- United States

- /

- Semiconductors

- /

- NasdaqGS:AMKR

Assessing Amkor Technology’s (AMKR) Valuation After Intel’s EMIB Packaging Win and AI Growth Optimism

Reviewed by Simply Wall St

Amkor Technology (AMKR) just landed a meaningful win, with reports that Intel is handing over its advanced EMIB chip packaging work. This underscores how central Amkor has become to AI driven semiconductor supply chains.

See our latest analysis for Amkor Technology.

The Intel packaging news lands on top of an already strong run, with Amkor’s share price up 79.77% over 90 days and a 69.27% total shareholder return over the past year, suggesting momentum is clearly building around its AI centric growth story.

If this kind of move has you looking for the next potential beneficiary of AI hardware demand, it might be worth scanning high growth tech and AI stocks for more ideas.

Yet with the stock soaring far above analyst targets and growth expectations already moving higher, investors now face a tougher question: Is Amkor still mispriced for the AI upcycle, or is the market already baking in years of expansion?

Price-to-Earnings of 35.9x: Is it justified?

At a last close of $44.71, Amkor is trading on a 35.9x price to earnings multiple that screens slightly cheap against semiconductor peers despite its sharp rally.

The price to earnings ratio compares what investors pay today for each dollar of current earnings, a key yardstick for capital intensive chip and packaging businesses where profits can be cyclical.

Amkor’s 35.9x multiple sits below both the US semiconductor industry average of about 38x and a peer group nearer 43.1x. It also lines up closely with an estimated fair price to earnings ratio near 36x, suggesting the current valuation is roughly in line with what the market could gravitate toward as expectations settle.

In that context, the stock appears positioned as a relative value name in an elevated sector, with investors paying a modest discount for earnings that are currently expected to grow materially faster than the wider US market.

Explore the SWS fair ratio for Amkor Technology

Result: Price-to-Earnings of 35.9x (ABOUT RIGHT)

However, Amkor’s valuation already assumes robust AI demand, so any delay in advanced chip orders or EMIB ramp could quickly pressure earnings expectations.

Find out about the key risks to this Amkor Technology narrative.

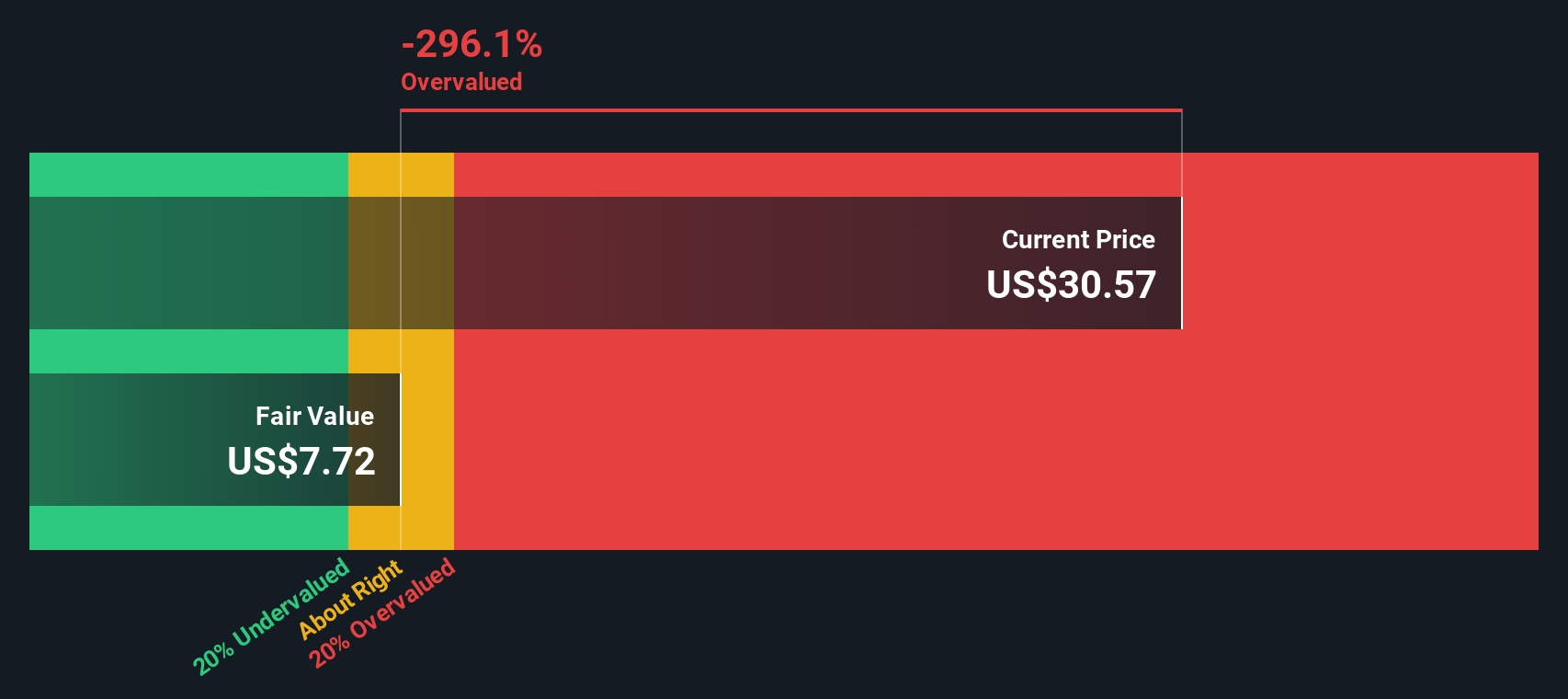

Another View: SWS DCF Model Flags Overvaluation

Our DCF model tells a very different story, putting Amkor’s fair value closer to $12.71 per share, well below the current $44.71 price and implying the stock is trading at a steep premium. If cash flows do not scale as hoped, could this rerate be sharp?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Amkor Technology for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 903 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Amkor Technology Narrative

If you would rather challenge these assumptions and dig into the numbers yourself, you can build a personalized view of Amkor in minutes: Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Amkor Technology.

Ready for more high conviction ideas?

Before momentum shifts again, you can plan your next moves with targeted stock ideas from the Simply Wall St Screener, tailored to different strategies and risk levels.

- Explore mispriced potential by scanning these 903 undervalued stocks based on cash flows, built around companies whose cash flows suggest the market has not fully caught up yet.

- Increase your income focus by checking these 15 dividend stocks with yields > 3%, where yields above 3% pair with businesses that can help anchor a portfolio.

- Look into the next wave of innovation by reviewing these 28 quantum computing stocks, which features companies that may be exposed to quantum computing as it develops.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AMKR

Amkor Technology

Provides outsourced semiconductor packaging and test services in the United States, Japan, Europe, and the Asia Pacific.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

PRME remains a long shot but publication in the New England Journal of Medicine helps.

This one is all about the tax benefits

Estimated Share Price is $79.54 using the Buffett Value Calculation

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026