- United States

- /

- Semiconductors

- /

- NasdaqGS:AMD

Does AMD’s 104% 2025 Rally Reflect True Value After Latest AI Partnership News?

Reviewed by Bailey Pemberton

- Ever wondered if Advanced Micro Devices (AMD) stock is really worth its current price, or if the excitement has pushed the stock beyond its true value?

- AMD has surged 104.6% so far this year, and with a 5.7% gain over just the past week, it is clear the market sees major growth potential or is reacting to shifts in risk.

- Recent headlines have spotlighted AI collaboration announcements, new chip releases, and growing demand for AMD’s latest processors, all combining to fuel investor enthusiasm. These developments have kept AMD front and center in market conversations and may explain much of the recent share price momentum.

- When we look at AMD’s valuation score, it lands at 2 out of 6, meaning it is only undervalued on a couple of fundamental checks. We are about to dig into what the valuation numbers are telling us, but stay tuned for an even better way to understand what fair value really means for AMD at the end of this article.

Advanced Micro Devices scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Advanced Micro Devices Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s value by projecting its future cash flows and discounting them back to today’s dollars. In AMD’s case, this involves forecasting how much cash the business is expected to generate and finding the present value of those future inflows.

AMD’s current Free Cash Flow is $5.57 Billion. Analysts expect rapid growth in the years ahead, with projections reaching $30.92 Billion by 2029. For the period between 2026 and 2035, forecasts climb sharply, from $7.33 Billion in 2026 (analyst consensus) up to $79.52 Billion by 2035 (long-range extrapolation).

Based on these cash flow projections, AMD’s estimated intrinsic value using the DCF approach is $391.35 per share. This figure is 36.9% higher than the current share price, suggesting AMD is undervalued according to this model.

In summary, the DCF model signals strong future cash flow potential for AMD, and the current price may present an opportunity for investors seeking growth in the semiconductor sector.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Advanced Micro Devices is undervalued by 36.9%. Track this in your watchlist or portfolio, or discover 879 more undervalued stocks based on cash flows.

Approach 2: Advanced Micro Devices Price vs Earnings

The price-to-earnings (PE) ratio is most useful for valuing profitable companies because it links a company’s share price directly to its underlying earnings power. For companies like Advanced Micro Devices that are generating consistent profits, the PE ratio is a reliable way to gauge how much investors are willing to pay for each dollar of earnings.

Growth expectations and risk play a big role in what a “fair” PE ratio should be. Higher growth prospects and lower perceived risks often justify a higher PE, while slower growth or higher risk can push the fair PE lower. Essentially, you want to pay more for companies that will grow faster and are less risky, but not overpay if those advantages are already reflected in the market price.

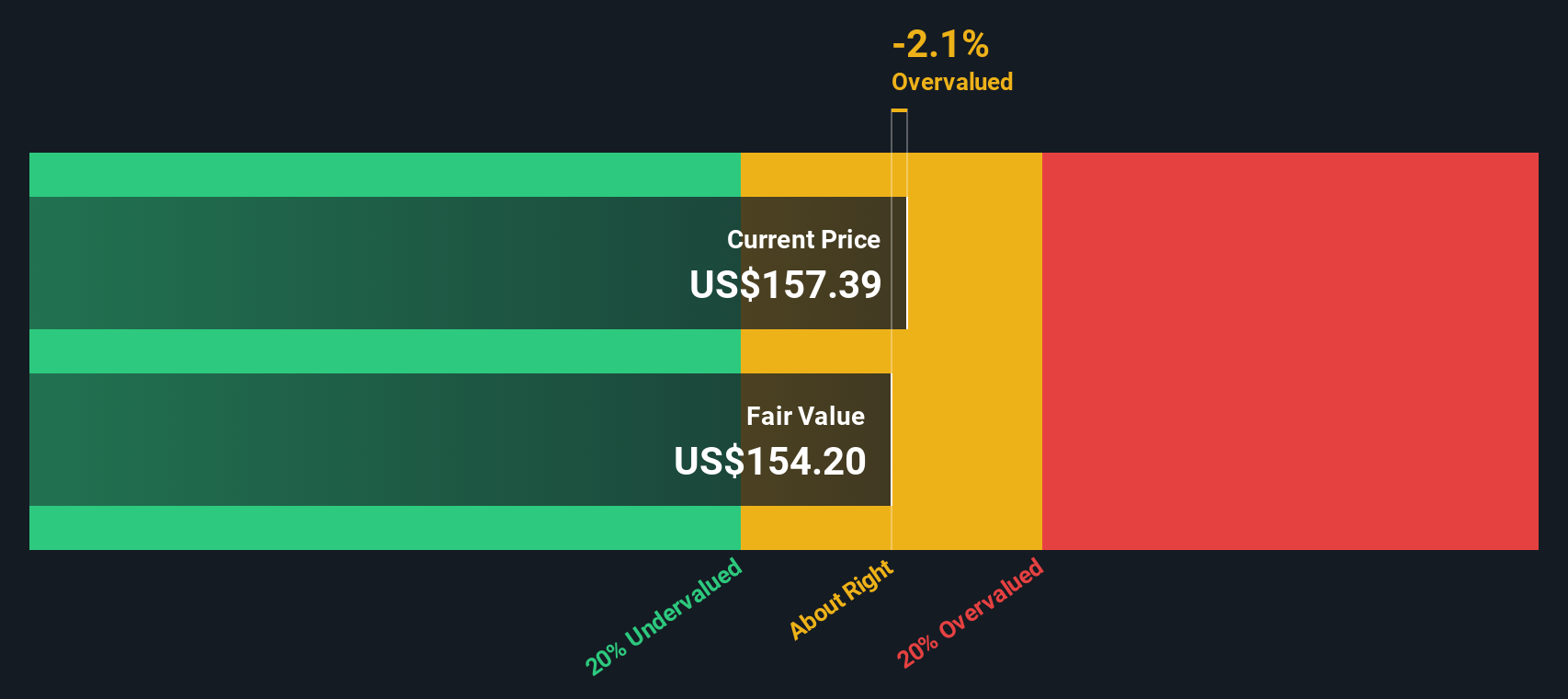

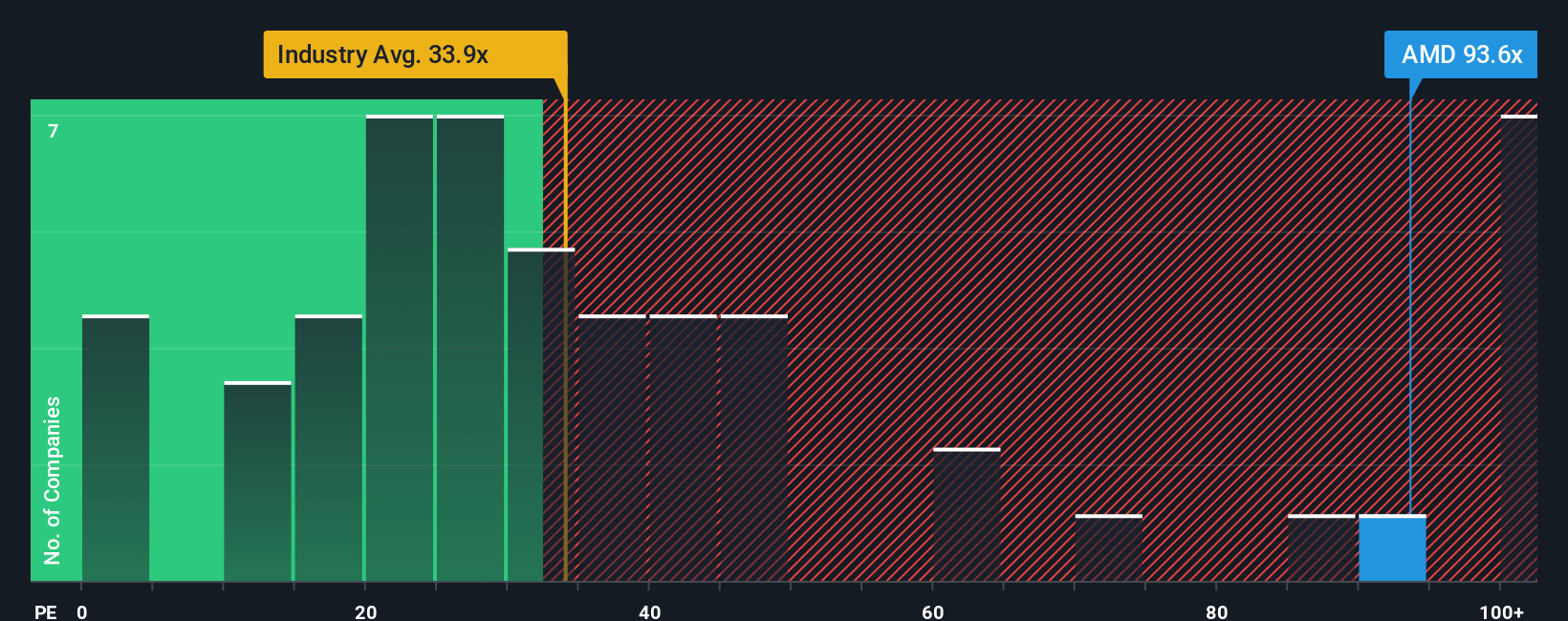

AMD currently trades at a PE ratio of 128.34x. This is considerably higher than both the semiconductor industry average of 33.99x and the peer average of 68.40x. However, comparing AMD solely to peers and industry averages can overlook important company-specific factors. That is where Simply Wall St’s Fair Ratio comes in. This proprietary metric, calculated at 63.72x for AMD, adjusts for factors such as AMD’s earnings growth outlook, profit margins, market capitalization, and industry risk, providing a more tailored assessment than broad benchmarks.

Since AMD’s current PE of 128.34x is almost double its Fair Ratio of 63.72x, the shares appear significantly overvalued based on this method. Investors should be mindful that much of AMD’s anticipated growth and enthusiasm is already factored into its share price.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1406 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Advanced Micro Devices Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a more dynamic, user-driven approach available on Simply Wall St’s Community page, used by millions of investors.

A Narrative is simply your perspective on a company’s future. You connect the story you believe about a business with your own estimates for its future revenue, earnings, margins, and fair value. This turns numbers into a financial roadmap backed by your conviction.

This approach empowers you to link AMD’s unique business developments, competitive context, and strategic direction directly to forecasts and valuations. This allows you to check whether your “story” supports today’s market price.

Narratives are incredibly accessible. On Simply Wall St, you can choose, create, and update your Narrative in just a few clicks. Because the tool is dynamic, your fair value updates automatically whenever new news or results emerge, keeping your view fully up to date.

Importantly, Narratives help you decide when to buy, sell, or hold by comparing your Fair Value, based on your story and assumptions, to the current market price. This makes your decisions data-driven but personalized.

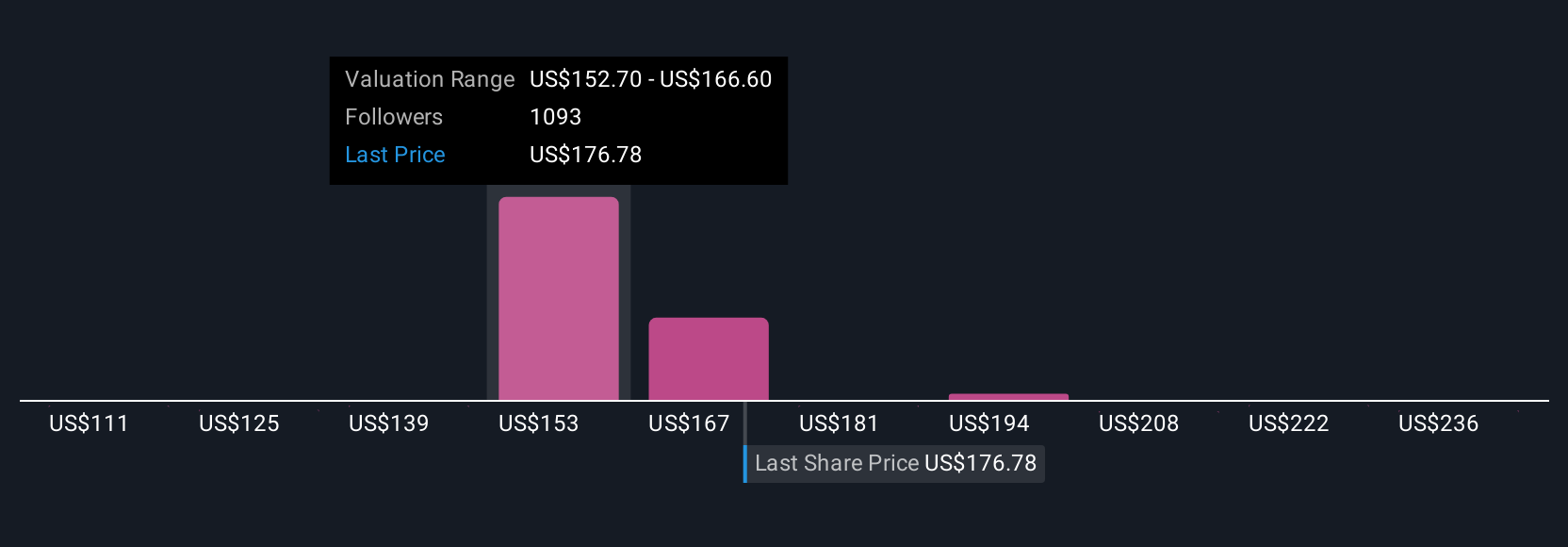

For example, one AMD Narrative may reflect a bullish belief that rapid AI demand will drive $59.8 billion in revenue and a fair value of $230 per share. A more cautious view might compound regulatory risks and tighter margins, resulting in a $136.68 fair value. This illustrates that your outlook can (and should) shape your investment decisions.

For Advanced Micro Devices, we will make it really easy for you with previews of two leading Advanced Micro Devices Narratives:

🐂 Advanced Micro Devices Bull Case

Fair Value: $270.00

Current price is approximately 8.6% below fair value

Revenue Growth Rate: 19.11%

- Powerful AI and Data Center growth: AMD's data center and client segments are surging, with 36% year-over-year revenue growth and expanding partnerships in AI infrastructure.

- Valuation upside: Forward P/E is lower than Nvidia's despite strong analyst upgrades and profit outlook; this suggests the stock may be undervalued compared to peers.

- Risks remain: Nvidia’s dominance, new U.S. export controls, and competitive threats from Intel and regulatory hurdles could pressure margins. However, AMD’s leadership and strategy present high-upside potential in AI and adaptive compute.

🐻 Advanced Micro Devices Bear Case

Fair Value: $180.10

Current price is approximately 37.1% above fair value

Revenue Growth Rate: 16.5%

- Market share gains are concentrated in desktop CPUs, but challenges persist in gaming and embedded segments, and the stock trades well above fair value.

- Competitive pricing and efficiency help AMD, but Nvidia’s dominance in AI and data center as well as ongoing supply chain risks threaten margin expansion.

- Xilinx acquisition and new product launches open up opportunities in adaptive and AI-driven hardware. However, execution and industry cyclicality could lead to underperformance if AI demand slows or competitors rebound.

Do you think there's more to the story for Advanced Micro Devices? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AMD

Exceptional growth potential with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives