$154.14 slightly exceeds the consensus price target of US$152.59, indicating that the stock is trading above analyst fair value estimates. This could imply limited immediate upside unless revenue and earnings forecasts signify stronger future growth than currently expected. ARM's longer-term strategies outlined at the AGM, such as advancements in customizable chip solutions, might be critical in justifying its current valuation levels.

Our valuation report unveils the possibility Arm Holdings' shares may be trading at a premium.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ARM

Arm Holdings

Arm Holdings plc architects, develops, and licenses central processing unit products and related technologies for semiconductor companies and original equipment manufacturers.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives