- United States

- /

- Semiconductors

- /

- NasdaqGS:AOSL

Alpha and Omega Semiconductor (NASDAQ:AOSL) pulls back 9.0% this week, but still delivers shareholders strong 24% CAGR over 5 years

It might be of some concern to shareholders to see the Alpha and Omega Semiconductor Limited (NASDAQ:AOSL) share price down 22% in the last month. But that doesn't change the fact that shareholders have received really good returns over the last five years. Indeed, the share price is up an impressive 193% in that time. We think it's more important to dwell on the long term returns than the short term returns. The more important question is whether the stock is too cheap or too expensive today. Unfortunately not all shareholders will have held it for five years, so spare a thought for those caught in the 41% decline over the last three years: that's a long time to wait for profits.

Although Alpha and Omega Semiconductor has shed US$91m from its market cap this week, let's take a look at its longer term fundamental trends and see if they've driven returns.

Check out our latest analysis for Alpha and Omega Semiconductor

Alpha and Omega Semiconductor wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. When a company doesn't make profits, we'd generally hope to see good revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

In the last 5 years Alpha and Omega Semiconductor saw its revenue grow at 6.3% per year. That's a fairly respectable growth rate. Broadly speaking, this solid progress may well be reflected by the healthy share price gain of 24% per year over five years. Given that the business has made good progress on the top line, it would be worth taking a look at the growth trend. Accelerating growth can be a sign of an inflection point - and could indicate profits lie ahead. Worth watching 100%

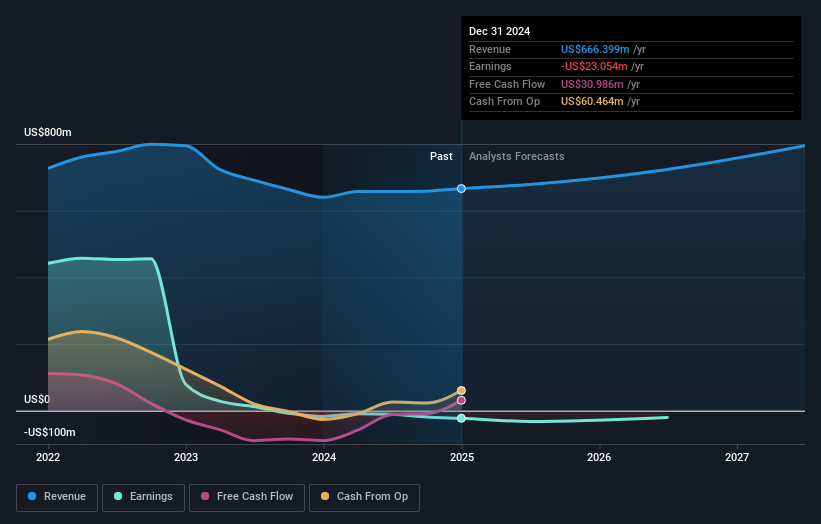

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

Take a more thorough look at Alpha and Omega Semiconductor's financial health with this free report on its balance sheet.

A Different Perspective

It's good to see that Alpha and Omega Semiconductor has rewarded shareholders with a total shareholder return of 43% in the last twelve months. Since the one-year TSR is better than the five-year TSR (the latter coming in at 24% per year), it would seem that the stock's performance has improved in recent times. Given the share price momentum remains strong, it might be worth taking a closer look at the stock, lest you miss an opportunity. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Consider for instance, the ever-present spectre of investment risk. We've identified 1 warning sign with Alpha and Omega Semiconductor , and understanding them should be part of your investment process.

But note: Alpha and Omega Semiconductor may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:AOSL

Alpha and Omega Semiconductor

Designs, develops, and supplies power semiconductor products for computing, consumer electronics, communication, and industrial applications in Hong Kong, China, South Korea, the United States, and internationally.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives