- United States

- /

- Semiconductors

- /

- NasdaqGS:AMD

Is AMD a Bargain After Surging 64% on AI and Data Center Wins?

Reviewed by Bailey Pemberton

- Eyeing Advanced Micro Devices and wondering if its recent gains mean the stock is a bargain or frothy? Take a closer look at what is driving the excitement and how valuation measures up.

- AMD’s share price has surged lately, jumping 14.8% in the past week and a massive 63.8% over the last month, on top of an impressive 119.1% year-to-date gain. These swings are turning heads, suggesting momentum and shifting expectations about its future.

- Recent headlines have highlighted AMD’s new product rollouts and its high-profile wins in the AI and data center space. Many believe these developments are fueling investor optimism. The competition with NVIDIA, along with chip industry investment news, continues to keep AMD front and center in tech conversations.

- Despite the buzz, AMD currently scores a 2 out of 6 on our valuation checks. It is worth digging into what this really means. Different approaches to valuation will be explored shortly, and there will be an even more insightful way to assess AMD’s value at the end of the article.

Advanced Micro Devices scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Advanced Micro Devices Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's true value by projecting its future cash flows and discounting them back to today's dollar value. This approach aims to capture the underlying financial strength of a business, setting aside day-to-day market noise.

For Advanced Micro Devices, the latest reported Free Cash Flow (FCF) stands at $4.12 Billion. Analysts expect this figure to grow steadily, with projections reaching $18.71 Billion by 2029. Analyst estimates cover the first five years, while later projections are extended using internal growth assumptions. Each year's future FCF is discounted back to the present, ensuring that long-term forecasts do not overstate the company's value.

Based on these projections, the DCF model calculates AMD’s estimated intrinsic value to be $165.19 per share. When comparing this figure to the current stock price, the analysis suggests the shares are trading at a premium, coming in at roughly 60% above the DCF-implied value. This signals that optimism about AMD’s future growth is already more than priced in.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Advanced Micro Devices may be overvalued by 60.0%. Discover 848 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Advanced Micro Devices Price vs Sales

The Price-to-Sales (P/S) ratio is often the preferred valuation multiple for tech companies like Advanced Micro Devices, especially when their profits can be volatile or earnings are being reinvested for growth. The P/S ratio helps investors cut through short-term noise and provides insight into how the market values each dollar of revenue, which is crucial for firms capitalizing on massive growth opportunities.

In assessing a "normal" or "fair" P/S ratio, it is important to consider company-specific growth expectations and market risks. Generally, the more rapid and consistent a company's revenue growth, the higher a justified P/S multiple. However, this must be balanced with potential risks unique to the industry or the company itself.

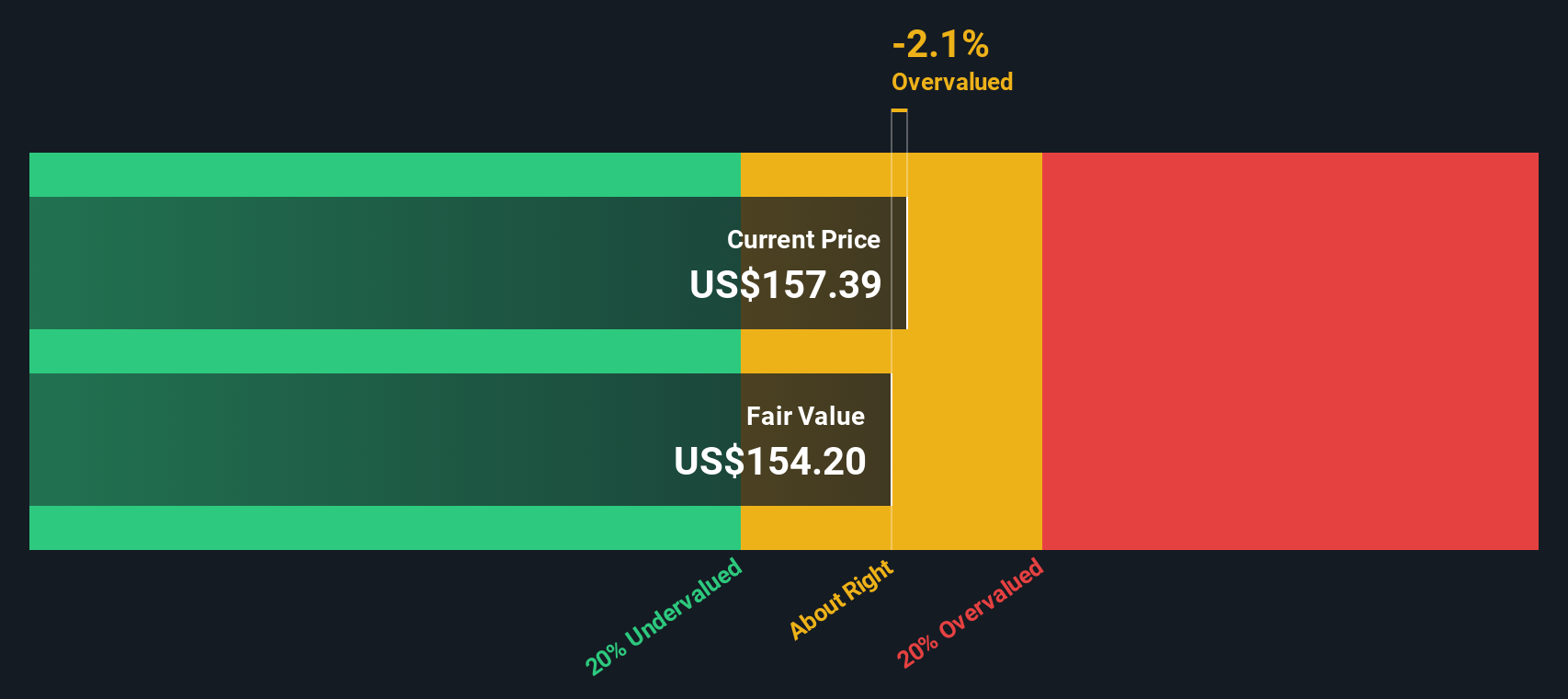

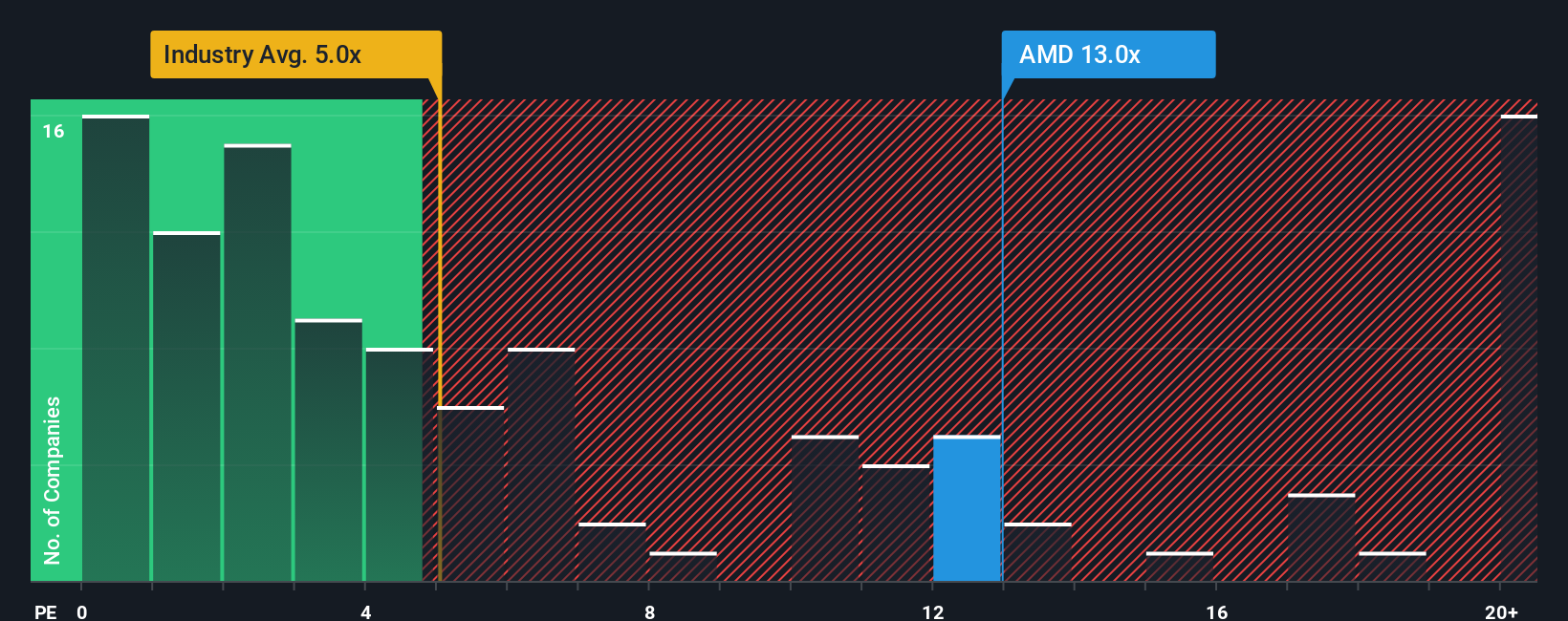

AMD currently sports a P/S ratio of 14.49x. For context, this is closely aligned with the average among its peer group at 14.68x and substantially higher than the broader semiconductor industry average of 5.26x, highlighting how richly AMD is valued relative to the sector.

Simply Wall St’s proprietary "Fair Ratio" adds an extra layer of nuance. Unlike a straight benchmark comparison, the Fair Ratio factors in not just AMD’s revenue growth and size, but also its profit margins and risk profile. This tailored approach helps create a better-defined benchmark, specific to AMD’s unique position and prospects.

For AMD, the Fair Ratio comes in at 17.84x, which suggests the stock’s current multiple is actually a bit lower than what might be considered justified given its growth and financial characteristics.

Result: UNDERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1382 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Advanced Micro Devices Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. Narratives are an innovative way to make investment decisions by connecting your perspective on a company’s story, such as how you see AMD’s future growth, products, and opportunities, with the financial numbers behind it, like your assumed fair value, future revenue, and margins.

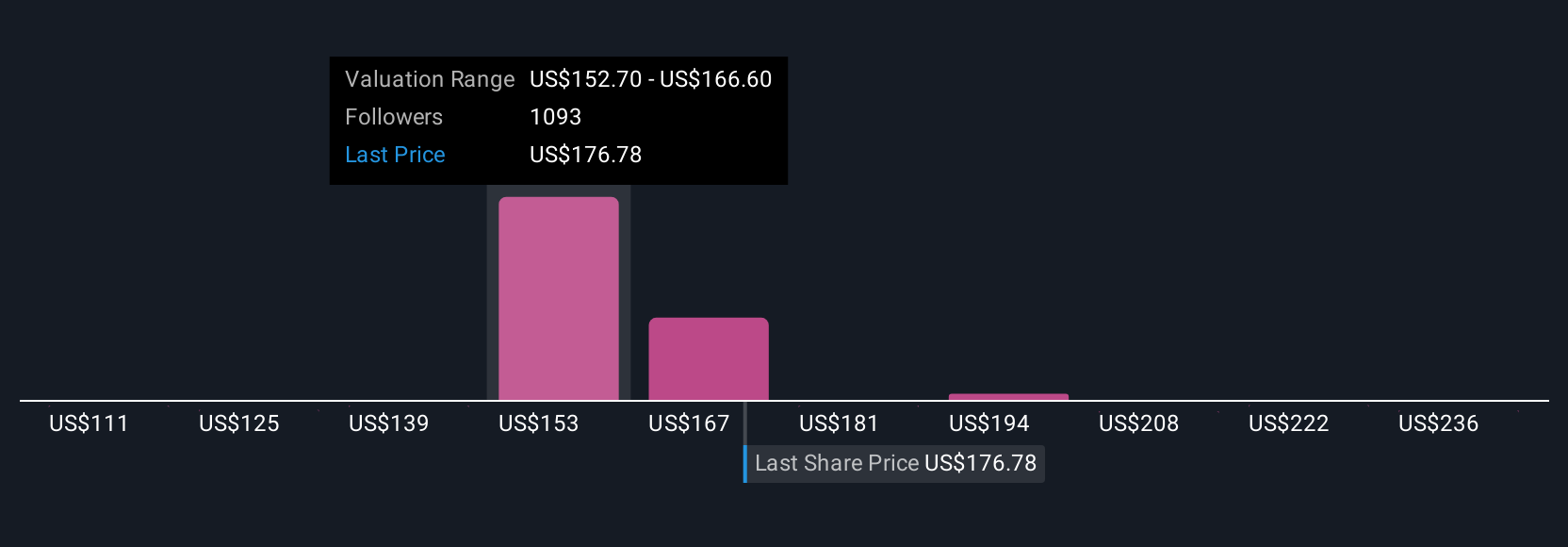

With Narratives, you go beyond the standard multiples. You express your view on AMD, articulate what you believe will drive its performance, and see how those beliefs lead to a specific forecast and fair value. Narratives help turn complex valuation into an approachable, guided process, and are available right on Simply Wall St’s Community page where millions of investors compare, discuss, and update their views in real time.

This tool lets you watch how your Narrative's calculated Fair Value compares to the current Price, helping you decide if AMD is a buy, hold, or sell. Because Narratives are dynamic, they will update as soon as big news or earnings are released.

For example, on Simply Wall St’s platform, one investor’s Narrative values AMD at $290, banking on ultra-bullish AI expansion and margin growth, while another puts fair value at $137, citing regulatory risks and manufacturing strains. This demonstrates that there is no single "right" answer, but a range of justified, story-driven perspectives tailored to your own research and conviction.

For Advanced Micro Devices, we’ll make it really easy for you with previews of two leading Advanced Micro Devices Narratives:

🐂 Advanced Micro Devices Bull Case

Fair Value: $290.64

Currently trading at approximately 9% below narrative fair value.

Revenue Growth Rate: 31%

- This outlook is extremely bullish on AMD’s future, forecasting continued strong revenue growth and margin expansion, especially as new products roll out in 2026.

- It suggests gross profit and revenue growth trends signal breakout performance, with a forecast that shares could hit the $200s or $300s within a few years.

- The narrative points to consistent improvements in operating metrics and highlights CEO Lisa Su’s leadership as a driver of efficiency and profitability.

🐻 Advanced Micro Devices Bear Case

Fair Value: $180.10

Currently trading at approximately 47% above narrative fair value.

Revenue Growth Rate: 16.5%

- This perspective sees AMD’s innovation and product strategy yielding significant market share, particularly against Intel in CPUs, but also highlights risks from entrenched competitor Nvidia.

- It notes growth drivers in data center and gaming, but maintains a more cautious outlook on the Embedded segment and the impact of industry-wide challenges such as supply chain disruptions.

- While optimistic about AMD’s momentum, this view expects the company may be overvalued at current prices and suggests that future risks should not be ignored despite recent wins.

Do you think there's more to the story for Advanced Micro Devices? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AMD

Exceptional growth potential with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives